Recommendations:

- Divert newly available resources (such as unused travel allowances) and leverage funding from the private sector and/or international partners, sovereign wealth funds, national reserves and other sinking funds to increase allocations to pro-poor sectors. In the long term, the tax capacity of Nigeria and Uganda should be improved.

- Use electronic platforms to distribute cash to hard-to-reach populations such as informal sector workers and low-income households. National databases such as voters’ rolls, social registers and household surveys can be used to identify vulnerable people.

- Promote investment in renewable energy, particularly for low-income households. Areas that are too remote to be connected to the electricity grid would also benefit from decentralised energy sources.

Executive summary

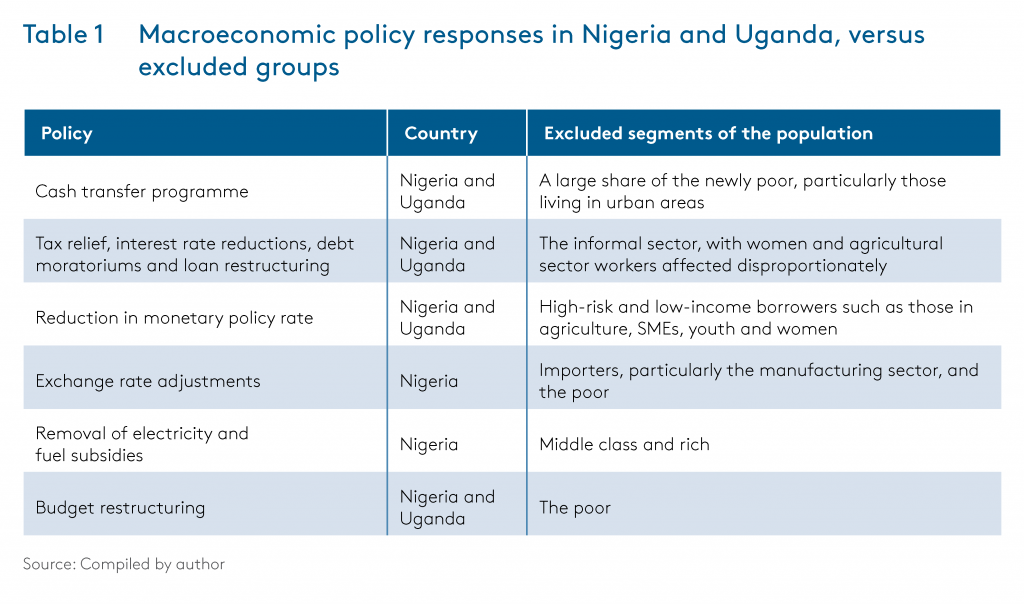

Countries across the world have deployed macroeconomic policies to address the negative economic implications of the COVID-19 pandemic and subsequent lockdown measures. However, these policies can have different outcomes for various segments of the population. This policy briefing assesses the channels through which macroeconomic policy responses in Nigeria and Uganda negatively affect or exclude specific groups, with the aim of resetting policies to achieve more inclusive outcomes that will support economic growth and development in the post COVID future. It finds that the urban poor and the informal sector are being excluded as a result of the poor coverage of cash transfer programmes and the implementation of policies mostly applicable to the formal sector. Loans to low-income borrowers are not likely to increase despite downward revisions to the monetary policy rate, while importers and poorer households will be the worst hit by exchange rate adjustments in Nigeria. While the middle class and rich are affected by the removal of subsidies in Nigeria, those living in poverty do not benefit from the budget restructuring in Uganda.

Introduction

While economic recessions can have significant distributional effects, the macroeconomic policies adopted to counteract recessions can have varying outcomes on different segments of the population. As such, a government’s policy responses to the COVID-19 pandemic can increase inequalities through key transmission channels. Data from the International Monetary Fund’s Policy Response Tracker shows that 89% of African countries have deployed fiscal stimuli for vulnerable populations, including those who have lost their livelihoods as a result of the crisis and low-income households. Liquidity has been provided to affected businesses and sectors such as tourism, hospitality and aviation in 92% of African countries.1International Monetary Fund, “Policy Responses to COVID-19”, https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19. Yet the design and implementation of such macroeconomic policies are often neutral, thus allowing existing forms of inequality to worsen. This policy briefing assesses the ways in which macroeconomic policy responses in Nigeria and Uganda negatively affect or exclude specific groups, particularly youth, women, the informal sector and the newly poor (especially in urban areas). In addition, businesses in the agricultural and manufacturing sectors, as well as small and medium-sized enterprises (SMEs), are negatively impacted by these policy responses. The aim of this policy briefing is to help reset policies to achieve more inclusive outcomes that will support economic growth and development in the post-COVID future.

The analysis covers the fiscal and monetary policies deployed by the Nigerian and Ugandan governments and shows how these policies could lead to worse outcomes for certain segments of the population. The dimensions of disparities considered for individuals include age, gender, place of residence (rural or urban) and income category; for businesses the dimensions include size of business and sector (agriculture, manufacturing and services).

Key findings

Poor coverage and cash transfer targeting exclude the urban poor. Both Nigeria and Uganda have expanded existing cash transfer programmes to deliver funds to the poor and those most vulnerable to the pandemic. Nigeria has scaled up its programme by increasing its National Social Register of poor and vulnerable households by 1.1 million households to 3.7 million households (15.5 million individuals).2Nan, “FG Enrolls 15.5m Persons in National Social Register”, The Guardian (Nigeria), August 23, 2020, https://guardian.ng/news/fg-enrolls-15-5mpersons-in-national-social-register/. The government gives NGN3Currency code for the Nigerian naira. 5,000 ($13) per month to the poorest households for at least three years to ensure food security. Similarly, since the pandemic the Ugandan government has increased funding for the Urban Cash for Work Programme (UCWP) to UGX4Currency code for the Ugandan shilling. 130 billion ($35 million) and social welfare programmes by UGX 152 billion ($41 million), with an additional UGX 45 billion ($12.03 million) for government relief aid in response to COVID-19 and another UGX 107 billion ($28.6 million) for the Social Assistance Grants for Empowerment (SAGE), targeting the elderly.5Development Initiatives, Socioeconomic Impact of COVID-19 in Uganda: How Has the Government Allocated Public Expenditure for FY2020/21? (Nairobi: Development Initiatives, August 2020), https://reliefweb.int/sites/reliefweb.int/files/resources/Socioeconomic_impact_of_Covid-19_in_Uganda.pdf. Under SAGE, each beneficiary is paid UGX 25,000 ($6.7) per month. The programmes have also been expanded, with the UCWP covering an additional 500 000 individuals and SAGE an additional 71 districts.6 World Bank, “Uganda: World Bank Provides $300 Million to Close COVID-19 Financing Gap and Support Economy Recover” (Press Release 2020/158/AFR, World Bank, Nairobi, 2020), https://www.worldbank.org/en/news/press-release/2020/06/29/uganda-world-bank-provides-300-million-toclose-covid-19-financing-gap-and-support-economy-recover

Despite these expansions, these cash transfer programmes underperform significantly in terms of size, coverage and targeting. At 0.002% and 0.00017% respectively, spending on cash transfer programmes as a share of gross domestic product (GDP) in Uganda and Nigeria is meagre.7IMF, “Policy Responses to COVID-19”. As a result, the programmes’ coverage falls significantly short. Based on the 2019 Nigerian Living Standards Survey (NLSS), about 83 million Nigerians are living in poverty, implying that 81% of poor people are excluded from the National Social Register.8National Bureau of Statistics, “2019 Poverty and Inequality in Nigeria: Executive Summary” (Abuja: National Bureau of Statistics, 2020). Similarly, in Uganda 10 million people are living in poverty, based on the household survey in 2016/17.9Uganda Bureau of Statistics, “2019 Statistical Abstract”, https://www.ubos.org/wp-content/uploads/publications/01_20202019_Statistical_Abstract_ -Final.pdf. However, only 1.5 million people benefited from the UCWP.10Development Initiatives, Socioeconomic Impact of COVID-19. Furthermore, the amounts allocated do not cover the cost of a basic nutritious diet per month for a household of five.

Given the strategy of identifying poor households in Nigeria – using the National Social Register to select the poorest 30% of households in states with high poverty levels – the beneficiaries are mostly members of agrarian and rural communities. Yet the newly poor in urban areas, such as SME owners, drivers and cleaners, are most susceptible to income shocks caused by the pandemic, making the targeting of the cash transfer programme sub-optimal. Even in Uganda, the majority of the additional funds is targeted at the UCWP and SAGE. However, the former is likely to experience delays owing to the pandemic and the elderly are not particularly prone to income shocks from the pandemic. In addition, the eligibility age for the SAGE programme was increased from 65 to 80 years, thus reducing the size of the target population.

Most of the policies deployed – tax relief, interest rate reductions, debt moratoriums and loan restructuring – do not impact the informal sector, affecting women and agricultural workers disproportionately. While both countries are using a range of policies to mitigate the impact of the pandemic on individuals and businesses, these policies mostly benefit formal sector workers and businesses. Yet the informal sector accounts for 65% and 50% of Nigeria and Uganda’s GDP respectively, and employs 80% of the labour force in both countries.11Bank of Industry, “Economic Development Through the Nigerian Informal Sector: A BOI Perspective” (Working Paper No. 2, Bank of Industry, Lagos, May 17, 2018), https://www.boi.ng/wp-content/uploads/2018/05/BOI-Working-Paper-Series-No2_Economic-Developmentthrough-the-Nigerian-Informal-Sector-A-BOI-perspective.pdf; Andrew Rugasira, “Unpacking Uganda’s Informal Sector”, Independent News, May 22, 2016, https://www.inde pendent.co.ug/unpacking-ugandas-informal-sector/; International Labour Organization, Women and Men in the Informal Economy: A Statistical Picture (Geneva: ILO Publications, 2018), https:// www.ilo.org/global/publications/books/WCMS_626831/lang–en/index.htm. Although not all informal workers are poor, they face a higher risk of poverty, are more susceptible to income shocks than their counterparts in the formal sector, and live in urban areas with higher living costs and little recourse to subsistence agriculture. With women accounting for 74% of workers (non-agriculture)12“Five Facts About Informal Economy in Africa”, ILO News, June 18, 2015, https://www.ilo.org/africa/whats-new/WCMS_377286/lang–en/index.html. in the informal sector in subSaharan Africa, and the agricultural sector contributing significantly to the informal economy, women and those who work in agriculture do not benefit from these relief policies.

Downward revisions to central banks’ policy rates have failed to reflect in the lending rate of commercial banks, particularly affecting high-risk and low-income borrowers such as small-scale farmers, SME owners, youth and women. Expansionary monetary policies have been adopted, with the Central Bank of Nigeria reducing its monetary policy rate from 13.5% to 11.5% and the Bank of Uganda reducing its rate from 9% to 7%.13Central Bank of Nigeria, “Central Bank of Nigeria Communiqué no. 132 of the Monetary Policy Committee meeting held on 21st and 22nd September 2020”, https://www.cbn.gov.ng/Out/2020/MPD/Central%20Bank%20of%20Nigeria%20Communique%20No.%20132%20of%20the%20Monetary% 20Policy%20Committee%20Meeting%20Held%20September%2021%20and%2022%202020.pdf; Bank of Uganda, “Monetary Policy Statement for October 2020”, https://www.bou.or.ug/bou/bouwebsite/bouwebsitecontent/MediaCenter/press_releases/2020/Oct/Monetary-Policy-Statement_October-2020-.pdf. However, interest on loans made by commercial banks remains high, affecting high-risk and low-income borrowers. Owing to externally determined conditions such as weather and price volatility, workers in the agricultural sector are widely viewed as high risk, making it difficult to reduce the lending rate offered to them. In addition, segments of the population with low income and limited access to collateral such as SME owners, youth and women are less likely to be offered favourable loan terms.

Exchange rate adjustments in Nigeria are having a direct negative impact on importers and an indirect impact on poorer households through rising domestic inflation. With crude oil contributing about 80% of foreign exchange earnings,14World Bank, “Nigeria Bi-Annual Economic Update: Fragile Recovery” (Washington DC: World Bank, 2017), http://documents1.worldbank.org/curated/en/349511494584937819/pdf/114996-WP-P163291-PUBLIC-NEUNoFinalfromPublisher.pdf. the foreign exchange shortage owing to the decline in demand for oil has put pressure on the exchange rate, leading to the devaluation of the naira. The official exchange rate was first adjusted from NGN 307/$1 to NGN 361/$1, and then to NGN 380/$1.15Central Bank of Nigeria, “CBN Exchange Rates”, https://www.cbn.gov.ng/rates/ExchRateByCurrency.asp. These revisions have led to a rise in the price of imports, particularly affecting the manufacturing sector, which is heavily dependent on imported raw materials and intermediate goods. As a result, domestic prices are rising, with implications for the purchasing power of poor citizens.

Removal of electricity and fuel subsidies is having a disproportionate impact on the income of the middle class and rich. As a result of the pandemic, the Nigerian government has increased the fuel price from NGN 121 ($0.32) to NGN 162 ($0.43) per litre. The electricity tariff has gone from NGN 30.23 ($0.08) to NGN 62.33 ($0.16) per kwh (for consumers with an electricity supply above 12 hours per day). The drop in government revenues necessitated the removal of these electricity and fuel subsidies. Given that poor households were not the main beneficiaries of these subsidy programmes – 43% of Nigerians, mostly those living in rural areas, do not have access to electricity16World Bank, “Access to Electricity (% of Population): Nigeria”, https://data.worldbank.org/indicator/EG.ELC.ACCS.ZS?locations=NG. and low-income households use relatively less fuel and electricity – the subsidy removal is likely to reduce the disposable income of the middle class and rich.

Budget restructuring in Uganda does not support those living in poverty. Neither the supplementary budget passed before the end of the 2019/20 fiscal year nor the 2020/21 budget caters adequately for those people most affected by the pandemic. The main beneficiaries of the supplementary budget are SMEs able to access funds from the Uganda Development Bank (UGX 455 billion [$122.1 million]) and suppliers of goods to government through the clearing of domestic arrears (UGX 223 billion [$59.9 million]), with allocations to social protection coming in third at UGX 105 billion ($28.2 million).17Government of Uganda, Ministry of Finance, Planning and Economic Development and the Civil Society Budget Advocacy Group, Citizens’ Guide to the Budget FY 2020/21 (Kampala: CSBAG, 2020), https://budget.go.ug/sites/default/files/National%20Budget%20docs/The%20Citizen%27s%20Guide%20To%20The%20Budget%20FY%202020-21.pdf. Similarly, the sectors with the biggest increases in budget allocation in 2020/21 are water and environment (35%), science, technology and innovation (30%), local government (28%) and public administration (26%).18Government of Uganda, Citizens’ Guide to the Budget Even in Nigeria, the 2020 budgetary allocations to works, power and housing; agriculture; and information and communications increased relative to the 2019 budget, while there were reductions in the allocations to education (16%), health (11%) and humanitarian affairs (12%).19Federal Republic of Nigeria, Budget Office of the Federation, 2020 Revised Appropriation Bill (Abuja: Federal Ministry of Finance, Budget and National Planning, 2020), https://www.budgetoffice.gov.ng/index.php/2020-revised-appropriation-bill.

Conclusion

Existing forms of inequality can deepen in the face of a major crisis such as the COVID-19 pandemic – and as a result of the neutrality of policies deployed in response to the crisis. The macroeconomic policy responses of the Nigerian and Ugandan governments have had the unintended effect of excluding youth, women, the informal sector and the newly poor (particularly in urban areas). At the same time, the removal of electricity and fuel subsidies are affecting the middle class and rich disproportionately, given that these groups were the beneficiaries of the initial subsidy programme. In addition, businesses in the agricultural and manufacturing sectors, alongside SMEs, are likely to be negatively affected by some of the policy responses.

Excluding a wide range of the population will not only affect present living conditions and wellbeing but also limit the private sector spending required to stabilise the economy and avert or recover from a recession. While the governments of both countries have increased spending in order to counteract the drop in private sector consumption and investment, taking on debt for this purpose, debt sustainability remains a pressing issue. As evidenced by their current budgets, debt servicing takes up a considerable amount of government revenue with implications for development spending.

In future, response strategies should be context-specific and take into consideration existing inequalities in order to provide a more tailored and inclusive approach. This will ensure that all segments of the population are reached, lead to efficiency in spending and limit negative welfare impacts.

Governments should revise their budget allocations to healthcare and social protection in order to address the needs of vulnerable people and affected businesses. In the short term, this can be done by using newly available resources (such as unused travel allowances), funding from the private sector and/or international partners, sovereign wealth funds, national reserves and other sinking funds. In the long term, the tax capacity of both countries needs to be improved to allow government to mobilise adequate domestic resources to meet current needs and build fiscal buffers.

Given the widespread access to mobile phones and the ease of electronic transfers, both countries should adopt electronic platforms to distribute cash to hard-to-reach populations. Countries that used electronic transfers extensively before the pandemic, such as Kenya, have been able to use these platforms for cash payments during the pandemic. National databases can be used to effectively identify vulnerable people.

According to the International Renewable Energy Agency, half of new solar and wind installations are cheaper than fossil fuel energy sources,20Harry Kretchmer, “Chart of The Day: Renewables Are Increasingly Cheaper than Coal”, World Economic Forum, June 23, 2020, https://www.weforum.org/agenda/2020/06/renewable-energy-cheaper-coal/. making renewable energy more affordable on average. Thus, promoting investment in and use of renewable energy is crucial, particularly for low-income households.

Acknowledgment

The author is grateful to Dr Susan Kavuma for peer reviewing this policy brief.

About CoMPRA

The COVID-19 Macroeconomic Policy Response in Africa (CoMPRA) project was developed following a call for rapid response policy research into the COVID-19 pandemic by the IDRC. The project’s overall goal is to inform macroeconomic policy development in response to the COVID-19 pandemic by low and middleincome countries (LMICs) and development partners that results in more inclusive, climate-resilient, effective and gender-responsive measures through evidence-based research. This will help to mitigate COVID-19’s social and economic impact, promote recovery from the pandemic in the short term and position LMICs in the longer term for a more climate-resilient, sustainable and stable future. The CoMPRA project will focus broadly on African countries and specifically on six countries (Benin, Senegal, Tanzania, Uganda, Nigeria and South Africa). SAIIA and CSEA, as the lead implementing partners for this project, also work with think tank partners in these countries.

Our Donor

This project is supported by the International Development Research Centre (IDRC). The IDRC is a Canadian federal Crown corporation. It is part of Canada’s foreign affairs and development efforts and invests in knowledge, innovation, and solutions to improve the lives of people in the developing world.