Recommendations

- Private sector has performed well in developing ICT infrastructure. While there are limitations to its contributions, these should be encouraged and incentivised. Caution should be exercised in policy (such as taxation) towards it.

- Ongoing investment in assets – especially fibre – needs to be made. Particular attention should be paid to expansion in Africa’s rural areas: identifying and incentivising local-level providers must be a priority.

- African countries need to upgrade their ICT policy capacity, to react to changes in the ICT environment, establish robust cybersecurity frameworks and ensure predictable conditions for the private sector.

Executive summary

Africa’s Information and Communication Technology (ICT) deficit is a major brake on its development prospects. Africa lags behind the rest of the world in the reach and quality of its ICT penetration. Investment in the order of $3 billion a year will be required to address this. The private sector has served the continent well in providing ICT infrastructure and this should be further encouraged. However, the limited incentives to invest in rural areas call for innovative thinking. Smaller, local initiatives may be of use in this respect. Africa also faces the problem of affordability – as much as ICT infrastructure may become available, it will count for little if Africa’s population is unable to use it. This calls for strategic and prudent policy interventions.

Information and Communication Technology in Africa: A background

Prospects for growth and development in 21st century Africa depend on how the continent positions itself for value-adding activities. The world’s economy is creating opportunities previously unimaginable. To take advantage of this, an effective enabling environment is essential. Information and Communication Technology (ICT) is a particularly important contributor to modern economies. Yet, as has long been recognised 1African Development Bank, Infrastructure Development, https://www.afdb.org/en/knowledge/publications/tracking-africa%E2%80%99s-progress-in-figures/infrastructure-development, little frustrates Africa’s potential like its infrastructural deficits and unfortunately ICT is not an exception. This policy briefing maps out the current state of ICT infrastructure on the continent and suggests practical recommendations to improve it.

ICT can be understood in terms of two technologies: telephony (particularly mobile telephony) and the Internet. With the advent of ‘third generation’ (3G) mobile technology in the early years of the millennium, and ‘fourth generation’ (4G) a decade later, telephony and the Internet have become increasingly interlinked. ICT enables improved efficiencies in performing tasks, allows for decentralised work and gives firms in remote locations opportunities to involve themselves in global value chains. Of special relevance to Africa, ICT also compensates, to a degree, for the lack of other infrastructure.2Narcyz Roztocki and H Roland Weistroffer, ‘Research Trends in Information and Communications Technology in Developing, Emerging and Transition Economies’, Roczniki – Kolegium Analiz Ekonomicznych 20 (2009): 113-127.The current COVID-19 pandemic has furthermore underlined the necessity of ICT enabled activities.3Gus Silber, interview with Terence Corrigan, 12 May 2020.

The African Union (AU) recognises the importance of ICT. The continental development strategy, Agenda 2063, repeatedly refers to it, envisaging a highly connected Africa. ICT will be a tool of business, social interaction and governance.4African Union, Agenda 2063: The Africa we want (Addis Ababa: AU, 2015), 13, 36, 66, 75,77.The AU has since expanded on this with its Draft Digital Transformation Strategy for Africa (2020–2030), a ‘strategy to guide a common, coordinated response to reap the benefits of the fourth industrial revolution’.5AU, Draft Digital Transformation Strategy for Africa (2020–2030), (Addis Ababa: AU, 2019), 1.

However, in investment terms, ICT is a relatively small proportion of Africa’s total infrastructure needs. The African Development Bank (ADB) estimates that dealing with the continent’s infrastructural backlog (the continent as a whole) will demand annual outlays of some $130 billion to $170 billion until 2025.6ADB, African Economic Outlook, (Abidjan: ADB, 2018), 70.Of this, between $4 billion and $7 billion would need to be put into the ICT sector.7Infrastructure Consortium for Africa, Infrastructure Financing Trends in Africa – 2018. (Abidjan: ICA Secretariat/ADB, 2018), 13.

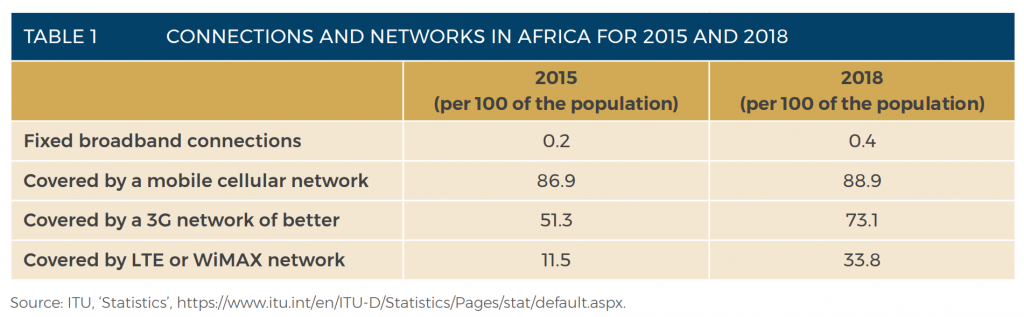

Currently, Africa’s ICT systems are inadequate to fulfil its aspirations. If ICT is – by quantum of expenditure – dwarfed by other needs, the shortfall remains daunting. Statistical information on coverage illustrates this. The International Telecommunication Union (ITU)8ITU, ‘Statistics’, https://www.itu.int/en/ITU-D/Statistics/Pages/stat/default.aspx.estimates that there were 76.7 mobile phone subscriptions per 100 inhabitants in its African region (essentially sub-Saharan Africa) in 2018 – up from 44.3 in 2010, and a mere 12.4 in 2005. Active mobile broadband subscription stood at some 30.7 per 100 in 2018 (1.7 in 2010).

The table below shows the proportion of connections or networks per 100 of the population in Africa, for the years 2015 and 2018 respectively.

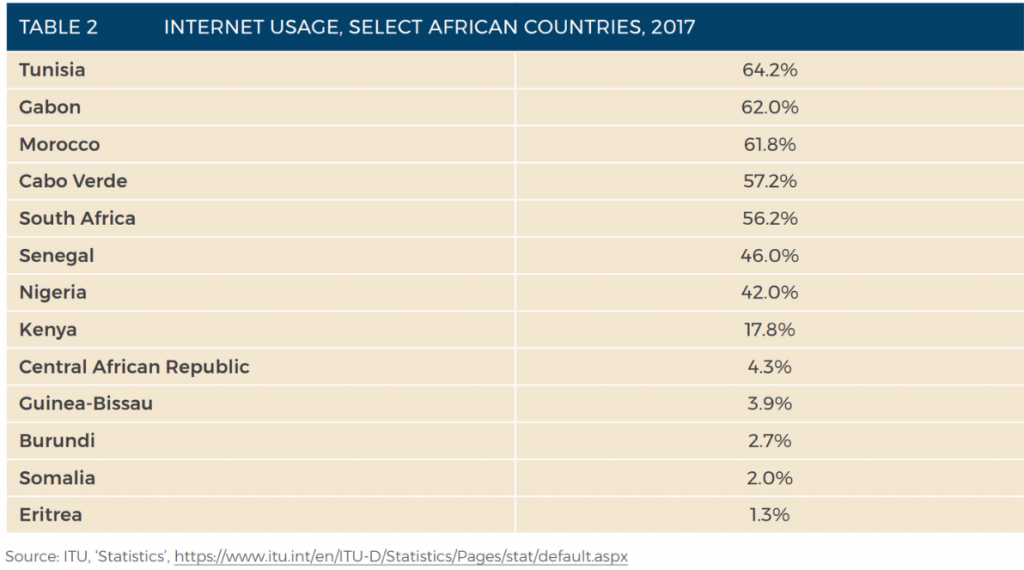

The ITU found that in 2018, only 26.3% of Africans were Internet users. This represented an almost threefold increase over 2010 (9.9%), and a tenfold increase over 2005 (2.7%). There is considerable diversity among Africa’s societies in terms of Internet usage, as shown in the table below.9ITU, ‘Statistics’, https://www.itu.int/en/ITU-D/Statistics/Pages/stat/default.aspx. (Note: the statistics are for 2017).

The overall impression is of progress but, by every measure, Africa lags behind world averages and other regions. Globally, Internet users, for example, account for 51.4% of the population – nearly double the proportion in Africa. In the Arab States, the equivalent number stands at 49.5%, at 46.2% in Asia and the Pacific, at 69.9% in the former Soviet Union states, 80.1% in Europe and 74.6% in the Americas.

Internet access, usage and availability are paired with measures of quality and affordability. According to the Speedtest Global Index, the average mobile download speed globally was 30.89 Mbps in April 2020, while the same for fixed broadband was 74.74 Mbps. In Africa, the highest mobile download speed was in Morocco, at 30.88 Mbps. The highest for fixed broadband was in South Africa at 33.14 Mbps. In both categories, the continent’s countries fell behind the rest of the world. Mobile and fixed broadband download speeds were 7.09 Mbps and 5.02 Mbps respectively in Sudan, 10.13 Mbps and 12.98 Mbps in Tanzania, and 11.02 Mbps and 32.98 Mbps in Ghana.10Speedtest, Speedtest Global Index, Global Speeds April 2020, https://www.speedtest.net/global-index.

The Alliance for Affordable Internet (A4AI) reports that of the 45 African countries (North African and Sub-Saharan) it tracks, only 10 meet its standard for ‘affordable Internet’. This it defines as 1 gigabyte (GB) of data costing 2% or less than the average monthly income. The countries whose costs meet this standard were Algeria, Botswana, Cabo Verde, Egypt, Gabon, Mauritius, Namibia, Nigeria, Sudan and Tunisia. Across Africa, the average cost was 7.1%.11Alliance for Affordable Internet, Affordability Report 2019. Regional Snapshot: Africa, (Washington DC: Web Foundation. 2019), 4.

So, as well as being significantly less ‘connected’ than the rest of the world, Africa trails behind in the quality of services available, as well as sheer costs. Importantly, the A4AI’s analysis – its Affordability Driver’s Index – shows that infrastructural factors12A4AI, The 2019 Affordability Report, (Washington DC: Web Foundation, 2019). Infrastructural drivers are defined as the ‘extent of infrastructure deployment and operations, alongside the policy and regulatory frameworks in place to incentivise and enable costeffective investment in future infrastructure expansion.’consistently underperform other drivers of access.

Expanding ICT infrastructure

Africa’s ICT infrastructure has grown over the past two decades. ICT is a prime case of infrastructural rollout, ‘leapfrogging’ dated technologies in favour of new ones. Thus, limited coverage by copper-based telephone systems made it practicable and attractive to shift straight to fibre-optic systems. The various fibre-optic cables that deliver connectivity to Africa – such as SEACOM, the West African Cable System, and Africa Coast to Europe cable – are examples of this. They offer the backhaul infrastructure that make possible high-quality Internet access, while dispensing with the need for expensive satellite services that had previously fulfilled the demand.

The Infrastructure Consortium for Africa (ICA) – a colloquium of governments and institutions aimed at developing the continent’s infrastructure, including the World Bank, the ADB, and the G7 countries – puts the average annual commitment to Africa’s ICT infrastructure in the period 2016-2018 at $4 billion.13ICA, Infrastructure Financing Trends in Africa, 13.The ‘funding gap’ is as much as $3 billion a year. (The ‘funding gap’ for the continent’s overall infrastructure needs is between $52 billion and $92 billion.)

The most notable feature of ICT financing is private sector investment. Of the $7.1 billion committed to ICT investments in 2018, well over half – $4.8 billion – originated in the private sector. Some $1.1 billion was committed by African governments, $550 billion and $503 billion by China and the ICA respectively, and $66 billion from other bilateral and multilateral partners.14ICA, Infrastructure Financing Trends in Africa, 49, 69.

Private sector interest in ICT reflects its profitability. This has, in turn, created opportunities for cooperation between firms, within the continent and abroad, and with the public sector.

Mobile telephony, for example, has seen South African companies MTN and Vodacom playing an important role. The fibre-optic cables mentioned above have been constructed and operated by consortia representing a mix of the private and public sectors (typically through wholly or partially state-owned telecommunications enterprises). Given the sums involved (the SEACOM cable was budgeted at some $650 million15SEACOM, ‘SEACOM Closes Financing, Starts Construction of Undersea Fibre Optic Cable Transcontinental Investment Boosts South and East African Economic and Social Development with High Capacity Link to India and Europe’, media statement, 2007, https://cisp.cachefly.net/assets/articles/attachments/09069_seacom.pdf..), this represents a major and welcome injection of capital.

Well-planned, well-executed state-led investment has proven effective in Rwanda. Here, starting at the turn of the millennium, the state had a vision of a knowledge-based economy. State funding was behind the backbone fibre network and, ultimately, much of the rest of the infrastructure. Subsequently, Rwanda developed and operationalised a Wholesale Open Access Network 4G LTE system in a public-private partnership with Korea Telecom (KT). This afforded KT a 25-year licence for the 800 MHz and 1800 MHz bands, which is in turn made available to providers.16A4AI, 2019 Affordability Report, 23-24.The official stress on ICT has been matched by Rwandan businesspeople, who have seen opportunities for smart ticketing in transport and drone technology in agriculture.17CNBC Africa, ‘How Technological Advancements are Driving Rwanda’s Growth’, (Video broadcast, 11 June 2019), https://www.cnbcafrica.com/videos/2019/06/11/how-technological-advancements-are-driving-rwandas-growth/.These opportunities are welcome, and are making Rwanda an increasingly attractive investment destination but, as the World Bank says, ‘the agenda remains unfinished’.18World Bank, Rwanda Systematic Country Diagnostic, Report No 138100-RW (25 June 2019), xiv.

One important emerging player in the provision of ICT infrastructure is China. It has integrated this into its Belt and Road initiative, under the heading of the Digital Silk Road. The COVID-19 pandemic has arguably accelerated interest on the continent in this initiative19Baker McKenzie, The Impact of COVID-19 on China’s Belt and Road Initiatives in Africa, 31 March 2020, https://www.bakermckenzie.com/en/newsroom/2020/03/bri-africa.and firms such as Huawei have a growing presence in the majority of African countries.20Mapping China’s Tech Giants, https://chinatechmap.aspi.org.au/#/map/.Chinese products and services are competitively priced and have contributed to African ICT solutions; for example, the M-Pesa money transfer system is run on Huawei platforms.21Irene Yuan Sun, Kartik Jayaram and Omid Kassiri, Dance of the Lions and Dragons (McKinsey & Company, June 2017), 42-44.Chinese firms are also investing in African technology firms such as Palmpay and Lori Systems.22Kate Clark, Start ups Weekly: Chinese investors double down on African start ups, Techcruch, 30 November 2019, https://techcrunch.com/2019/11/30/startups-weekly-chinese-investors-double-down-on-african-startups/.

Looking forward

ICT infrastructural development is a good-news story for the continent. Challenges, however, remain and the continent’s full participation in the digital world depends on addressing them.

The key issue compromising the growth of ICT in Africa is affordability. The costs of ICT use must align with the abilities of African users to pay for it. The relatively slow uptake of Rwanda’s 4G network has been ascribed to the cost relative to the existing 3G.23GSMA, Wholesale Open Access Networks, (London: GSMA, 2017), 4.

In principle, this might be the subject of policy and regulation, although this is a challenging area for many African countries, whose capacity for policy making and implementation is limited. Telecommunications policy in South Africa, for example, has been dogged by uncertainty, despite the sophistication of the economy.24Helenya Fourie, Lara Granville and Nicola Theron, Regulatory Ambiguity and Policy Uncertainty in South Africa’s Telecommunications Sector, (Working Paper 729, Economic Research Southern Africa, Cape Town, 2018), https://econrsa.org/system/files/publications/working_papers/working_paper_729.pdfThe solution may be to focus on a few key policies to encourage competition and developmentally focused investment in ICT infrastructure. For example, keeping interconnection fees between networks under control is essential, as these can be used to leverage undue market dominance.25Alan Knott-Craig, interview with Terence Corrigan, 13 May 2020.

Extending rural access, meanwhile, is another imperative. The infrastructure for Internet connectivity is sometimes unavailable in rural areas, and the private sector is understandably less inclined towards rural projects. Creative options might fruitfully be explored. These include assisting local SME-style operators in filling this gap and encouraging a secondary market in spectrum (particularly as 5G is introduced – although it is currently restricted to a few urban centres, predominantly in South Africa).26Towela Nyirenda-Jere, interview with Terence Corrigan, 13 May 2020; Sun, Jayaram and Kassiri, Dance of the Lions and Dragons.

Added to this is the potential offered by ongoing innovation. For example, the multiplier effects offered by cloud technology are steadily expanding the ICT competitiveness of the continent.

Yet, however successfully infrastructure is rolled out across the continent, this will count for little if it is not accompanied by a corresponding expansion of the skills base – for installation, maintenance and innovation. According to Dr Towela Nyirenda-Jere of the Secretariat of the New Partnership for Africa’s Development: ‘We need expertise and skills to deal with the ICT system. If we don’t get it right it will be difficult to make the African Continental Free Trade Area work. The COVID-19 pandemic has shown just how important ICT and technology are for Africa.’

Acknowledgement

SAIIA gratefully acknowledges the support of the Swedish International Development Cooperation Agency (SIDA) for this publication.