The generic industry is essential for provision of low-cost medicines. In Southern Africa, where there is a high burden of HIV and a lack of access to resources for health care and medicines, the industry is particularly important.

The growth of the generic drug industry has resulted in tensions with big multinational pharmaceutical firms. These firms rely on patents to protect the intellectual property of their products. Patenting laws like the World Trade Organisation’s agreement on Trade-Related Aspects of Intellectual Property (TRIPS) stipulates that patents last for 20 years from the date of registration. This gives manufacturers an opportunity to provide drugs exclusively for that period so that they can recoup money spent on research and drug development.

But it also places the power of managing drug prices in the hands of manufacturers. This drives up prices, making many medications inaccessible to the poor, particularly in developing countries.

The big challenges

This is particularly problematic for patients who have developed immunity to certain drugs.

Certain patients are reliant on new medication because of drug resistance. In Africa there are more than 32 000 people suffering from multiple drug resistant TB (MDR-TB). In 2010, according to the World Health Organisation, one in 20 HIV-positive patients worldwide were infected by a drug-resistant strain of tuberculosis.

Accessing affordable drugs for these patients is problematic because new treatments still under patent are exorbitantly expensive.

The same problem applies to a range of other potential treatments. For example some third-line anti-retroviral therapies (ARVs) are still under patent, making them expensive. Second-line treatment is necessary for patients who are not responding to first-line ARVs. There are 2.5 million people in South Africa on ARVs. Around 9% are failing first-line anti-retroviral therapy year-on-year and need to be put on second-line ARVs.

The Indian generic drug market

India is one of the key providers of generics to developing states. It supplies 20% of the global market for generic medicines and accounts for more than 80% of the world’s anti-retroviral purchases annually. It has provided a large proportion of key medicines to global aid and non-profit organisations such as Medecins sans Frontieres, PEPFAR, UNICEF and the Global Fund.

Indian generic drug manufacturing capabilities, which have brought down the price of certain medicines, benefited from a lack of patent barriers.

But global patent laws imposed in the last decade, including one in India in 2005, mean that certain drugs cannot be manufactured by the generic industry.

As a result India has granted certain patents for TB, HIV and hepatitis C medicines manufactured by US firms, which stopped its manufacturers from reproducing those drugs. At the same time, India has not been limited by the patent laws. Its patent authority has rejected applications for patents from big pharmaceuticals such as Novartis and Gilead which manufacture cancer and hepatitis C drugs respectively. This means Indian manufacturers are allowed to produce the cheaper generics of the same products.

In addition to the patent challenge, India’s ability to produce generics could also be hampered if it finalises a free trade agreement with the European Union, which it has been negotiating for eight years. Talks are set to resume next month.

Among the negotiations is a data exclusivity clause, which will allow the pharmaceutical producers of European Union member countries to retain the clinical test data which shows the safety and efficacy of a new drug before it can be commercialised for up to five years. It would mean that the generic companies would need to generate their own data before they market those off-patented drugs.

If the clause is approved, it could constrain India’s generic industry and be detrimental to southern Africa’s pharmaceutical industries as generics of these drugs would not be imported to the region.

Other barriers to drug provision

Medicine provision in the region faces several challenges which patenting could exacerbate. These include:

- Regional business barriers such as small markets, weak and differing medicine registration policies and restricted access to medicines because of intellectual property rights on drugs.

- Multiple regulatory authorities, which mean there are conflicting laws for the different countries in the region.

- National irregularities in supply chain management which result in stock outs. The supply chains of products are disrupted, causing delayed distribution of medication.

Drug provision is also hindered by regulatory problems, such as drug regulators not having the capacity to evaluate medicines and approve new ones.

The future of generics

Patent laws and drug exclusivity agreements are a major challenge for the global HIV and AIDS movement. South Africa and the Treatment Action Campaign fought a long but successful battle to gain access to more affordable medicines. It used constitutional litigation to gain access to cheaper generic anti-retrovirals.

Other southern African countries like Malawi and Zambia also rely heavily on inexpensive treatment and generics because of high HIV rates and drug stock outs.

Given the fact that the future of generic drug production hangs in the balance, developing countries need to consider alternatives for southern Africa.

Pharmaceutical companies have traditionally offered ‘cut price deals’ on anti-retrovirals to developing countries to prevent loss of income to the generic companies. These deals target specific products offered on a country by country basis. There is a lack of transparency around which prices are offered to which country.

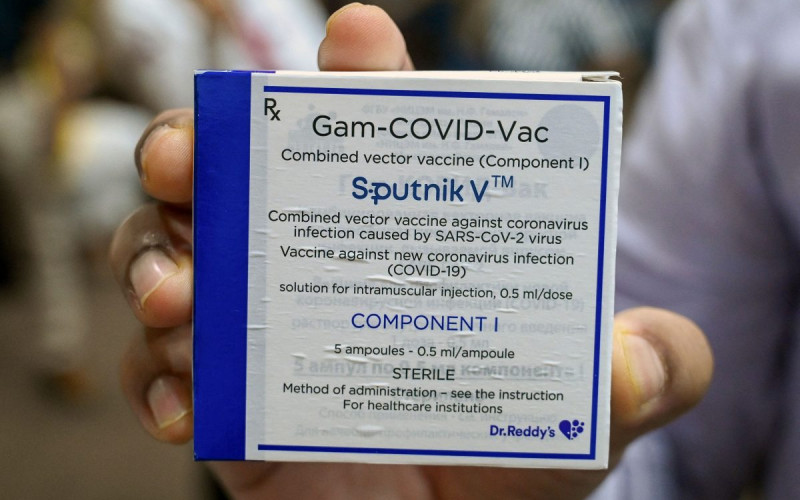

There is an increased need for extensive research and development of new medicines and vaccines. This would allow additional companies to enter the market and ensure competitive prices.