Recommendations

Rapidly develop Africa’s significant renewable energy potential:

- The G20 and other partners should engage with and support Africa in unlocking its enormous renewable energy potential, including green hydrogen.

- The AU should promote the establishment of solar plants and other renewable energy infrastructure in Africa for full exploitation of its renewable energy resources.

- The AU should advocate for ‘friend-shoring’ partnerships between the Global North and African countries for effective and beneficial partnership on green value chains.

- Africa should strengthen its participation in renewable energy technology value chains, including lithium-ion batteries and other clean energy technologies.

Strengthen access to finance for renewable energy deployment:

- The G20 should strongly advocate for the Global North to adhere to their climate finance pledges.

- The AU should support initiatives that build a foundation for a thriving carbon market in Africa.

- The AU should support African countries in reviewing their revenue sharing frameworks to support financing for the energy transition.

Strengthen technology transfer in support of a just transition:

- The AU should strengthen collaboration and networking between Africa and partners (both South–South and South–North) to strengthen renewable energy research, knowledge sharing, capacity-building, technology development, and technology transfer.

- The AU should advocate for favourable protection of African intellectual property and support the patenting of green technologies.

Executive Summary

Africa has the fastest-growing population but the lowest rates of energy access globally. About 600 million people lack access to electricity and 970 million people lack access to clean cooking energy in Africa. Africa has enormous renewable energy resources, yet these resources remain largely untapped. The key challenges the continent faces in expanding solar, wind, geothermal and hydro energy production include insufficient investments in renewable energy and significant reliance on the Global North for the supply of renewable technologies. To address these challenges, African countries need to invest in effective interventions geared towards the exploitation of the continent’s abundant renewable energy sources. This will require mobilising adequate resources to finance renewable technologies through strengthening partnerships and collaborations. Such partnerships will be instrumental in building local capacity and accelerating Africa’s energy transition.

Introduction

Africa has the fastest-growing population but the lowest rates of energy access globally. In 2021, about 600 million people (43% of the population) lacked access to electricity. The number of people without access to electricity in Africa is projected to double by 2030. Similarly, 970 million Africans lack access to clean cooking energy; it is estimated this number will grow to 1 billion by 2030.1IEA, Africa Energy Outlook 2022 (Paris: IEA, 2022) Evidently, meeting the growing demand for energy in African countries remains a key policy challenge that requires significant interventions.

The adoption of renewable energy presents an opportunity to sustainably meet the continent’s growing energy demand. African countries are accelerating the pace of adopting renewable energy technologies and defining their path towards sustainable energy transformation.2RES4Africa Foundations, Africa’s Energy Future is Renewable (Rome: Res4Africa Foundation, 2023) This demonstrates the progressive steps being taken to reduce carbon emissions and achieve sustainable renewable energy production and green industrialization. Nearly all African countries have signed the Paris Agreement and prepared Nationally Determined Contributions, which outline their energy transition agenda.

Other key recent initiatives include the African Union Climate Change and Resilient Development Strategy and Action Plan (2022-2032), which supports enhanced climate cooperation and long term climate resilient development. The Compact with Africa programme creates an opportunity to advance African climate priorities within the G20 working groups on finance, the environment and climate, as well as energy transitions. The Accelerated Partnership for Renewables in Africa (APRA) initiative, supported by Denmark, Germany and the United Arab Emirates, seeks to promote the uptake of renewables and green industrialization in Kenya, Ethiopia, Namibia, Rwanda, Sierra Leone and Zimbabwe. The Moroni Declaration for Ocean and Climate Action in Africa calls on signatories to mobilise at least $15 billion by 2030 to conserve and restore 2 million km2 of ocean, enabling the sequestration of 100 million tonnes of CO2. The Nairobi Declaration emanating from the Africa Climate Summit convened in Nairobi in 2023, sets out concrete, systematic and sustainable plans to make the step-change that is needed to progress towards net zero emissions in Africa and calls for strong action in support of adaptation and climate finance. These initiatives are key in accelerating progress towards achieving universal access to affordable, reliable, sustainable and modern energy in Africa by 2030. Notably, 12 African countries that represent over 40% of the continent’s total CO2 emissions are committed to reach net zero emissions by around 2050.3IEA, Africa Energy Outlook 2022

Renewable energy, excluding traditional biomass, accounts for almost one-fifth of sub-Saharan Africa’s primary energy mix.4Climate Analytics, Renewable energy transition in Sub-Saharan Africa (Berlin: Climate Analytics, 2022) Despite the progress made in adopting renewable energy technologies in Africa, several challenges persist, including the mobilisation of finance, the establishment of supportive public policies, access to technology and requisite capacity. Consequently, African countries are at different stages in adopting renewable technologies. This policy brief reviews the status and potential of renewable energy and associated technologies in Africa. The brief also explores financing for renewable technologies and technology transfer in Africa.

Status of Renewable Energy and Renewable Technologies in Africa

Africa’s Renewable Energy Potential and Production

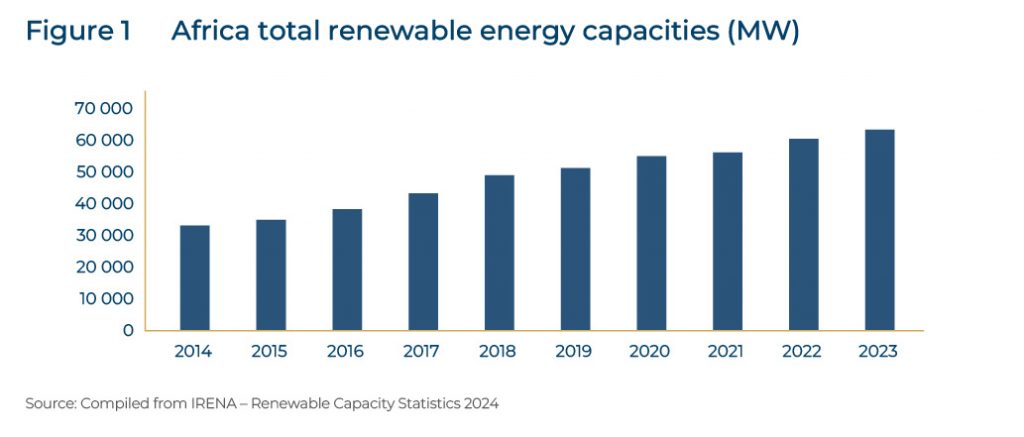

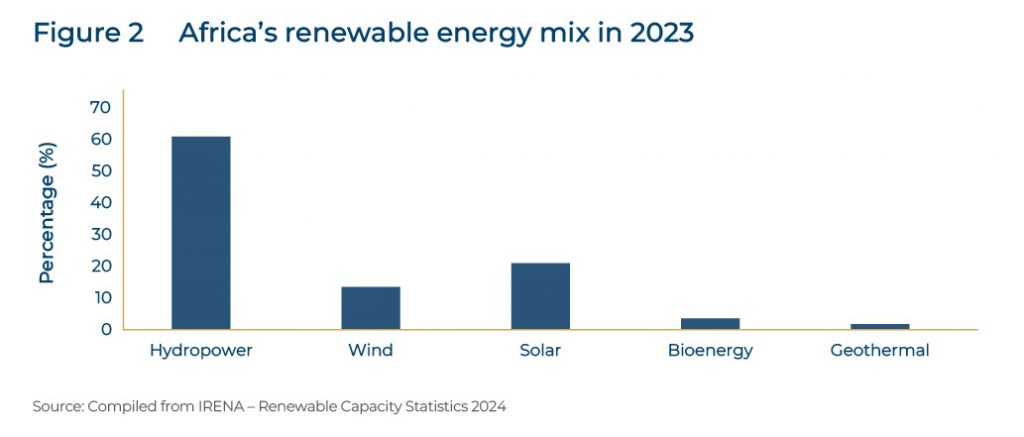

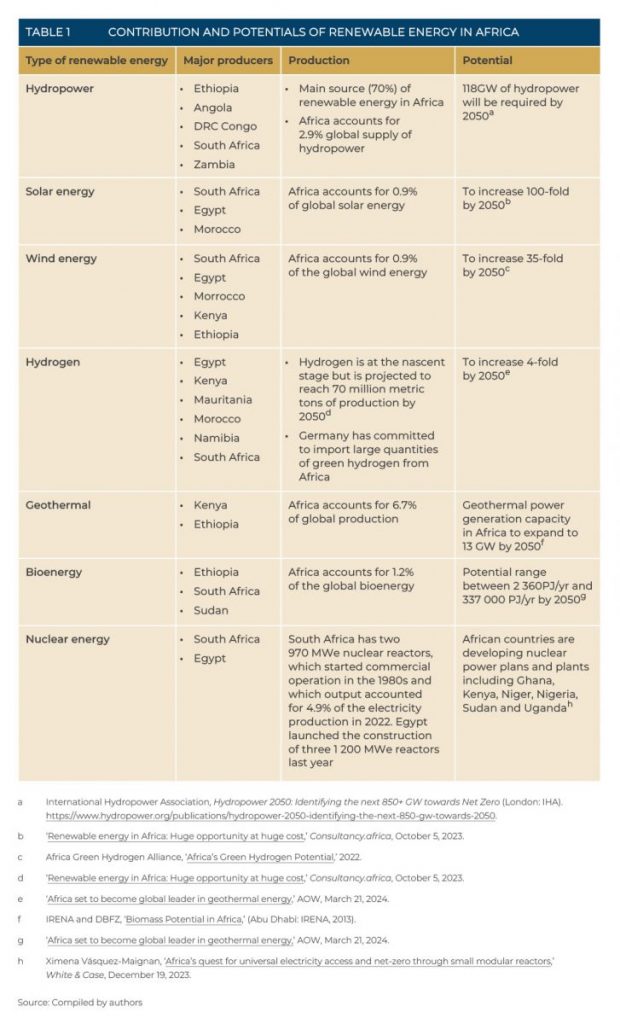

Africa accounts for just 1.6% of global installed renewable energy capacity.5Mulualem G Gebreslassie, Solomon T Bahta, Yacob Mulugetta, Tsegay T. Mezgebe and Hailekiros Sibhato, ‘The need to localize energy technologies for Africa’s post COVID-19 recovery and growth,’ Scientific African 19 (2023). African countries accounting for the highest shares of renewables include South Africa, Egypt, Ethiopia, Morrocco, the DRC, Zambia, Nigeria, Kenya and Mozambique.6IRENA, ‘Renewable Capacity Highlights’ Africa has the potential to increase its share of renewable energy, as demonstrated by the growth in renewable energy in recent years (Figure 1). Hydro power, solar and wind accounted for the highest shares of the renewable energy mix in 2023, as shown in Figure 2. Table 1 shows the current production and potential for various renewable energy sources in Africa.

Despite lagging in installed renewable energy capacity, Africa possesses large untapped renewable energy resources. For example, Africa hosts 60% of global solar resources, yet currently less than 1% of this potential has been exploited. It is projected that the uptake of solar energy will outcompete other sources of power continent-wide by 2030.7RES4Africa Foundations, Africa’s Energy Future is Renewable Exploitation of solar energy is hampered by the presence of very few local solar panel manufacturers, which tends to drive the cost of solar panels up. Other constraints include limited government commitment towards affordable solar products, as illustrated by the high taxes and tariffs on such products. About 89% of Africa’s hydropower potential remains untapped.8Carrieann Stocks, ‘An investor’s guide to hydropower in Africa’ International Water Power and Dam Construction, December 3, 2021. Africa has significant wind resources that can produce about 180 000 Terawatt hours (TWh) per annum.9Sean Whittaker, ‘Exploring Africa’s Untapped Wind Potential’ (Washington, D.C.: IFC, 2020). It has been estimated that Africa could produce 30–60 million tonnes per annum (mtpa) of green hydrogen by 2050.10‘Africa’s Green Energy Revolution (Hydrogen’s role in unlocking Africa’s untapped renewables),’ Africa Energy Portal, November 22, 2022. Although nuclear is a key potential source of clean energy in Africa, it requires economic support from the Global North, and securing broad public acceptance of this energy source has proved a challenge.

Like Africa, Asia is well endowed with some of the best renewable energy resources in the world. Asia is leading in the adoption of renewable energy and holds important lessons for Africa. Supportive public policies on energy, strategic investments, an emphasis on research and development, increased demand, reduced technology costs and resource potential are among the factors that make Asia a global renewable energy force.

Renewable Technologies and Innovations

The renewable energy agenda has seen a global increase in the production and use of electric vehicles. Electric vehicles have the potential to avoid 49.5 million tonnes of CO2 emissions by 2050.11C Sudjoko, NA Sasongko, I Utami and A Maghfuri, ‘Utilization of electric vehicles as an energy alternative to reduce carbon emissions,’ IOP Conference Series: Earth and Environmental Science, 926. In Africa, the electric mobility sector is in the nascent stages, with less than 3 000 electric vehicles in circulation by 2021, representing less than 1% of global electric vehicles.12International Energy Agency, Global EV Outlook 2022 (Paris: IEA, 2022). The adoption of electric vehicles is influenced by government incentives, as well as customers’ preference for sustainable and environmentally friendly transportation solutions. Examples of such incentives include tax and duty reductions or exemptions for electric vehicles in Kenya, Rwanda, Angola, Ghana and Tunisia; a roadmap for electric vehicle adoption in South Africa; production or assembly of electric vehicles in South Africa, Egypt and Morocco; adoption of national electric vehicle import targets in Kenya and Ethiopia; and the development of national electric mobility policies in Egypt, Kenya, Ivory Coast and Zimbabwe.

Despite some progress, adoption of electric vehicles in Africa is constrained by several factors. High cost of ownership remains a key constraint, primarily driven by fewer local manufacturing firms on the continent. Establishing local manufacturing for parts and batteries in Africa will not only promote technology transfer from global manufacturing firms but also bridge the access and ownership gaps for electric vehicles. Other constraints include absence of supportive policies and laws for electric mobility, limited charging infrastructure, limited incentives to encourage investors and prospective clients, and costly electricity due to aging energy production systems. Africa is home to key startups for clean and renewable energy, driven by increased digitalization and demand for efficient energy services. Key technologies include digital and smart technologies, solar technologies, electric mobility and cryptocurrencies. Some startups in Africa operating in the renewable energy technology space include: Gridless (Kenya), Greenlight Planet (Kenya), MKOPA (Kenya), SLS Energy (Rwanda), Thinkbikes (Nigeria), Lumos (Nigeria), Worldtech Consult (Ghana), Wassha (Tanzania), Easy Solar (Sierra Leone), upOwa (Cameroon), Steinhoff International (South Africa), and Promasidor (South Africa).13Startuplist. Africa, ‘Clean Energy Startups in Africa,’. Most of these startups are foreign owned and the majority of African countries have not established comprehensive policy and legal frameworks to nurture and scale up innovations. Furthermore, startups are constrained by the high cost of energy services, inadequate energy infrastructure, inadequate skills and poor visibility for startups to cooperate and identify partners and investors.

Critical Minerals and the Green Energy Transition

Africa possesses significant reserves of critical minerals that are essential for the energy transition. For instance, Guinea has the world’s largest bauxite reserves, Gabon is the world’s second largest producer of manganese, the DRC produces over 70% of global cobalt production, Namibia is a leading exporter of uranium ore, Zambia is the world’s largest exporter of unrefined copper, Zimbabwe is the world’s third largest exporter of chromium ore, and South Africa produces 90% of global platinum group metal reserves.14Mo Ibrahim Foundation, Africa’s Critical Minerals: Africa at the heart of a low-carbon future (London: Mo Ibrahim Foundation, 2022) These resources make up 40% of the global critical mineral reserves and feed into the various renewable energy technologies in the global market.

Global economic and technological shifts have created a strong demand for these minerals to help countries meet net zero goals.15Shiquan Dou, Deyi Xu, Yongguang Zhu and Rodney Keenan, ‘Critical mineral sustainable supply: Challenges and governance,’ Futures 146 (2023). These minerals are critical to renewable and low- carbon technologies including solar, electric vehicles, battery storage, green hydrogen and geothermal. The World Bank estimates that about 3 billion tonnes of critical minerals will be needed to decarbonize the global energy system by 2050, with the production of minerals such as graphite, lithium, and cobalt needing to increase by nearly 500% by 2050.16Gerrit van Rooyen, ‘Africa risks squandering its critical mineral opportunity’ Oxford Economics (blog) March 31, 2023. Africa is in a position to be a key player in the global clean energy market by integrating into the global supply chain for critical minerals and materials. The increasing demand for these minerals also offers Africa an opportunity to create jobs, diversify economies and boost revenues – but only if the minerals are mined and processed in a sustainable, fair and just manner.17UNCTAD, ‘Critical minerals,’.

In order to strengthen linkages between the exploitation of critical minerals and the establishment of green industries in Africa, it is necessary to put in place well designed interventions to address infrastructure deficiencies and security risks around mining areas. Other issues of interest to African policy makers include developing high-skilled labour, enhancing transparency in mineral value chains, effective management of mineral revenues, environmental protection and addressing social ills like child labour.18IEA, ‘Africa Energy Outlook 2022’.

Financing of Renewable Energy Technologies

Africa requires $557 billion to address its energy gaps by 2030 and about $3 trillion by 2050. It also requires $277 billion annually to implement its NDCs to meet 2030 climate goals. Unfortunately, Africa accounts for only 0.6% of the global renewable energy investment of $434 billion in 2021. Annual climate finance flows in Africa stood at only $30 billion in the same year.19RES4Africa Foundations, ‘Africa’s Energy Future’. Furthermore, Africa needs $320 to 610 billion to produce 30 to 60 mtpa of hydrogen.20‘Africa’s Green Energy Revolution (Hydrogen’s role in unlocking Africa’s untapped renewables),’ Africa Energy Portal, November 22, 2022. In this regard, Germany has recently pledged $4.3 billion in Africa’s green energy to support investment in hydrogen.21‘Germany pledges 4 billion Euros in Africa’s green energy: AfDB President calls for enhanced partnership,’ press release, African Development Bank, November 22, 2023.

Although there are various initiatives to finance climate change efforts for a climate resilient Africa such as Africa Climate Change Fund (a multi-donor trust fund), mobilizing resources has remained a key challenge towards financing renewable technologies in Africa. Countries in the Global North have committed to mobilise climate finance towards supporting countries of the Global South, but the amount of funding made available to date remains far from what is required. African leaders have stated that transitioning to a low-emission economy and accelerating green industrialization remain a distant dream without support by the Global North. Further, the increasing use of market instruments as loans is increasingly raising concerns on the debt sustainability in the energy transition process. The majority of energy finance to Africa between 2012 and 2021 came from a few countries (primarily G20 members), as well as multilateral financing entities – including China, France, Italy, the US and the World Bank Group.22Oyintarelado Moses, ‘Who Finances Energy Projects in Africa’ (Working Paper, Carnegie Endowment for International Peace, Washington DC, 2023).

Through the Bujumbura Declaration (2021), African leaders urged the World Bank Group to scale up its investment in energy cooperation in Africa by maintaining the financing of gas-to-power projects beyond July 1, 2025 through differentiated financing models and instruments to secure transition plans to cleaner energy.23World Bank,‘The Bujumbura Declaration 2021,’. Further, in recent International Development Association (IDA) meetings, African leaders have requested the World Bank to increase their IDA contribution from the $93 billion raised in 2021 to at least $120 billion in 2024 and have called for the tripling of the IDA’s financing capacity to $279 billion by 2030. Support from G20 countries is critical in realizing this request by Africa leaders.

Mobilizing resources for investment in renewable energy requires engagement of the private sector. Green projects face low investment and high required rates of return because private investors see green technologies as riskier than alternative investments.

A key challenge lies in preparing bankable projects, given that energy projects will only attract sufficient finance from private sector investors if uncertainties are reduced and risks mitigated. The African Development Bank manages the Sustainable Energy Fund for Africa, a multi-donor fund established in 2011 to unlock private sector investments in renewable energy and energy efficiency.24African Development Bank, ‘Sustainable Energy Fund for Africa,’. Further, Africa has established a standards framework, the Programme for Infrastructure Development in Africa (PIDA) Quality Label to guide the preparation of quality infrastructure projects at an early stage.25African Union Development Agency-NEPAD,’Programme for Infrastructure Development in Africa (PIDA): First 10-Year Implementation Report’ (Johannesburg: AUDA-NEPAD, 2023). Ensuring this framework is aligned to the G20 Principles for Quality Infrastructure Investment is critical in the continent’s efforts to derisk energy projects.

While capital markets have the potential to play a significant role in mobilizing resources, African engagement in the green bond market represents less than 1% of the more than$2.0 trillion of capital raised at global level in 2022.26‘Global Green Bond Initiative joins with African Development Bank to strengthen green bond markets in Africa,’ press release, African Development Bank, December 1, 2023. Green bonds ringfence the bond proceeds for environmental sustainability projects. The Sustainable Bond Programme, established by the African Development Bank in 2023, combines a Green Bond Programme and a Social Bond Programme, enabling the issuance of green bonds, social bonds, and sustainability bonds. Under this programme, Africa has signed up to the Global Green Bond Initiative to help private capital flow from institutional investors into climate and environmental projects. The anticipated impact could be up to $16–21 billion in green investments. It is noted that international investors are typically reluctant to make investments in the Global South, especially when green bonds are in local currencies, which unfortunately are often unstable.

The development of carbon markets in Africa presents an opportunity to mobilise resources to finance clean technologies, including renewable energy. The Africa Carbon Markets Initiative (ACMI) was inaugurated during COP27. Between 2016 and 2021, African countries accounted for 11% of the total global carbon credits issued, with only 2% of its maximum annual capacity for carbon credits tapped. The demand for carbon credits originating from Africa has grown by 36%. Thus, establishing the foundation for a thriving carbon market that aligns with both environmental and developmental objectives will be instrumental in diversifying resource mobilization for Africa’s energy transition.27Esther Irungu, ‘Accelerating Growth of Carbon Market in Africa,’ KIPPRA, February 1, 2024.

African countries have adopted varying formulae for resource revenue sharing arrangements. Sovereign wealth funds are used to shift spending from the present to the future, thus building savings balances for the long-term. Yet, African countries still face low financial transparency, thus posing risks and uncertainties relating to resource revenue flows. In addition, most of the revenue sharing frameworks have not prioritized green energy investments.

Transfer of Renewable Energy Technology

Despite the African continent having significant renewable energy resources, it has limited capability to develop these resources and relies largely on imports for renewable technologies.28Mulualem G Gebreslassie, Solomon T Bahta, Yacob Mulugetta, Tsegay T Mezgebe et al,‘The need to localize energy technologies for Africa’s post COVID-19 recovery and growth.’ Scientific African, 19 (2023). Four countries, the US, Japan, Germany and China, share 75% of renewable energy patents. Further, Japan, the United States, Germany, Korea and China cumulatively make up 73% of the renewable energy technology patent applications between 2010 and 2019, with Africa contributing less than 1% of the total global clean energy patent applications.29James Nurton, ‘Patenting trends in renewable energy,’ Wipo Magazine, March, 2020; UNEP, ‘Under One Per Cent of Clean Energy Technology Patents Filed in Africa, Highlighting Huge Potential For Exploiting Renewable Energy Sources,’ press release, May 13, 2023.

Several challenges hinder the growth of patenting in Africa. For example, poor institutional frameworks can lead to inefficient patent systems and examination processes, compromising the quality of patent applications, legal security, and technology transfer and licensing.30UNEP and European Patent Office, ‘Patents and clean energy technologies in Africa’ (Nairobi: UNEP, 2013)

Additionally, the process of developing renewable technology innovations is capital intensive and, in most cases, requires suitable skilled personnel. Africa’s lower numbers of patents applications can be attributed to the fact that the continent has a small share of renewable energy investments (about 2% of the global clean energy investments) that can be utilised for research and development, technology transfer and capacity building.

Africa accounts for only 2% of global trade in intermediate manufactured goods.31Vicky Chemutai, ‘African perspectives on trade and the WTO,’ Great Insights Magazine, December 22, 2016. The continent has the potential to offer a lot more than primary commodities that have undergone no or minimal value addition. The World Trade Organization estimates that a significant amount (11%) of Africa’s total intermediate goods imported in 2021 is used to produce green products. This demonstrates that a relatively large portion of renewable energy technologies are being imported into the continent. Nearly $342 million was spent by South Africa, Ethiopia and Egypt to import wind turbines over the period 2009 to 2013. In the same period, these African countries imported solar cells from China worth $869 million.32UNEP, ‘South-South trade in renewable energy: A trade flow analysis of selected environmental goods’, (Geneva: UNEP, 2014) Similarly, Fuji Electric and Mitsubishi Electric Corporation, both based in Japan, supply renewable technologies and parts that are instrumental in the construction of geothermal power plants in Africa.33Alexander Richter, ‘Final phase for Olkaria I Unit 6 geothermal project, Kenya’ Think Geoenergy, June 10, 2021.

African countries are integrated in global value chains mainly as suppliers of raw materials, which are processed outside Africa. The majority of the Global South, including Africa, are not major players in the key supply chain segments of renewable technologies, such as design and manufacturing. Some African countries are only involved in the supply of essential minerals like lithium, copper, cobalt and platinum, but are not involved in other stages of the value addition, including further processing and transformation of raw materials.

African countries are implementing various initiatives to enhance participation in global and regional green value chains. For example, Zambia and the DRC have formed the DRC Congo–Zambia Battery Council to enhance their battery value chain. The China–Ghana–Zambia Renewable Energy Technology Transfer (RETT) programme supports the production of renewable technologies in Africa by learning from China’s technical skills and experiences through workshops and knowledge sharing sessions.34MMEIPA, ‘China-Ghana-Zambia Renewable Energy Technology Transfer (RETT) program,’. Development and integration of local markets and infrastructure, skills development and retention, data collection and improving access to finance are other initiatives at play to enhance participation. However, more needs to be done to cement Africa’s position as a major player in the value chain of renewable technologies and support the continent in meeting its potential.

Conclusion

The analysis of Africa’s renewable energy capacity and potential demonstrates the important role of the continent in meeting the world’s clean energy goals. Africa is well endowed with renewable energy resources such as solar, wind and hydro, as well as possessing significant reserves of critical minerals necessary for renewable and low-carbon technologies. The continent has not yet fully exploited these valuable resources in support of its sustainable growth. African countries have not put in place adequate public policies to support strategic investments; enhance research, development, technology and innovations; stimulate demand; and promote the adoption of affordable technologies.Africa, therefore, requires technical, human and financial partnerships to move beyond mere raw material supply, assist in diversifying their economies, and help the region advance up clean energy and high-tech value chains.