This year marks the tenth anniversary of the framework as it does the Kimberley Process, another high-profile international regulatory scheme in which South Africa plays an instrumental role in preventing conflict minerals from entering the international diamonds supply chains through certification.

Given the broadly receptive attitude of the South African government to many similar initiatives – including those like the Open Governance Partnership (OGP) launched in 2011 by SA and seven other states including Norway, the United States (US) and the United Kingdom (UK), is SA failing to recognise its own self-interest and potential geopolitical advantages in joining the EITI?

Self-Image

It’s worth examining first some of the well-established reasons for SA’s EITI absence. First, the country’s reluctance to join the EITI partly derives from its government’s self-image and conception of SA’s global role. Officials have long pointed out that key northern states, including Canada, have refused to accede to the EITI. In addition, reference is often made to the EITI’s membership, which consists mostly of developing states from the global south.

A second set of reasons relate to the existing arrangements in SA’s domestic context, which are deemed sufficiently robust to safeguard extractive revenues from abuse. The EITI in this reading will be redundant in the SA context. Critiques though point out that in most countries corrupt deals leading to the illicit diversion of extractive revenues are likely to take place at the contract negotiation phase before the active production starts. This is also a view shared by many in South Africa. In this regard, the upcoming 6th EITI global conference on 23-24 May in Sydney will address and tackle one of the yawning gaps in the EITI’s procedures, namely that it does not yet cover the contracting and concession phases at which extractive revenues have often been diverted.

A recent SAIIA briefing paper on Mozambique’s EITI experience highlights this problem, arguing that closing loopholes at the contractual stages will be vital to bolstering the EITI’s coverage and effectiveness. Were SA to join the initiative and be represented at the top table in Sydney, would this not potentially bolster the collective African influence in the process? African peers would be able to leverage their number alongside SA’s diplomatic weight to influence the framework to pay more attention to Africa’s specific needs in revenue transparency and due diligence. As significant mineral and energy resources continue to be discovered across the African continent, such a need cannot be over-emphasised given the political fragility and inadequate governance arrangements that exists in many extractive contexts in Africa, both old and new.

A third reason for SA’s EITI abstention stems from domestic political considerations. The overarching policy concern with respect to the country’s extractive wealth revolves primarily around redistribution – essentially to redress historical imbalances in the ownership of and benefits from SA’s mineral wealth. Relatedly, civil society activism has concentrated more on strengthening internal oversight mechanisms such as the Promotion of Access to Information Act (PAIA) No.2 of 2000, rather than mobilising to compel government’s adherence to global extractive regulatory norms like the EITI. This lack of domestic interest in, or even awareness of, the EITI contrasts markedly with the successful application of pressure from civil society to compel EITI adherence in other African countries like Ghana. Furthermore, some analysts in fact regard PAIA as serving more as a tool in the hand of the SA government to compel accountability and compliance by companies, rather than a lever which is freely available for citizens and campaigners to force government’s disclosure on extractive contracts. Many of these are still classified as state secrets in SA.

Expanding reach

Yet, a major transformation is currently underway in terms of the EITI’s membership. It is true that until recently, the majority of the EITI-compliant countries – with the exception of Norway – came from developing regions and Africa in particular, which accounts for 21 of the EITI’s 31 member countries. As evidence of its expanding reach, the EITI has recently drawn into its orbit a number of influential northern states, including many which were initially reluctant to sign up to its process. The UK, the country most instrumental to the EITI’s founding, which then did not join it, seems to be having a change of heart. Its Prime Minister, David Cameron, has signalled that the UK wishes to follow the US example which is on the verge of signing up after forming a multi-stakeholder group (MSG) comprising industry, government and civil society representatives to oversee the implementation of a US EITI. Given the renewed, practical emphasis on transparency, accountability and open government in the UK’s G8 Presidency agenda, David Cameron has called for an urgent review of the UK’s position on EITI membership. Australia also has conducted an EITI pilot with a view to becoming compliant.

This shift potentially removes some of the ideological hang-ups behind SA’s EITI abstention. Is it then time for SA to finally join the initiative?

Significantly, SA’s adherence to the EITI could turn out to be a major strategic advance for global extractive industry transparency both at the regional and global levels. One possible route towards membership could be to highlight the potential to project regional and global level influences through the EITI, something that could help Pretoria see some of its broader benefits. This could help bring more clarity and greater objectivity to official assessments of SA’s EITI membership. South Africa’s EITI entry would likely further incentivise other Southern African Development Community (SADC) countries – including important resource-producers like Zimbabwe and Botswana – to join too. For too long, the obvious possibility of using the framework to further geopolitical influence has been ignored primarily because the EITI, given its provenance and composition, was seen as ideologically anathema right from the outset.

On closer inspection, the EITI could provide not just a platform for the pursuit of the sort of middle power aspirations which SA clearly harbours, including in the form of mediating international norms. From a self-interest perspective, the EITI’s composition and voluntary nature also makes it amenable to the exercise of South African soft power and influence. Clearly then, an active and expanding SA role in the EITI potentially opens up channels for SA’s domestic regulatory best practices to be ‘regionalised’ or ‘globalised’. In doing this, SA could lead the way on extractive regulatory reform not just among its SADC peers, but also on the wider continental and global stage.

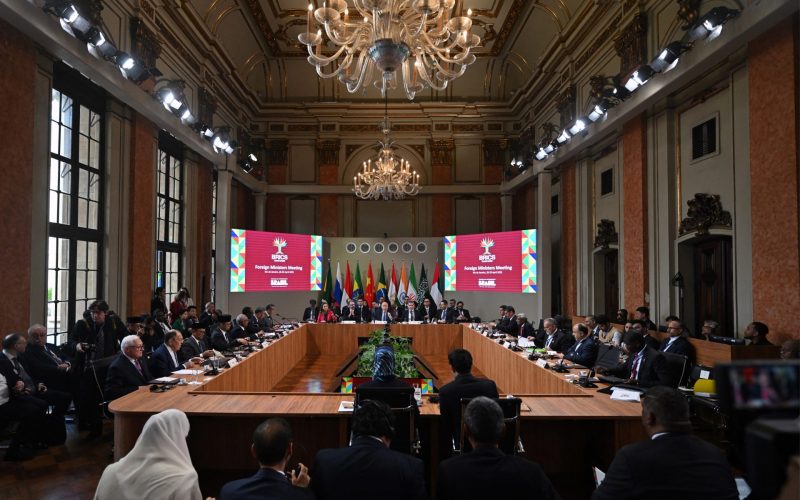

Remarkably, SA’s BRICS partners continue to be conspicuous EITI absentees, even as another South African influenced framework – the Africa Peer Review Mechanism (APRM) – has brought resource transparency more centrally onto its agenda. Though the SA government has failed to grasp the instrumental potentials of the EITI framework, the comparatively advanced nature of SA’s internal politics, legislations and oversight mechanisms – as the government itself claims – provides a persuasive enough argument that the country will bring something unique to the EITI, allowing it to promote experience sharing engagements with its African peers beyond just revenue transparency in the EITI framework. A peer-to-peer engagement of this sort will arguably be more relevant to the experience of many African resource producers given their shared commonalities with SA, including on poverty and redistribution challenges.

Ultimately, if South Africa wants to advance both its particular interests and extractive sector transparency globally, it should do so by pitching its tent firmly in the EITI alongside African peers such as Nigeria, which introduced modest innovations into the EITI through for example extending its national extractive audits to cover oil licensing and contracts. In sum then, the ideological argument with which South Africa’s rejection of the EITI has often been suffused obscures the advantages and potential self-interest in joining. On the eve of the 6th EITI global conference this May, South African stakeholders including the Parliament, the executive, civil society and the private sector ought to re-enter a dialogue around the potential benefits of the EITI not just for South Africa itself but also its likely contribution to furthering South African investment, diplomatic and other interests in the EITI-compliant jurisdictions across the continent and beyond.