Recommendations

- Countries should join the GSLTF’s Coalition for Solidarity Levies with a view to implementing tax proposals made by the GSLTF.

- Developing country governments should actively engage in the design and implementation of the proposed levies to ensure that their perspectives and priorities are incorporated from the outset.

- Tax policymakers and tax administrators should conduct independent assessments of the proposed solidarity levy options, focusing on equitable access mechanisms, the operationalisation of ‘solidarity’, potential economic impacts and robust transparency and accountability.

- Global leaders should continue to advocate for reforms to the international financial architecture, global tax governance and anti-avoidance mechanisms to maximise access to funds generated through solidarity levies.

Executive summary

Solidarity levies offer a crucial opportunity to generate the scaled-up financing needed to support development and climate actions. This policy brief provides an overview of the work of the Global Solidarity Levy Task Force (GSLTF) in generating tax options to mobilise finance to realise climate and sustainable development goals. It advocates for countries to join the GSLTF and for developing countries to assess proposals for their potential to unlock financing that they can access.

Introduction

Inadequate development and climate finance presents a key barrier to achieving the Sustainable Development Goals (SDGs) at the core of the 2030 Agenda for Sustainable Development and the Paris Agreement. All African countries have ratified the Paris Agreement,1 African Development Bank Group, “Africa NDC Hub”, accessed March 10, 2025, https://www.afdb.org/en/topics-and-sectors/ initiatives-partnerships/africa-ndc-hub. but decarbonising – and developing along a low-carbon trajectory – requires significant finance. Developed countries, as the major emitters, have acknowledged their responsibility to support developing countries through finance, technology transfer and capacity building. However, available development and climate finance is insufficient, and the amount required runs into trillions of dollars as opposed to the billions currently being mobilised.2 World Bank Group, From Billions to Trillions: MDB Contributions to Financing for Development, Policy and Strategy Report (World Bank Group, 2015).

Solidarity levies present options to scale up the available development and climate finance. This policy brief outlines the potential of solidarity levies as a way to generate additional development and climate finance. It encourages countries to actively participate in the GSLTF Coalition for Solidarity Levies with a view to adopting its tax recommendations. It calls on developing countries to participate in the process by assessing the tax options developed by the GSLTF and contributing to deliberations to ensure that the solidarity aspect is realised.

The financing gap

The UN Conference on Trade and Development (UNCTAD) calculated in 2023 that between $6.9 trillion and $7.6 trillion is needed annually to achieve the SDGs.3UN Conference on Trade and Development, “UNCTAD Counts Costs of Achieving Sustainable Development Goals” accessed March 11, 2025. The UNCTAD calculation was based on 50 SDG indicators across six transformative pathways for sustainable development.

The SDG targets are severely off track. The UN Department of Economic and Social Affairs 2024 Sustainable Development Goals Report indicates that only 17% of the SDG targets are likely to be achieved by 2030, nearly half are experiencing slow or limited progress, and over a third have either stagnated or declined.4UN, The Sustainable Development Goals Report 2024 (UN, 2024). In the report, the department notes that there is an investment gap of $4 trillion per year for SDG implementation in developing countries. The report also highlights that many developing countries have narrowing fiscal space and are experiencing debt distress.5UN, The Sustainable Development Goals Report. The sizable financing gap poses a significant challenge to global efforts to achieve development and climate goals. This is even more striking in the face of the immense funds allocated to fossil fuel subsidies, estimated at $7 trillion in 2022.6Simon Black et al., “IMF Fossil Fuel Subsidies Data: 2023 Update” (Working Paper, IMF, 2023). Since solidarity levies are targeted at recovering taxes from the heaviest polluters, they represent an opportunity to counterbalance this misalignment in financing priorities.

The potential of global solidarity levies

The GSLTF was launched in November 2023 during the 28th Conference of the Parties (COP).7Global Solidarity Levy Task Force, “About Solidarity Levies”, accessed March 11, 2025. The country co-chairs of the task force are Barbados, France and Kenya. Its aim is to generate political support for a range of tax options. Additionally, it seeks to build momentum for the adoption of these taxes by encouraging countries to take the lead in implementing them.

To achieve this, the GSLTF has established a coalition of the willing. The Coalition for Solidarity Levies consists of Antigua and Barbuda, Colombia, Denmark, Djibouti, Fiji, the Marshall Islands, Senegal, Sierra Leone, Somalia, Spain and Zambia. A range of partners support the work of the GSLTF, including the International Monetary Fund (IMF), the World Bank, UNCTAD, the Organisation for Economic Co-operation and Development, the G20 (Group of Twenty), G24 (Intergovernmental Group of Twenty-Four on International Monetary Affairs and Development), the European Commission, the AU and the Coalition of Finance Ministers. The GSLTF intends to present levy options at COP30 in 2025.8GSLTF, “About Solidarity Levies”.

Ahead of COP30, it produced a straw-man proposal containing the proposed levy options and put it out for consultation.9 GSLTF, “Consultation on Straw-Man Options for Solidarity Levies”, accessed March 11, 2025.

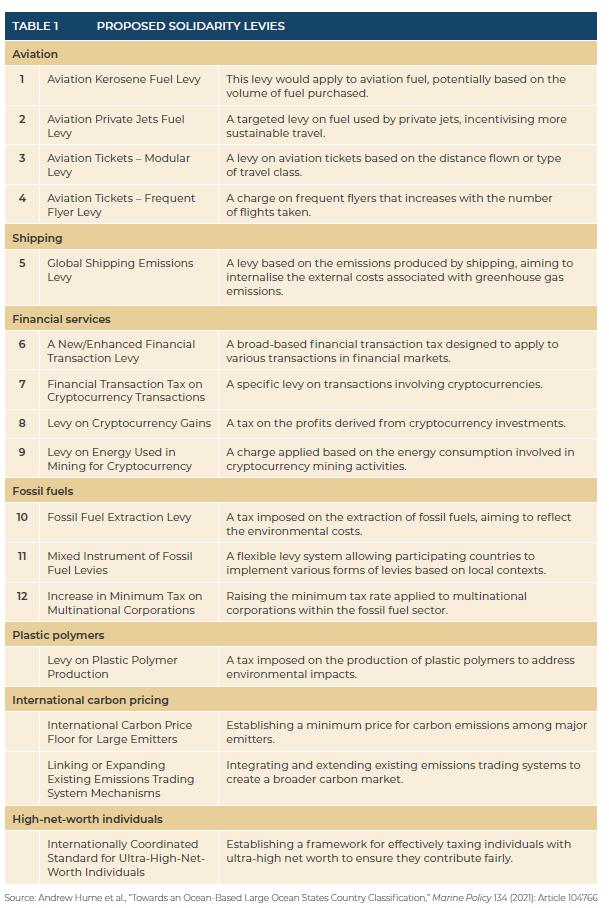

There are 16 proposed options, including levies on aviation, fossil fuels, carbon pricing, shipping, financial transactions, plastic polymers, cryptocurrencies and high-net-worth individuals.10GSLTF, “Consultation on Straw-Man Levy Proposals”, accessed March 11, 2025. What these tax proposals have in common is that they target undertaxed sectors responsible for driving carbon emissions. Each option is presented within a framework of three elements: how it would work, including applicable base, proposed tax rate and recovery method; an estimated range of how much money it could raise; and whether it makes sense in terms of criteria for sound tax and economic practices.11GSLTF, “Consultation on Straw-Man Options”.

The GSLTF has calculated the annual revenue potential of the levies. A global levy of 0.1% on trading stocks and bonds has the potential to generate $418 billion; a levy on fossil fuel extraction of $5 per tonne of CO2 could potentially generate $210 billion; while a global carbon price on international shipping and aviation could generate $200 billion.12GSLTF, “For People and the Planet” (Flyer, February 27, 2025). In an optimistic projection, the GSLTF estimated that the total revenue potential of solidarity levies could exceed $500 billion in annual revenue.13GSLTF, “Submission to UNFCCC: Solidarity Levies in the Baku to Belém Roadmap to 1.3 T” (2025).

How the proposed taxes would work

The recovery mechanism for the proposed tax options is via the country’s own tax system, so the taxes would directly benefit the country levying them.14One exception to countries collecting the tax directly is the proposed maritime tax, which will be collected by the International Maritime Organisation (IMO). In April 2025, the IMO approved net-zero regulations for global shipping with the aim of reducing greenhouse gas emissions from ships to zero by 2050. The IMO will set up a net-zero fund to collect emissions levies on shipping. Several of the options proposed by the GSLTF have already been implemented in various countries. For example, over 40 countries currently have some form of financial transaction tax.15Center for Economic and Policy Research, Financial Transactions Taxes Around the World (2020).

This enhances the feasibility of the proposed options as proven tax types are generally easier for tax authorities to implement and administer than untested ones. The GSLTF has proposed 16 levies as options. The straw-man proposal outlines how each of these would work. Table 1 provides an outline of the proposed levies. The GSLTF intends to launch a dashboard that tracks which countries have implemented levies.16Tom Evans (Senior Associate, European Climate Foundation), email to author, March 24, 2025. The dashboard can be updated as more countries adopt them. It is being developed in collaboration with the London School of Economics’ Centre for Economic Transition Expertise at the Grantham Research Institute on Climate Change and the Environment.17Evans, email.

Developing the solidarity aspect

Revenue reallocation is a significant area that requires further attention, particularly for developing countries. The way in which revenues from these levies are distributed will determine how much funding flows to low-emitting countries that are most vulnerable to climate change and face significant development challenges. The crux is that participation in these levies is at individual countries’ discretion. Likewise, developed countries have discretion as to how much of the revenue they allocate as grants to developing countries. While it would be beneficial for developed countries to spend a share of the levies generated on their own mitigation efforts – since emissions reductions benefit everyone – the equity aspect remains central. How developed countries choose to use these funds as climate financing and development finance warrants additional deliberation.

Building the case for solidarity levies

The GSLTF Co-Chairs and Secretariat have been attending key events in the international relations calendar to raise awareness of the GSLTF’s proposals.18Evans, email. These policy windows include the Finance in Common Summit, the Spring Meetings of the World Bank Group and the IMF and the Financing for Development Conference. They represent important opportunities in the lead-up to COP30, where the GSLTF intends to table its proposals.

The GSLTF is gaining traction with its awareness building. This is evident in the recognition by these forums of the opportunity solidarity levies present to mobilise additional finances. For example, the 2025 Finance in Common communiqué states that leaders ‘recognized the need to mobilize increased concessional resources for the lower income countries, including through new avenues such as the Global Solidarity Levies TF and other initiatives’.19Finance in Common, FICS 2025 Final Communiqué (2025).

The 2025 Finance in Common Summit, held in Cape Town, South Africa was attended by a wide range of development finance experts. The summit was jointly organised by the Development Bank of Southern Africa and the Asian Infrastructure Investment Bank, with the backing of Agence Française de Développement and several other prominent international and regional partners. This makes the endorsement one that is relevant and aligned with the work of the institutional stakeholders who are playing a central role in addressing the challenge of mobilising additional finance. At the summit, the GSLTF engaged with the Green Climate Fund and the Loss and Damage Fund – important strategic partners for the initiative. The GSLTF also met with governments that expressed an interest in joining the coalition of the willing.

The Finance in Common Summit was held alongside the G20 Finance Ministers and Central Bank Governors Meeting. The G20 Finance Ministers Chair’s Summary expressed support for the initiative, welcoming ‘collaborative efforts and partnerships aimed at mobilising climate finance from all sources’.20G20, Chair’s Summary First Finance Ministers and Central Bank Governors Meeting, Cape Town (2025). Given their leadership in national tax policy, finance ministers are central to tax mobilisation efforts. Their endorsement provides a major boost to the case for solidarity levies.

In April 2025, the GSLTF convened a closed ministerial meeting on the sidelines of the World Bank and IMF spring meetings. The meeting aimed to begin prioritising solidarity levies and to initiate discussions on how the resulting revenues should be allocated. This gathering laid the groundwork for further engagement in Seville during the Fourth International Conference on Financing for Development. As part of the lead-up to the conference, the GSLTF will host a side event at PrepCom4. These engagements are important milestones that build the case for solidarity levies. In response to the UN’s call for submissions, the GSLTF has submitted its views on the Baku to Belém Roadmap to $1.3 trillion. This figure refers to the New Collective Quantified Goal on Climate Finance agreed on at COP29. It calls on developed countries to take the lead in raising at least $300 billion annually for developing nations with a broader aim for all contributors, public and private, to scale up financial flows to developing countries to at least $1.3 trillion per year by 2035.21UNCTAD, Countries Agree $300 Billion by 2035 for New Climate Finance Goal – What Next? (2024).

COP29 was a significant milestone in the climate finance landscape. The GSLTF’s submission acknowledges the call to increase climate finance flows to developing countries, recommending that the road map to achieving the New Collective Quantified Goal on Climate Finance should be developed in a consultative manner. It should also ‘result in a clear pathway of recommendations and a sequence of actions, outlining a practical route to mobilise $1.3T by 2035’.22GSLTF, “Submission to UNFCCC”.

The submission recommends that the GSLTF and experts on global solidarity levies be among the parties consulted during the development of the road map and that solidarity levies should emerge as a focus area that offers a potential solution to the large gap in funding. Importantly, the GSLTF highlights that developing countries are faced with shrinking fiscal space, budget deficits and debt challenges while official development assistance is decreasing. Solidarity levies would be a source of concessional financing to developing countries at a time when it is urgently needed.23GSLTF, “Submission to UNFCCC”. These actions should build a solid groundwork for countries to adopt global solidarity levies. But the timing of the GSLTF’s proposals coincides with a period of significant geopolitical challenges. This could affect the crucial COP30 moment for their formal introduction. It is, therefore, important that countries support the proposed levies, especially since they offer opportunities to generate significant new revenue.

Conclusion

Overall, solidarity levies hold potential for securing additional funds for eradicating poverty, reducing inequality and achieving a low-carbon, climate-resilient future. However, for this potential to be realised, it is important that country officials engage with the proposed solidarity levy options. By joining the coalition of the willing established by the GSLTF, countries can proceed to implement tax proposals and generate tax revenue from untapped sources, which will see the heaviest polluters paying for development and climate actions. Developing countries, in particular, should evaluate these options as potential sources of new revenue.