Summary

- A few centuries ago, people from Micronesia sailed some 400kms to the Palauan archipelago where they quarried stone. In Micronesia that stone became Rai ‒ an ingenious early method of enabling trade and asset exchange between people living on distant islands.

- In the modern world of e-money and digital leapfrogs, Rai can be used to help conceptually understand the technological innovation provided by blockchain and other digital accounting tool equivalents, such as tokenisation.

- China’s central bank, the People’s Bank of China (PBoC), started researching a digital version of the national currency, an e-CNY, in 2014, the groundwork for which was completed in 2019. Since then, the e-CNY has evolved slowly in the breadth and depth of its applications within China, a process expected to speed up in 2024.

- Africa’s estimated 42 currencies are mainly used only within the issuing zone. Intra-African trade tends to be driven by African companies and their local banks. Correspondent banks are used, which are typically outside of Africa, to settle payments between two African countries in a third, external currency, typically dollars or euros.

- The Pan-African Payment and Settlement System (PAPSS) is expected to reduce costs and to accelerate the settlement and payment of trade transactions using local currencies.

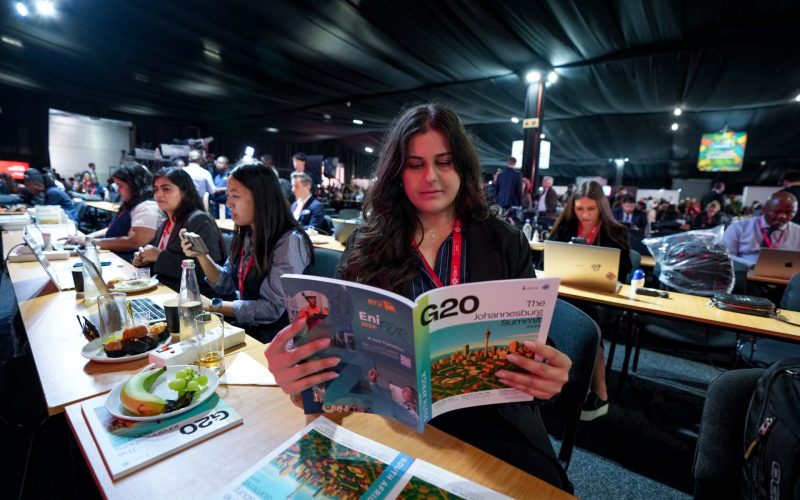

- Only Nigeria has an active digital currency in Africa, but other African countries are exploring the option. Understanding the form and implications of China’s digital currency agenda, and how it may directly and indirectly shape China’s economic relations with Africa, is important in informing Africa’s own digital currency debate.