Recommendations

- Development partners should reallocate resources earmarked for public investment to de-risk private projects in Africa to spur economic recovery.

- The G20 should consider partially cancelling African countries’ debt, extend the Debt Service Suspension Initiative (DSSI) for another two years and ensure that borrowing countries pace their debt payments to prevent being overwhelmed by an untenable debt burden upon the expiry of the DSSI.

- The Paris Club should prioritise bringing commercial creditors and new actors to the table and build a fair and transparent multilateral framework to address and resolve Africa’s potentially unsustainable debt burden.

- G20 partners should work with other countries to explore the feasibility of establishing independent, publicly owned credit rating agencies to afford African countries more transparent and fair credit ratings.

- National governments should establish donor coordination frameworks which will ensure that development finance support programmes are aligned behind a single national plan and traditional and non-traditional donors are able to collaborate with one another.

Executive summary

Having been pummelled by the effects of COVID-19, developed and developing countries are pursuing strategies to accelerate their recovery process and to bolster their health systems and economies against future crises. However, significant fiscal constraints are making it difficult for many developing countries to finance their recovery processes. This is particularly evident in Africa, where governments – having exhausted their more liquid domestic assets – often have had to tap their sovereign wealth funds, international capital markets and other external development finance options, exacerbating their already-high public debt levels. African countries need substantially more development finance to tackle current and future economic challenges. However, up until COVID-19, flows of donor finance to Africa had been on the decline for some years. Borrowing from international capital markets is not always a cost-effective route for African countries to follow. Many African governments have been calling for debt cancellation and other forms of relief, but to no avail.

The efforts of the G20, International Monetary Fund, World Bank, African Development Bank and African Union, among others, have provided essential lifelines to African countries as they have navigated the worst of the pandemic. The G20’s Debt Service Suspension Initiative and the International Monetary Fund’s Common Framework are just two examples of such initiatives. Generally, however, global donor activities and frameworks have been fragmented and poorly coordinated. The G20 and other development partners can do more to streamline and coordinate their financial assistance and debt relief efforts in Africa. Priorities include unlocking much more finance to accelerate countries’ economic recovery and longer-term transformation (especially private-sector investment), making capitalmarket borrowing more accessible to African countries, and extending more generous debt relief in exchange for African countries engaging in better fiscal management.

Introduction

Following the massive disruption to the global economy caused by the COVID-19 pandemic, both developed and developing countries are pursuing a myriad of health and economic policies and strategies to bring about the sustainable and inclusive recovery of their economies. A swift recovery would lay the foundations for transformative growth and minimise the debilitating impact of the pandemic on economic progress and poverty reduction efforts globally. Unfortunately, the pace of recovery in the developed and developing world is poles apart. Many developed countries are fast-tracking their recovery process by leveraging national emergency funds and tapping global financial markets to provide stimulus measures to households and businesses, while also inoculating a significant share of the adult population. In African countries, economic recovery remains fragile in the face of the slow pace of vaccination (which continues to expose the region to potential mutations of the virus)1Albert Zeufack et al., ‘An Analysis of Issues Shaping Africa’s Economic Future,’ Africa’s Pulse, no. 24 (World Bank, October 2021), https://openknowledge.worldbank.org/handle/10986/36332. and development financing challenges.

With only 3.3% of Africans fully vaccinated, the continent is far from realising its vaccination target of 40% of the population by the end of 2021, with the African Vaccine Acquisition Trust (AVAT) and the COVID-19 Vaccines Global Access (COVAX) – the main sources of vaccines – remaining heavily underfunded.2Angel Gurría, ‘Remarks at the 2020 Official Development Assistance Levels and Trends Release’ (OECD, April 31, 2021), https://www.oecd.org/about/secretary-general/oecd-sg-remarks-to-launch-the-2020-oda-levels-and-trends-13-april-2021.htm?_ga=2.21775096.2103262702.1634731272-620457207.1634731271. To date, only Mauritius and the Seychelles have fully vaccinated more than 60% of their respective populations. Ironically, because of stockpiling, 100 million vaccine doses from the G7 risk expiring by the end of 2021.3Oxfam International, ‘Empty Promises Will Not Save The World From COVID-19, Campaigners Warn Ahead of Biden Global Vaccine Summit,’ September 21, 2021, https://www.oxfam.org/en/press-releases/empty-promises-will-not-save-world-covid-19-campaignerswarn-ahead-biden-global.

In terms of financing their economic recovery, African countries are severely challenged in comparison with more advanced economies. Many African countries simply lack the fiscal space to finance a robust and sustainable economic recovery from COVID-19. Although the World Bank noted that fiscal deficits remained under control in 2020 and are expected to narrow in 2021 and beyond, the size of the fiscal support measures deployed by African governments has been very small compared with those in advanced economies.4Albert Zeufack, et al., ‘An Analysis of Issues Shaping Africa’s Economic Future.’ While advanced economies mobilised about 6% of their gross domestic product (GDP) to tackle the impending recession, African countries barely mobilised 1% in response to the crisis.5United Nations Commission for Africa (UNECA), ‘Africa: Statement by African Ministers of Finance and Economy on the IMF,’ October 1, 2021, https://allafrica.com/stories/202110010999.html. According to the Organisation for Economic Cooperation and Development (OECD), the advanced economies’ fiscal response to COVID-19 was on average seven times larger than that of low-income countries.6Angel Gurría, ‘Remarks at the 2020 Official Development Assistance Levels and Trends Release.’ There are several reasons for this.

Firstly, in their quest to mitigate the impact of the crisis on their economies, Sub-Saharan African (SSA) countries have not only exhausted their already-insufficient domestic revenues, but some have also tapped into their commodity-backed sovereign wealth funds which were reserved for future generations.7Andrew Bauer, ‘How Have Governments of Resource-Rich Countries Used Their Sovereign Wealth Funds During the Crisis?’ (Natural Resource Governance Institute, August 21, 2020), https://resourcegovernance.org/blog/how-have-governments-resource-richcountries-used-their-sovereign-wealth-funds-during-crisis. COVID-19 appeared when many countries were facing rising debt and structurally large fiscal deficits, which meant that their fiscal space was already heavily constrained. Prior to the onset of COVID-19, more than 40% of SSA countries were already at debt-distress levels, prompting the International Monetary Fund (IMF) and the World Bank to call on countries to be more cautious with their pace of debt accumulation.8Jill Ward and Matthew Miller, ‘IMF’s New Boss Voices Concern About Rising African Debt Levels,’ (Bloomberg, November 19, 2019), https://www.bloomberg.com/news/articles/2019-11-19/imf-s-georgieva-voices-concern-about-rising-african-debt-levels. Notwithstanding this, approximately 95% of low-income developing countries in SSA recorded significant increases in public debt stocks in 2020. Even countries with sound public financial management controls like Ghana and Rwanda saw their public debt rise from 63% and 62% of GDP, respectively, in 2019 to 81% and 71% of GDP, respectively, in 2020.9IMF, ‘Fourth Review of the Policy Coordination Instrument and Request of an Extension of the Policy Coordination Instrument – Press Release; Staff Report; and Statement by the Executive Director For Rwanda,’ July 2021, https://www.imf.org/-/media/Files/Publications/CR/2021/English/1RWAEA2021002.ashx; IMF, ‘IMF Executive Board Concludes 2021 Article IV Consultation with Ghana,’ Press release, July 20, 2021, https://www.imf.org/en/News/Articles/2021/07/20/pr21221-ghana-imf-executive-board-concludes-2021-article-iv-consultation. Interest payments on debts alone are forecast to exceed 10% of government revenue in 2021 in nearly half the countries on the continent and to exceed 20% in countries like Nigeria, Kenya, Angola, Ghana and Zambia. The shrinking fiscal space has constrained African countries’ ability to commit the level of resources required to initiate a swift and effective recovery. To deal with the fallout from the pandemic and to finance their basic recovery, African countries will need an additional $285 billion through to 2025.10IMF, ‘Managing Director Kristalina Georgieva’s Remarks at Summit on the Financing of African Economies,’ May 18, 2021, https://www.imf.org/en/News/Articles/2021/05/18/sp051821-remarks-at-financing-african-economies-conference. To return to pre-pandemic levels and effectively transform their economies, they will need twice this amount.

Meanwhile, the external development financing landscape is becoming more difficult for many African countries to navigate. Despite newly introduced initiatives, the unfair and unsustainable terms of borrowing dictated by international capital markets are hindering countries’ ability to borrow in order to release the pressure on their tight fiscal space. The challenges of borrowing from the capital markets are exacerbated by a decline in donor financing to Africa prior to the pandemic11OECD Data, https://data.oecd.org/oda/distribution-of-net-oda.htm. and weak donor coordination frameworks around which aid is mobilised. The breakdown in donor coordination frameworks over the past decade, such as the Paris Declaration, Accra Agenda for Action and the Addis Ababa Financing for Development, has resulted in the fragmentation of limited aid resources. This fragmentation could limit countries’ ability to effectively coordinate scarce financing for their economic recovery plans.

The external development finance landscape and COVID-19 recovery in SSA

Access to finance is currently an urgent priority for African countries, with governments also calling for debt cancellation and other forms of relief. It is noteworthy that while other major development finance flows such as foreign direct investment (FDI), trade and remittances are trending downwards due to the COVID-19 pandemic, bilateral overseas development assistance (ODA) to Africa increased by 4.1% in 2020 – driven mostly by emergency aid flows.12Jorge Rivera and Sara Harcourt, ‘Global aid spending in 2020 — What did we learn?’ ONE, April 14, 2021, https://www.one.org/international/blog/global-aid-spending-2020/. The support provided by various development partners – including the Group of 20 (G20) and the Bretton Woods institutions – and philanthropic organisations has been critical in mitigating the economic and health impacts of the pandemic.13Commodore Richmond, ‘Reform Partnership Governance and COVID-19: Scan of COVID-19 Governance-Related Policy Actions,’ (African Center for Economic Transformation [ACET], December 12, 2020), https://acetforafrica.org/acet/wp-content/uploads/publications/2021/03/SCAN-OF-COVID-19-GOVERNANCE-RELATED-POLICY-ACTIONS-ENGLISH_Final.pdf. A few examples of such assistance are discussed below.

The G20’s Debt Service Suspension Initiative (DSSI), which instituted a moratorium on debt service for developing countries, has so far provided $5.7 billion in relief to 43 eligible countries. In SSA, 30 sovereign countries (80% of eligible countries in the region) participated in the DSSI, thereby enabling these countries to channel resources towards fighting the pandemic and safeguarding lives and livelihoods. Although the DSSI has been extended until December 2021, there are major concerns about its implementation.14White & Case, ‘The G20 Debt Service Suspension Initiative – Reaction from Key Market Participants’, June 8, 2020, https://www.whitecase.com/publications/alert/g20-debt-service-suspension-initiative-reaction-key-market-participants Private creditors and many debtor countries (who hold 31% of African debt) do not want to participate, while China’s position on debt relief for SSA countries under the initiative is still not clear. Furthermore, there are growing concerns that a lack of participation by commercial creditors in debt-relief efforts could see these creditors profiting from the riskreduction efforts in these initiatives, while refusing to assume potential losses once they materialise.15Daniel Munevar, ‘Sleep now in the fire: Sovereign Bonds and the Covid-19 Debt Crisis,’ (EURODAD, May 2021), https://d3n8a8pro7vhmx.cloudfront.net/eurodad/pages/2307/attachments/original/1621949568/sovereign-bond-report-FINAL.pdf?1621949568.

Several eligible African countries have not participated in the programme as they fear a fall in their credit rating or potentially high sovereign bond spreads in the future. For some, the conditions attached to participating in the DSSI could prevent them from accessing further non-concessional loans for the duration of the programme.16

Ulrich Volz et al., ‘Debt Relief for a Green and Inclusive Recovery: Securing Private Sector Participation and Creating Policy Space for Sustainable Development,’ (Boston University, June 2021), https://www.bu.edu/gdp/files/2021/06/DRGR-Report-2021-FIN.pdf. Finally, there have been concerns about the new Development Assistance Committee (DAC) rules, which allow donors to report debt rescheduling or cancellation as ODA, and how this will contribute to rising numbers of loans being made to already-debt-distressed countries in the coming years.17Nerea Craviotto, ‘Four challenges when it comes to reporting debt relief as ODA’ (EURODAD, November 25, 2020), https://www.eurodad.org/four_challenges_when_it_comes_to_reporting_debt_relief_as_oda.

Beyond the DSSI, the Common Framework of the IMF was endorsed by the G20, together with the Paris Club, in November 2020 to support low-income countries with unsustainable levels of debt. Initiated at the request of debtor countries, this framework was hailed as historic as it brings China, the Paris Club and other non-Paris Club official creditors together into a single, debt-relief coordination mechanism. While this is a step in the right direction, as of April 2021, only three of the 73 DSSI-eligible countries that face a high risk of debt distress (Ethiopia, Chad and Zambia) had asked to participate in the Common Framework.18Paris Club, ‘Common Framework for Debt Treatments beyond the DSSI,’ 2020, https://clubdeparis.org/sites/default/files/annex_common_framework_for_debt_treatments_beyond_the_dssi.pdf Unfortunately, the framework is considered inadequate as it is limited to DSSI-eligible countries and does not detail concrete measures that could induce privatesector participation in the initiative.19Patrick Bolton, Mitu Gulati and Ugo Panizza, ‘Debt risks in Sub-Saharan Africa and Beyond,’ (Graduate Institute, Geneva, 2021), https://repository.graduateinstitute.ch/record/298908/files/Debt-risks-subSaharan-Africa.pdf.

The IMF’s Rapid Financing Instrument (RFI) and Rapid Credit Facility (RCF) have generated approvals of about $16.1 billion in loans to 34 SSA countries.20IMF, ‘COVID-19 Financial Assistance and Debt Service Relief,’ November 15, 2021, https://www.imf.org/en/Topics/imf-and-covid19/COVID-Lending-Tracker#AFR. The IMF has also shored u zero-interest lending through its Poverty Reduction and Growth Trust (PRGT). The recent approval of $650 billion in Special Drawing Rights (SDRs) will go a long way towards boosting liquidity and combatting COVID-19 in Africa – provided a viable framework can be developed to enable advanced economies to pass on their SDRs to poorer countries.

The World Bank, in turn, has supported 30 SSA countries through its Fast-Track COVID-19 Facility.21World Bank, ‘World Bank Group’s Operational Response to COVID-19 (coronavirus) – Projects List,’ October 25, 2021, https://www.worldbank.org/en/about/what-we-do/brief/world-bank-group-operational-response-covid-19-coronavirus-projects-list. In addition, the bank’s Health Emergency Preparedness and Response MultiDonor Fund has to date extended approximately $50 million in financing to eligible countries.22World Bank, ‘World Bank Group to Launch New Multi-donor Trust Fund to Help Countries Prepare for Disease Outbreaks,’ April 17, 2020, https://www.worldbank.org/en/news/statement/2020/04/15/world-bank-group-to-launch-new-multi-donor-trust-fund-tohelp-countries-prepare-for-disease-outbreaks As of September 20, 2021, the bank has approved the allocation of $1.9 billion to the acquisition and distribution of COVID-19 vaccines in 30 Sub-Saharan African countries and $2.8 billion to the continent as a whole.23Albert Zeufack et al., ‘An Analysis of Issues Shaping Africa’s Economic Future.’

Other regional development finance institutions (DFIs) have stepped up to provide support as well. The African Development Bank (AfDB) mobilised $10 billion to establish its COVID-19 Response Facility to assist governments and the private sector. It also launched a $3 billion ‘Fight COVID-19 Social Bond’, with a 3-year maturity period. The Islamic Development Bank, in turn, has – using several instruments – contributed a total of $2.4 billion to West and Central African countries (Côte d’Ivoire, Mauritania, Sierra Leone, Mali, Uganda, Chad and Guinea-Bissau). China, which has a 17% stake in African debt, has also been involved in debt relief efforts by participating in the DSSI and negotiating a DSSI suspension through China Exim Bank for Angola and Zambia.24Deborah Bräutigam and Kevin Acker, ‘Chinese lending to Africa in the pandemic era,’ in Shaping Africa’s post-Covid recovery (London: CEPR Press, 2021).

Currently, participation in the DSSI and the Common Framework seems to be the best options for African countries to manage their debt more effectively and enhance their fiscal space. There is, however, a general consensus that the current debt relief efforts are inadequate – ‘the numbers don’t match the scale of the problem’.25United Nations Conference on Trade and Development (UNCTAD), ‘Bold public spending only way to recover better from COVID-19,’ September 21, 2020, https://unctad.org/news/bold-public-spending-only-way-recover-better-from-covid-19. This has compelled countries like Ghana and Nigeria to go to international capital markets at a cost. For example, in March 2021 Ghana successfully floated a $3 billion Eurobond issuance26Graphic Online, ‘Ghana successfully issues US$3 billion Eurobond notwithstanding COVID-19 pandemic,’ March 30, 2021, https://www.graphic.com.gh/business/business-news/ghana-successfully-issues-us-3-billion-eurobond-notwithstanding-covid-19-pandemic.html. and in September Nigeria raised $4 billion in Eurobonds.27Albert Zeufack et al., ‘An Analysis of Issues Shaping Africa’s Economic Future.’

SSA countries disadvantaged in terms of access to and cost of development finance

Before COVID-19, debt levels in Africa were already of growing concern. The pandemic has pushed them even higher, with the ratio of public debt to GDP increasing across the continent. Despite all the efforts to contain the debt burden of developing countries, only two African countries are now at a low risk of debt distress in the wake of COVID19.28Albert Zeufack et al., ‘An Analysis of Issues Shaping Africa’s Economic Future.’ Furthermore, between 2017 and 2019, the uptake of more expensive financing instruments like Eurobonds has resulted in higher interest rates on international capital markets. Irrespective of debt-to-GDP ratios, African economies on average pay higher-thannormal coupon rates. The spreads on African government bonds are 5.7 percentage points higher than other borrowers (6.8% for African governments compared to 1.05% for others). Even after controlling for global factors and country-specific risk, African economies that participated in the Heavily Indebted Poor Countries (HIPC) initiative in the past are more likely to pay higher coupon spreads at issue than an average country.29Michael Olabisi and Howard Stein, ‘Sovereign bond issues: Do African countries pay more to borrow?’ Journal of African Trade, Volume 2, Issue 1–2 (December 2015): 87–109, https://www.atlantis-press.com/journals/jat/125905669/view. Furthermore, DSSIeligible countries have a higher average coupon rate, equivalent to 7%.30Daniel Munevar, ‘Sleep now in the fire: Sovereign Bonds and the Covid-19 Debt Crisis.’ The situation is further exacerbated by the fact that many African countries have attained middle-income status and no longer have access to concessional loans from development lenders.

The difficult position of African countries in international capital markets has become even more apparent in the wake of COVID-19. Within the first year of the pandemic, at least 10 African countries were downgraded by credit rating agencies (CRAs) – Angola, Botswana, Cameroon, Cape Verde, Democratic Republic of the Congo, Gabon, Mauritius, Nigeria, South Africa and Zambia. As stated earlier, debt restructuring by countries under a globally coordinated mechanism like the Common Framework comes with the risk of downgrades – as the experience of Ethiopia suggests.31NASDAQ, ‘S&P joins Fitch in downgrade of Ethiopia on potential debt restructuring,’ February 12, 2021, https://www.nasdaq.com/articles/sp-joins-fitch-in-downgrade-of-ethiopia-on-potential-debt-restructuring-2021-02-12. The approach adopted by CRAs unduly adds to the cost of borrowing and greatly limits the potential of international capital to facilitate the economic recovery process in Africa.

International response to the COVID-19 crisis and recovery in developing countries affected by weak global donor coordination

COVID-19 happened at a time when global donor coordination was at its weakest in over a decade. The progress made in terms of donor coordination and aid effectiveness following the high-level forums in Rome (2003), Paris (2005), Accra (2008) and Busan (2011) has been on the decline, and this clearly hindered effective responses and the mobilisation of funds by donors in the early months of the pandemic. Advanced economies that were better resourced and had the political heft to galvanise support to slow the spread of the virus globally, especially in very deprived countries, were seen instead to be prioritising national and sub-national measures. For example, the US – which has historically led global pandemic response efforts – prioritised domestic economic and health concerns while disassociating itself both from coordination efforts and high-level funding on the global stage.32Adva Saldinger, ‘Aid advocates want future US COVID-19 funding to have global focus,’ (Devex, March 30, 2020), https://www.devex.com/news/aid-advocates-want-future-us-covid-19-funding-to-have-global-focus-96866.

The silence from developed countries led to 160 global leaders calling on the G20 to take bold steps to strengthen weak health systems in Latin America and Africa.33Erik Berglöf, Gordon Brown and Jeremy Farrar, ‘A Letter to G20 Governments,’ (Project Syndicate, April 6, 2020), https://www.project-syndicate.org/commentary/a-letter-to-g20-governments-by-erik-berglof-et-al-2020-04. Until then, efforts to manage the global spread of COVID-19 had been chaotic and fragmented, with countries ‘putting in too little too late towards prevention’.34Donor Tracker, ‘Prominent global leaders say G20 must immediately fill role of global coordinator for COVID-19 efforts, propose convening executive taskforce and pledging conference,’ April 6, 2020, https://donortracker.org/Global-G20-leadership-coordinate-COVID-19. This significantly slowed the international donor community’s response to African countries. In contrast, the speed with which the African Union (AU) persuaded members to adopt the Africa Joint Continental Strategy for COVID-19, establish the AU COVID-19 Response Fund35AU and Africa Centres for Disease Control and Prevention (Africa CDC), ‘Africa Joint Continental Strategy for COVID-19 Outbreak,’ March 5, 2020, https://africacdc.org/download/africa-joint-continental-strategy-for-covid-19-outbreak/. and constitute an African Task Force for Coronavirus was critical in stemming the spread of the virus and providing much-needed supplies to the continent.

While global cooperation and commitment in fighting COVID have improved, the weakened aid architecture and low commitment to development effectiveness pose a risk to recovery efforts in Africa. Firm commitment to the principles of aid effectiveness were crucial for the quick recovery of the global economy after the 2008/9 global financial crisis (GFC). Today, poor donor coordination alongside reductions in ODA by major development partners such as the UK could have a major, negative impact on economic recovery. Many SSA countries are now struggling to harmonise the limited grant financing with their economic growth and recovery plans. According to the global movement, ONE, had all donors met the target of spending 0.7% of gross national income (GNI) on ODA, an additional $189 billion would have been available for developing countries to fight COVID and get their economies back on track.36Jorge Rivera and Sara Harcourt, ‘Global aid spending in 2020 — What did we learn?’

In a 2017 study conducted by the African Center for Economic Transformation (ACET), it was clear that the thrust behind the budget support envisaged in the aid/development effectiveness paradigm has been reversed by bilateral donors, with many partners having abandoned general budget support (a major instrument for supporting economic recovery in developing countries) in favour of project aid and new models of development cooperation, such as trilateral development cooperation frameworks and blended financing facilities.37ACET, ‘Mobilizing and Managing External Development Finance for Inclusive Growth: Six Countries’ Experiences and Lessons,’ 2017, https://acetforafrica.org/acet/wp-content/uploads/publications/2017/09/ACET_MOB_SYNReport_Sep2017_FINAL_singlepagesWEB-2.pdf Furthermore, emerging economies (eg, China) and non-state actors have remained outside any coordination systems, despite constituting an increasingly important source of development finance for Africa. Local coordination arrangements designed by national governments have not always been fit for purpose.

Policy priorities to mobilise sustainable financing for economic recovery

SSA is set to recover from the 2020 recession with an expected growth rate of 3.3% in 2021, although this is much lower than other regions.38Albert Zeufack et al., ‘An Analysis of Issues Shaping Africa’s Economic Future.’ This rebound is being fuelled by high commodity prices, improvements in global trade, and the removal of stringent public health-related economic measures. Yet it masks the deeper debt sustainability problems facing many African countries.39World Bank, ‘Sub-Saharan Africa Exits Recession in 2021 but Recovery Still Vulnerable,’ October 6, 2021, https://www.worldbank.org/en/news/press-release/2021/10/06/sub-saharan-africa-exits-recession-in-2021-but-recovery-still-vulnerable.

The G20 and other development partners can do more to ease the debt burden of African countries, thereby helping to fast-track inclusive and transformative economic recovery across the continent. Addressing the escalating debt crisis, facilitating access to affordable finance and ensuring that development partner coordination is de-fragmented and aligned to national economic development plans should be at the core of any support provided to the continent.

In 2020, ACET identified Ten Policy Priorities for Africa’s Recovery, Growth, and Transformation.40ACET, ‘Covid-19: Ten Policy Priorities for Africa’s Recovery, Growth, and Transformation,’ June 2, 2020, https://acetforafrica.org/publications/policy-briefs-and-discussion-papers/covid-19-ten-policy-priorities-for-africas-recovery-growth-and-transformation/. On the basis of these recommendations and the work performed under the G20 Compact with Africa (CwA), the following steps are proposed to achieve sustainable financing for economic recovery and transformation on the continent.

First, as stated above, Africa urgently needs additional financing to accelerate countries’ economic recovery efforts. While not sufficient on its own, ODA is nevertheless critical for the implementation of development policies and the financing of public goods needed to boost health standards and economic recovery on the continent. Furthermore, grants from non-traditional development partners such as foundations are crucial accompaniments to ODA as they support the piloting and testing of new innovations that are essential for economic transformation. Optimising the value of these grant funds requires national governments to put in place donor coordination frameworks to ensure that partner support is aligned behind a single national plan. For such a framework to work, traditional and nontraditional donors need to commit to aligning their finance to national imperatives and plans and to collaborate through these frameworks.

The G20 countries have a myriad of traditional and non-traditional bilateral donors. Most of these countries are also hosts to Africa’s largest foundation donors, with the CwA platform offering a potential template for donor coordination. Furthermore, as development grant assistance is limited in scale, African countries also need to attract private-sector investors – local, regional and foreign. The steady shift from development cooperation to economic cooperation can, if effectively structured, facilitate the gradual recovery in FDI and other private capital flows to the continent.

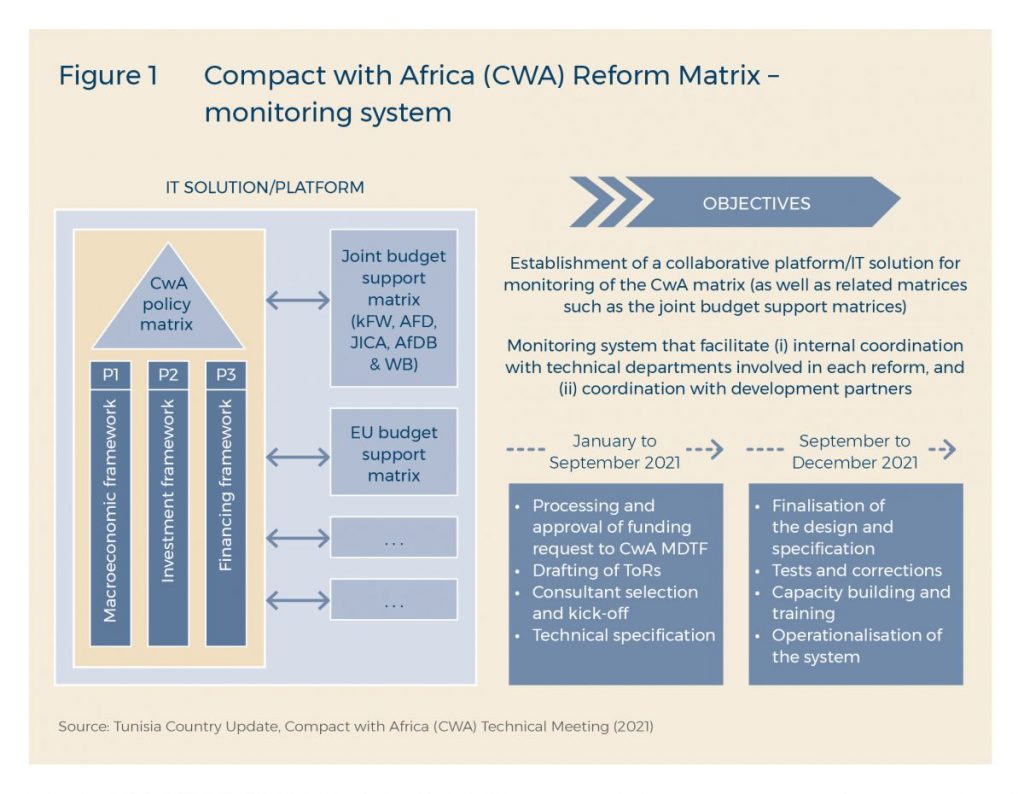

Tunisia (a CwA country) offers a useful model for promoting donor coordination. As a horizontal ministry that interacts with multiple development agencies, the Tunisian Ministry of Development and International Cooperation (MDCI) developed a collaborative monitoring system that facilitates internal coordination between technical departments involved in CwA reforms and development partners to ensure alignment behind a common national plan. The coordination platform includes an IT system that gives stakeholders direct and real-time access to data from programmes such as the CwA, Tunisia’s Joint Budget Support Matrix – financed by the Kreditanstalt für Wiederaufbau (KfW), Agence Française de Développement (AFD), Japan International Cooperation Agency (JICA), AfDB and World Bank – and the EU Matrices, thereby ensuring transparency and regular communication about the status of agreed reforms. The platform also enables the government of Tunisia to track the levels of private investment that a country attracts as a result of the reforms, including FDI from G20 countries.

Second, development partners could reallocate some resources earmarked for public investment to de-risk private projects on the continent, thereby spurring recovery. Furthermore, the IMF could work with developed countries to reallocate their substantial SDR allocations (which they will not be using in the short term) to de-risk capital-market borrowing by African countries. These two processes should help reduce the cost of borrowing for African countries and businesses.

Third, the G20 should yield to ongoing calls for debt cancellation and extend the DSSI for an additional two years, while also pacing debt payments within the period to prevent African countries from being suddenly overwhelmed with a huge debt burden at the conclusion of the DSSI. There have been growing calls for the G20 and the donor community to cancel the debt of low- and middle-income countries. While Africa’s rising debt (post the HIPC) has made development partners hesitant about going the debt relief route, it is critical to give African countries much-needed fiscal space to prioritise investments in strategic economic sectors so that they can ‘build forward better’. Timely debt relief is relatively effective; by delaying it, development partners will simply leave overindebted countries and their populations worse off.41Ulrich Volz et al., ‘Debt Relief for a Green and Inclusive Recovery: Securing Private-Sector Participation and Creating Policy Space for Sustainable Development,’ June, 2021, https://www.bu.edu/gdp/files/2021/06/DRGR-Report-2021-FIN.pdf. Alongside any support they receive from the G20, African governments should also commit to engaging in improved fiscal management by borrowing responsibly and being more prudent with their expenditure to ensure that they do not regress again.

Fourth, the development of a fair and transparent multilateral framework for the purpose of debt crisis resolution is urgently required to address countries’ unsustainable and inimical debt situation.42Global Action for Debt Cancellation, ‘Open Letter to All Governments, International Institutions and Lenders,’ https://debtgwa.net/open-letter. Bringing commercial creditors and new actors in the development finance architecture to the table could unlock additional sources of finance to stimulate the recovery of African countries. A recent IMF study estimated that, if brought on board, the private sector could, by the end of the decade, bring additional annual financing equivalent to 3% of SSA’s GDP for physical and social infrastructure.43Devine et al., ‘Private Finance for Development Wishful Thinking or Thinking Out of the Box?’ (IMF, May 14, 2021), https://www.imf.org/en/Publications/Departmental-Papers-Policy-Papers/Issues/2021/05/14/Private-Finance-for-Development-50157. Including private actors in global debt management efforts requires the G20 to find a way to create a public registry for loan and debt data, which adequately covers debt across countries of all income levels as well as instruments.44Daniel Munevar, ‘Sleep now in the fire: Sovereign Bonds and the Covid-19 Debt Crisis. Existing initiatives like the OECD Debt Transparency Initiative have so far excluded information both on middle-income countries and sovereign bonds, making is difficult to fully appreciate the debt challenges faced by developing countries. Improving debt transparency will be key to African countries improving their debt management practices, which in turn will bolster their economic recovery. It is also imperative that any support given to African countries that is aimed at enhancing debt management to stimulate economic recovery, prioritises capacity-building of government officials in the area of debt management – particularly debt audits and internal controls as well as the prudent management of expenditure (the latter being a neglected area).

Finally, G20 partners should heed calls and work with other countries to explore the feasibility of establishing independent and publicly owned CRAs that will assess Africa’s credit ratings more fairly and transparently – which should hopefully bring down the cost of borrowing to levels similar to those in other countries.

Acknowledgement

SAIIA gratefully acknowledges the support of the Konrad Adenauer Stiftung for this publication.