Research shows that most agro-processing and storage technologies require significant investment and scale, therefore currently favouring larger, commercial farmers over smallholder farmers. To support smallholder access to value-addition supply chains in Africa, it is therefore recommended that the AU-EU partnership focus on:

- The reform of cooperative structures to aggregate farming produce, leverage economies of scale, and organise farmers around price-setting and processing for value-addition.

- Rapid and targeted deployment of mini-grids in village communities engaged in staple and cash crop farming as an enabler for yield-improvement, post-harvest storage, and aggregated processing technologies.

- Incentives to increase access to micro- and commercial finance for farmers and cooperatives, and the roll-out of technology-specific micro-enterprise training that is easily accessible to rural end users.

Executive summary

The economic impacts of the COVID-19 pandemic exacerbate uncertainty around the future of work in Africa. The impact of climate change on Africa’s largely rain-fed agricultural sector only deepens the growing food crisis and compounds the employment challenge. Africa has the lowest agricultural productivity per capita across the world, due in large part to a severe lack of investment at the level of the smallholder farmer. This represents major latent job creation and food security potential, which can be unlocked through fast, affordable access to key productivity inputs, including electricity. The question is: how? The Powering Agriculture campaign was launched in 2019 to help fill the agriculture-energy nexus knowledge gap and better inform public-private partnership action. This policy briefing highlights three key, practical policy recommendations for mobilising Africa’s next green revolution.

Unlocking the trifecta: Food security, livelihood creation, and energy access in Africa

The future of work is a major source of uncertainty, especially in sub-Saharan Africa, where economic activity has decelerated over the past decade and where further declines are projected due to the COVID-19 pandemic. Given that the agriculture sector accounts for more than 32% of the continent’s gross domestic product, food systems account for over 65% of the continent’s labour force, and that food demand is quickly on the rise, agriculture has major potential to deliver economic benefits, while supporting livelihoods and improved food security.

However, the sector struggles to absorb large volumes of new workers given its low productivity and low profitability. Yields from maize – the continent’s most important staple crop – average two tons per hectare annually, less than a quarter of yields in the Americas, and over the past 30 years productivity per person in Africa has increased at only a fraction of the rate in Asia.1Sudeshna Ghosh Banerjee et al., Double Dividend: Power and Agriculture Nexus in Sub-Saharan Africa (DC: World Bank, 2017).According to the Food and Agriculture Organization (FAO), this is because growth in sub-Saharan African agricultural output has accrued predominantly from area expansion and intensification of cropping systems, as opposed to targeted, widespread improvements in productivity.2OECD/FAO, OECD-FAO Agricultural Outlook 2016-2025 (Paris: OECD and Food and Agriculture Organization of the UN, 2016).Smallholder farmers produce 85% of sub-Saharan Africa’s agricultural output, with more than 75% of them preparing their lands using only hand tools, and only 5% of total cultivated land under irrigation. Importantly, only $40 per ton of value is added to agricultural produce post-harvest in Africa, a mere fifth of value added in high-income countries.3Banerjee et al., “Double Dividend”.

Over the past 15 years, African governments that have effectively promoted agricultural productivity (such as Ethiopia and Rwanda) have enjoyed faster poverty reduction, higher labour productivity in non-farm sectors, and a more rapid diversification of the labour force from farming into the broader economy.4Thomas Jayne, Felix Kwame Yeboah and Carla Henry, The Future of Work in African Agriculture: Trends and Drivers of Change, Working Paper No. 25 (International Labour Office, December 2017).Post-harvest agro-processing in particular currently accounts for very few jobs across the continent.5Jayne et al., “The future of work in African agriculture”.Given the growing challenge of land fragmentation and scarcity, agro-processing represents a major near-term opportunity to simultaneously address livelihood creation, food security, and economic growth through value-addition.

Investment in power infrastructure, while certainly not the only enabler, is vital to unlocking this productivity. Currently, the agriculture sector accounts for just 2% of total electricity consumption across the continent, but as large multi-national companies, such as Lorentz and Embraco, enter the agro-processing sector, electricity demand in the sector is expected to double by 2030.6Banerjee et al., “Double Dividend”.In fact, according to the World Bank, there are thirteen major agricultural value chains in sub-Saharan Africa that have high electricity valueadd and which will together represent 6GW of agricultural electricity demand by 2030, demonstrating the ‘value-addition gap’ and the potential for enhanced electricity access to support agricultural productivity.7Banerjee et al., “Double Dividend”In rural areas, decentralised solutions, such as solar mini-grids (small-scale generation systems serving a limited number of consumers through local distribution networks), are critical to accelerating access to reliable, high-quality power. Mini-grids themselves can equally benefit from agro-processing demand through increased electricity revenues, thereby improving affordability for end-users, and increasing the pace of progress towards achieving energy access for all.

Zero hunger, energy access and decent work are all pillars of EU engagement with African stakeholders. In this context, it is important to ask how public and private sector stakeholders can partner to leverage the job creation potential of the agriculture sector, and what role renewable energy can play to hasten this revolution. With the emergence of the COVID-19 pandemic, answering these questions is even more urgent. Indeed, according to the FAO, the potential of agriculture and agri-food value chains to lift large numbers of the rural poor out of poverty is well-recognised, but under-supported with data for policymaking.8FAO, The Hand-in-Hand Initiative Information Note, (Food and Agricultural Organization, November 2019), http://www.fao.org/3/nb922en/nb922en.pdf.This briefing outlines three actionable policy recommendations by exploring the case of maize farming in Uganda.

How to usher in the next green revolution: A case study of Uganda

Uganda is an example of a predominantly agrarian African society, where most farming is small-scale, low-input and non-irrigated. Maize is the most widespread cereal crop, grown in all parts of the country. However, the collapse of the cooperative as an organising structure for farmers during the agriculture sector’s liberalisation in the mid-1990s has left Ugandan farmers with little price-negotiating power, and with few linkages to the food and beverage multinationals, like supermarkets and breweries, who serve growing demand from urban consumers.9Nana Kwapong and Patrick Lubega, ‘Revival of Agricultural Cooperatives in Uganda’ (Policy Note No. 10, International Food and Policy Research Institute (IFPRI), 2010).Given the lack of standards, quality control, and reliability of local produce, these companies often resort to importing raw materials. Smallholder farmers are then forced to rely on informal middlemen, who have little incentive to invest in backward linkages. An analysis of best-available data identifies three key opportunities for public and private partnerships to expand smallholder productivity.

Filling the gap for village-level aggregation and processing

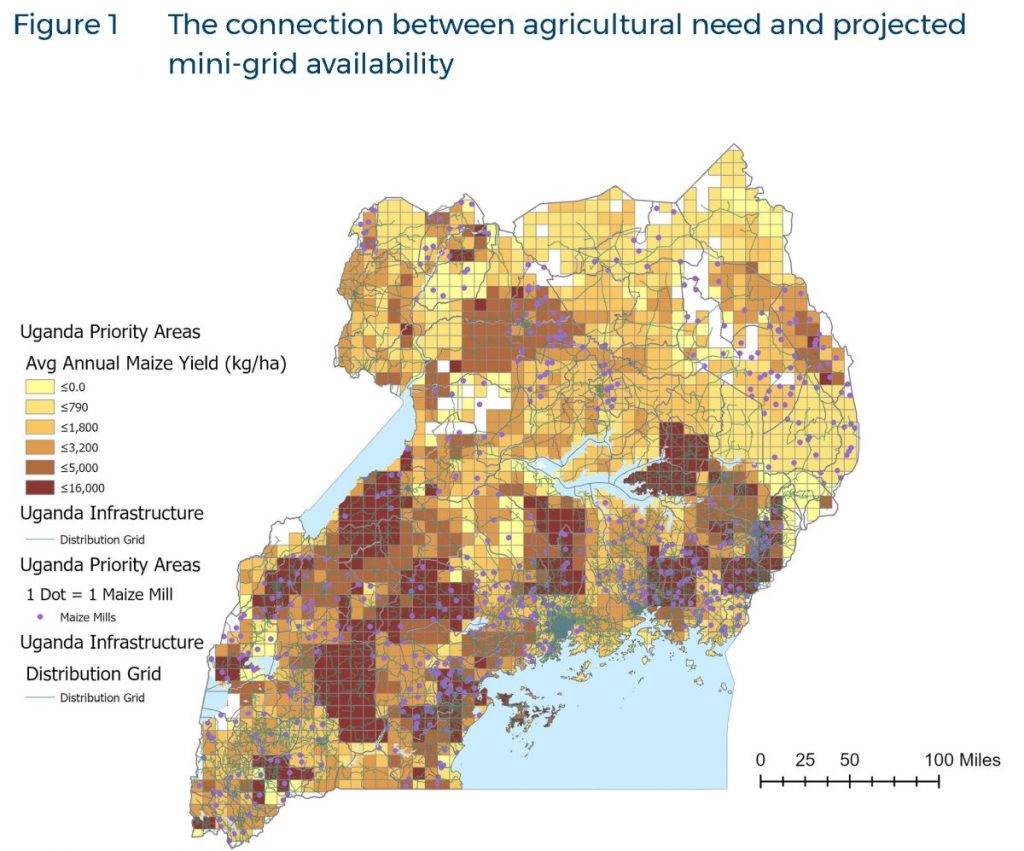

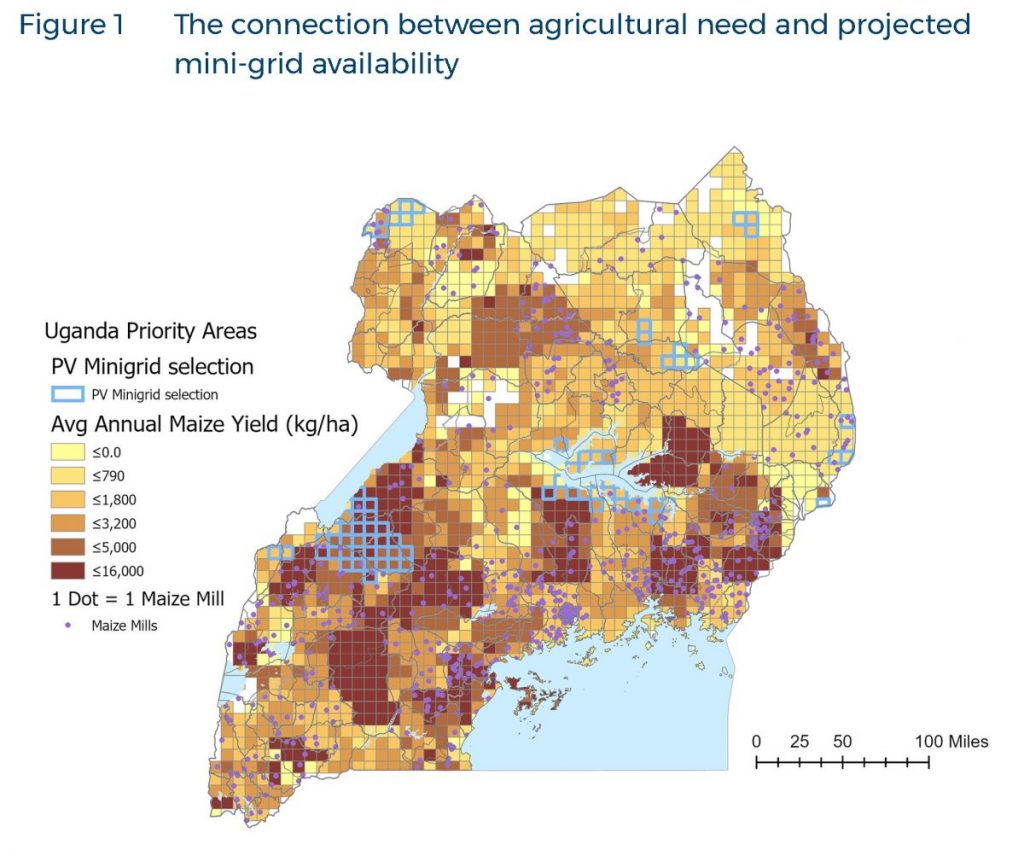

Because of the supply chain breakdown, there are very few village aggregation centres for maize processing in Uganda. A recent millers survey finds most districts have limited milling capacity, especially in the west and northern regions where farmers rely heavily on low-output, low-quality diesel mills. Uganda’s entire western region, for instance, had only 173 active maize mills, or 55 metric tons daily processing capacity.10Strengthening Partnerships, Results, and Innovations in Nutrition Globally (SPRING), Uganda: Mapping of Maize Millers. A Road Map to Scaling Up Maize Flour Fortification (Arlington: SPRING/USAID, 2017).High capacity mills are found mostly in urban, electrified areas (see Map 1a, Figure 1). However even in electrified areas, the unreliability of power supply and the relatively high tariffs present a widely acknowledged challenge for millers, reducing effective milling capacity.11SPRING, “Uganda: Mapping of Maize Millers”.The product space for maize in Uganda is thus not fully exploited, and can be expanded by improving access to processing for flours, oils, and other high-end products that meet regional quality standards.12Mildred Barungi, State of Uganda’s Maize Industry, Case Study 6 (Economic Policy Research Center, 2019)As electrification rates across Uganda are low, and as stand-alone solar mills are not yet commercially viable,13Lighting Global, The Market Opportunity for Productive Use Leveraging Solar Energy (PULSE) in Sub-Saharan Africa (Washington, DC: IFC, 2019).mini-grids represent an important opportunity to serve the needs of thousands of communities who are currently without high-quality, reliable grid access, while displacing diesel-powered mills.

Combining the miller survey data with least-cost electrification projections for Uganda14International Energy Agency (IEA), Africa Energy Outlook 2019, World Energy Outlook special report (Paris: IEA, 2019).and maize crop statistics15IFPRI, Global Spatially-Disaggregated Crop Production Statistics Data for 2000 Version 3.0.7 (Harvard Dataverse, 2019).shows that more than 60% of maize croplands in Uganda can be served at least-cost by mini-grids (see Map 1b, Figure 1). More than half of those croplands are in districts without known milling capacity, demonstrating the immediate potential of mini-grids to drive processing activity. Similarly, while oil seeds are major cash crops in Uganda, vegetable oils are mostly imported due to limited processing capacity.16Open Capital Advisors, Promoting Productive Uses of Energy in Uganda: Status and Potential for Growth (Nairobi: Shell Foundation, 2018).In fact, oil seed and oil palm are part of a suite of strategic commodities the Ugandan government is targeting for smallholder intervention,17Government of Uganda, Ministry of Agriculture, Animal Industry and Fisheries, Agriculture Sector Strategic Plan, Lighting Global “The Market Opportunity for PULSE”. (Kampala: Government of Uganda, 2020).signaling the broad opportunities for domestic processing activities across multiple crops. Thus, policy and energy planning which promotes rapid, targeted deployment of mini-grids in underserved communities can encourage localised, village-level agro-processing activity.

Addressing the demand for micro-finance and commercial cooperatives

More than 60% of maize farmers in Uganda are unable to apply any cash inputs at all to their farms.18Mildred Barungi, State of Uganda’s Maize Industry, Case Study 6 (Economic Policy Research Center, 2019).Farmers are unable to invest in even basic means to improve yield, like resistant seed varieties or fertilizers, much less storage and processing. Meanwhile, most diesel mills use poor-quality machinery manufactured from non-food grade materials. As such, most of the functional grain processing and storage facilities available in Uganda are owned by private companies in urban areas far from farmers. Uganda is not unique in this access challenge. Indeed, while sub-Saharan Africa’s addressable market for irrigation, cooling, refrigeration and agro-processing is estimated at $11 billion today, when discounted for farmer ability to pay, the serviceable market shrinks to $700 million.19Lighting Global “The Market Opportunity for PULSE”.Micro-finance solutions are therefore critical to support small farmers and down-stream value-addition.

Furthermore, policy reforms are needed to encourage commercial cooperatives that can effectively organise production and post-harvest logistics and negotiate for higher prices in the market, as opposed to unions only selling directly to market boards. A recent USAID project in Uganda found village aggregation centres and associated interventions could improve maize farm yields by 35% on average, and increase prices received for maize by more than 30%, which together more than doubled household incomes for farmers in the study.20Eduardo Tugendhat, Transforming the Uganda Maize System: Positive Impact Case Study (Palladium, 2017).Cooperatives themselves will require capital to make cash payments to farmers, invest in high-quality machinery, and leverage economies of scale. Financing solutions, such as agricultural bank loans, that are tailored to cooperative needs are critical to re-building supply chains and encouraging aggregation. Thus, both micro and commercial finance is needed. Designing policy incentives to attract financial institutions will require a detailed understanding of the supply and value chains, potential markets and opportunities, and relevant risks.

Promoting micro-enterprise training that is easily accessible to rural end users

Agro-processing currently accounts for only 2.8% of employment in Uganda, but the sector is expected to grow rapidly.21Jayne, et al., “The future of work in African agriculture”Alongside maize milling, a wave of agro-processing enterprises are emerging – from fruit drying to refrigeration and cold storage, oil pressing, egg incubation, solar coffee pulping, honey processing, and more. In fact, there are over 100 firms developing off-grid solar productive use appliances in sub-Saharan Africa, and hundreds more distributing them.22Lighting Global “The Market Opportunity for PULSE”Productive uses of energy in agriculture can not only increase monthly incomes, but also generate strong multiplier effects in the downstream agri-food sector and the broader non-farm economy.23Jayne et al., “The future of work in African agriculture”This has significant development implications, as women and youth are the hardest impacted by the current dearth of rural employment opportunities – labour force participation is 45% higher for urban women and youth than their rural counterparts in Uganda.24Madina Guloba, Sarah Ssewanyana and Elizabeth Birabwa, Rural Women Entrepreneurship in Uganda: A Synthesis Report on Policies, Evidence and Stakeholders, Research Series No. 134 (Kampala: Economic Policy Research Center, 2017).

Given the potential of the sector to create much-needed rural employment, it is key to develop appropriate, targeted training programmes easily accessible by rural communities. As much as 30% of annual maize production in Uganda (roughly half a million tonnes, or $4.5 million) is lost due to poor post-harvest handling practices for drying and storage,25Apurba Shee et al., ‘Determinants of postharvest losses along smallholder producer’s maize and sweet potato value chains:

an ordered Probit analysis,’ Food Security: The Science, Sociology and Economics of Food Production and Access to Food, The International Society for Plant Pathology 11, no. 5 (2019): 1101–1120.and losses are even higher for more perishable crops. Indeed, the World Bank estimates the value of annual post-harvest loss in sub-Saharan Africa for all grains to be about $4 billion – more than the value of food aid the continent received over the last decade.26World Bank, Missing food: The case of post-harvest grain losses in sub-Saharan Africa, Report No. 60371-AFR (Washington, DC: World Bank, 2011).Further, over 60% of millers use poor management practices, jeopardising worker safety and consumer health, and highlighting the need for training.27SPRING, “Uganda: Mapping of Maize Millers”.Mini-grid companies themselves highlight the need for basic micro-enterprise training among rural end-users, from post-harvest best practice to bookkeeping and business planning.28Rebekah Shirley et al., ‘Powering Jobs: The Employment Footprint of Decentralized Renewable Energy Technologies in Sub Saharan Africa,’ Journal of Sustainability Research 2, no. 1 (2019): 1-38.As the agriculture sector continues to develop, farmers and agro-processors will require a greater range of technical, business and behavioural skills than the current training systems produce. Governments can mobilise resources for widespread training and recruitment programmes through agricultural technical and vocational institutes as well as cooperatives, to ensure the workforce is able to leverage improved access to energy, finance, and other key inputs to enhance productivity and increase incomes.

Conclusion: Actions for the EU-AU partnership to enable a green transition

Agriculture is perhaps the sector best poised to benefit from the potential of clean energy access. This linkage can deliver multiple benefits, including mitigating climate change, unlocking productivity, boosting near-term economic growth, and creating local jobs. While many African countries, including Uganda, have implemented government initiatives to improve mechanisation, these efforts often focus on yield improvement interventions, neglecting value-addition. While electricity access is important for expanding productivity, energy infrastructure investments must be coordinated with other targeted interventions such as agricultural finance, the reform of agriculture cooperatives and training. The combination of these elements will stimulate agricultural production, with significant multiplier effects in the rural economy. The EU’s Comprehensive Strategy with Africa, as well as the AU’s Agenda 2063 prioritise local production, fair value chains, education, job creation and hunger elimination. These are important aspirations that require concrete action led by policy makers. By partnering in these three policy areas – mini-grid expansion, access to finance, and cooperative and training reforms – powerful opportunities can be unlocked, ushering in Africa’s next green revolution.

Acknowledgement

This policy briefing has been published as part of a series under the project Partnership for a Green Transition and Energy Access: Strategic priorities for Africa and Europe. The project is a partnership between SAIIA and the Konrad Adenauer Stiftung’s Regional Programme on Energy Security and Climate Change in Sub-Saharan Africa.