Recommendations

- Global (eg, G20) and continental (AU) dialogues have consistently embraced the concept of leveraging private financing in infrastructure development. However, the drawbacks of private investment in infrastructure and the measures needed to overcome these should not be neglected in such discussions.

- Public funds should be leveraged in those sectors and segments of infrastructure development where there is scant interest from private financiers. Piecemeal rather than comprehensive use of private financing could be more cost effective.

- Private financiers favour profit considerations over development impact. Where governments lack the experience or technical capacity to ensure private financing delivers on development objectives, MDBs could be a better alternative.

- Capacity development should be viewed as a core component of loans, rather than as an add-on to project lending. This will also help countries better manage engagements with all financiers, ultimately enhancing African agency in infrastructure development.

Executive summary

The virtues of private sector financing in infrastructure development are widely promoted: it supports countries in bridging their infrastructure financing deficit, helps countries diversify their financing portfolio, brings projects online quicker, and often respects countries’ sovereignty by not imposing conditionalities. Yet much research glosses over the shortcomings of private capital investment in infrastructure: the interest rate exceeds that of all other creditors with shorter maturities; and private financiers often lack a development mandate, are more selective of the projects they finance and are more risk averse. These factors, coupled with weak institutional structures and a volatile macroeconomic environment in many African countries, make private finance less attractive. This briefing highlights some of the challenges encountered when engaging private capital for infrastructure development. It offers recommendations to policymakers on how to avoid these pitfalls and enhance African agency in infrastructure development.

Introduction

Infrastructure development, as a driver of economic growth, remains central to the development agenda of every African country. Yet a significant infrastructure financing deficit – estimated at between $68 billion and $108 billion annually [1] – is holding back infrastructure development on the continent. To bridge this deficit, copious dialogues and policymaking efforts are aimed at attracting private financiers – corporates, infrastructure funds, pension funds and sovereign wealth funds, among others – to infrastructure investment.

The virtues of private sector financing in infrastructure development are widely promoted: it supports countries in bridging their infrastructure financing deficit, helps countries diversify their financing portfolio, brings projects online quicker, and often respects countries’ sovereignty by not imposing conditionalities.[2] Yet most research and dialogue gloss over the shortcomings of private sector financing of infrastructure: the interest rate exceeds that of all other creditors while maturities are shorter; and private financiers often lack a development mandate, are more selective of the projects they finance and are more risk averse. African policymakers engaging in infrastructure financing should consider these characteristics which, coupled with often-weak domestic institutions and volatile macroeconomic environments, make the offering less attractive.

This briefing draws on a series of studies that the South African Institute of International Affairs (SAIIA) undertook through the Global Economic Governance Africa programme.[3] It highlights some of the challenges that these studies identified in respect of sector financing. It also offers lessons for policymakers on how to avoid the pitfalls and enhance African agency in infrastructure development.

Infrastructure financing in African countries: a changing milieu

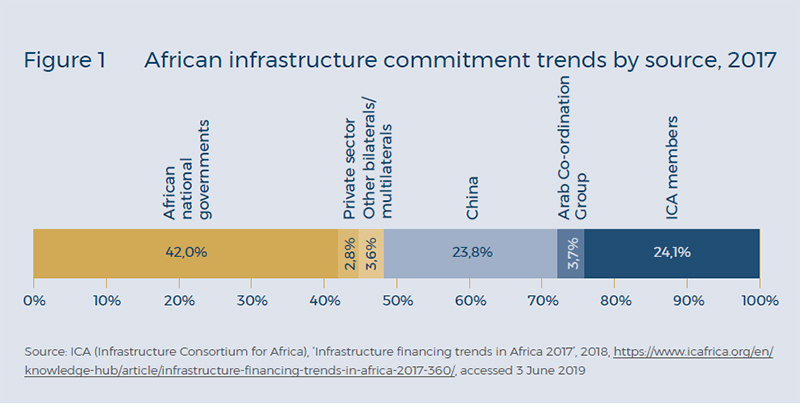

The infrastructure financing milieu in Africa has changed drastically over the past two decades. Public financing traditionally accounted for the bulk of infrastructure expenditure, supplemented primarily by loans from multilateral development banks (MDBs). However, the addition of alternative sources of finance – new and non-Organisation for Economic Co-operation and Development (OECD) bilateral lenders, bonds raised on domestic and international markets, and private financiers – has altered this traditional make-up. Concessional financing has declined, with market-based loans increasing from 54% in 2005 to 66% in 2016.4 In 2017 financing from African governments, MDBs and OECD countries constituted 66.1% of total financing; China alone accounted for 23.8% and contributions from private sources came to 2.8%

(see Figure 1).

Global (eg, G20 and the Global Infrastructure Hub) and continental (AU) dialogues [5] have consistently embraced the concept of leveraging private financing in infrastructure development. The size of this potentially untapped source is illustrative in South Africa: pension assets, one source of private capital, equate to 87% of South Africa’s gross domestic product (roughly $350 billion in 2018).[6] Much of this dialogue among multilateral and regional institutions reflects on bridging the technical challenges hindering greater private financial involvement. Of these the main challenges are: a lack of financial instruments, a lack of expertise among private investors to engage in infrastructure projects, a preference for traditional asset classes, a limited number of bankable projects in which to invest and strict regulatory thresholds for institutional investors.[7]

Characteristics of private sector financing

The drawbacks of private investment in infrastructure are typically neglected. The following section details some of the main drawbacks: higher cost, prioritisation of profit over development, selectivity and risk-averseness.

Cost considerations

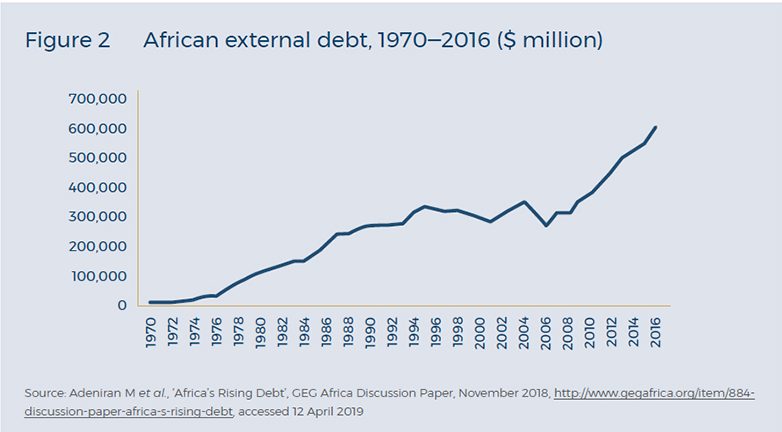

Private sector financing is considerably more expensive than all other sources of finance, with less favourable terms attached. Interest rates on private sector loans typically range from 15–25% with maturities ranging between seven and nine years. In contrast, the interest on bilateral loans typically ranges from 2–5%; non-concessional loans from MDBs typically attract 2.5% interest and concessional loans 1–2%, with maturities ranging from 25–40 years.[8] Higher financing costs are concerning for a continent confronted with rising debt. While overall debt levels on the continent remain manageable, the steadily upward trend at increased costs is worrying (see Figure 2).

The negative impact of excessive debt cannot be overstated: Adeniran et al. cite the negative ‘social impact of debt build-ups on sustainable development, the widening infrastructure deficit despite the rising debt commitment, dampened growth prospects and the high incidence of poverty’ [9] as key inhibiting factors impeding development. In addition, the Heavily Indebted Poor Countries Initiative that sought debt relief for the continent throughout the 2000s highlighted private financiers’ reluctance to restructure debt.

Prioritisation of profits over development

Unlike public sector or MDB lenders, private financiers often favour profit considerations over development impact. Private financiers also typically pay scant attention to mechanisms designed to enhance sustainable development outcomes of infrastructure, such as job creation, local content procurement, enterprise development, socio-economic development or the mainstreaming of gender considerations into infrastructure projects. While socially responsible investment is increasing among private financiers (eg, ringfencing investment in sustainable infrastructure programmes such as green bonds), this practice remains nascent.

South Africa’s Renewable Energy Independent Power Producer Procurement Programme (REI4P) highlights the reluctance of private investors to accommodate economic development criteria. Through the REI4P, South Africa’s national energy utility procures electricity from independent power producers through a competitive bidding programme. Bids were evaluated on a 70/30 split for price and economic development considerations, rather than the 90/10 split typically employed for government procurement. Private developers deemed these additional development criteria too onerous. Yet, despite the government’s upping economic development criteria over subsequent electricity procurement windows, the average tariffs for wind and solar dropped considerably, [10] highlighting the continued profitability of projects despite increased development considerations.[11]

The private sector’s scant regard for development outcomes was also observed in the failure to mainstream marginalised groups in infrastructure development in Rwanda. For example, [12]

some private equity interviewees acknowledged that attention to gender-based issues had been a result of top-down pressure arising from the need to comply with the requirements of development finance institutions and MDBs, with little meaningful engagement beyond treating gender as a tick-box exercise.

Evidence from this case study also illustrated that despite strong inclusive growth policies in Rwanda, inadequate monitoring and implementation capacity allows private financiers to evade or circumvent their obligations in this regard.[13] Private funds as an alternative financing source should not be discounted because of the lack of a development mandate. Factoring it into consideration when leveraging private finance is vital. Where governments lack experience or technical capacity to ensure private financing delivers on development objectives, MDBs could be a suitable alternative. MDBs have decades’ worth of development knowledge and technical implementation capacity to help countries achieve the greatest development impact.

Selectivity and risk aversion

Institutional investors often value ‘safety of assets over development outcomes’.[14] This alludes to an additional shortcoming of private financiers: the tendency to select least-risk infrastructure sectors and stages of the infrastructure value chain.

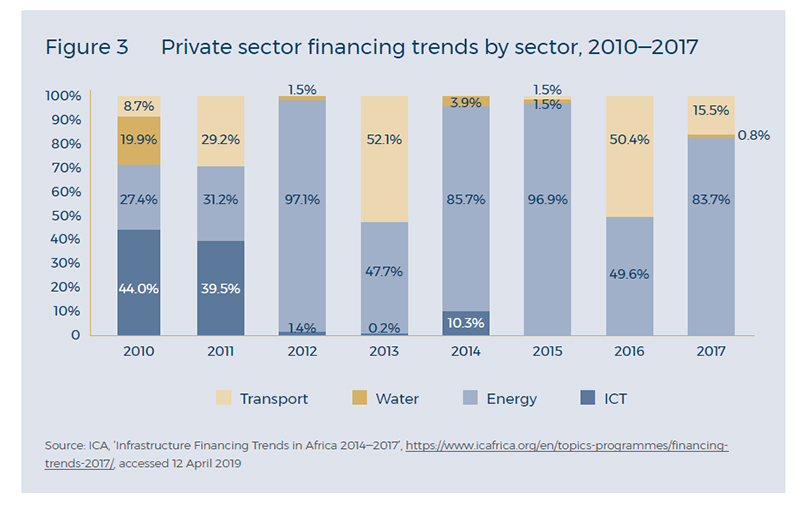

Historically, private financing has been concentrated in the information and communications technology (ICT), renewable energy and transport sectors (see Figure 3). Interest in these sectors is driven by four factors: ‘firstly, the clear costs associated with such projects, secondly, the low risk exposure during development and construction, thirdly the easy securitisation of revenue streams and finally the private sector’s control over the management of the investment’.[15] It is important to differentiate between economic infrastructure (ICT, renewable energy, transport), which typically sees returns on investments, and social infrastructure (education and healthcare), which typically does not recover capital costs but has the biggest development impact. There is little appetite among private investors for social infrastructure projects.

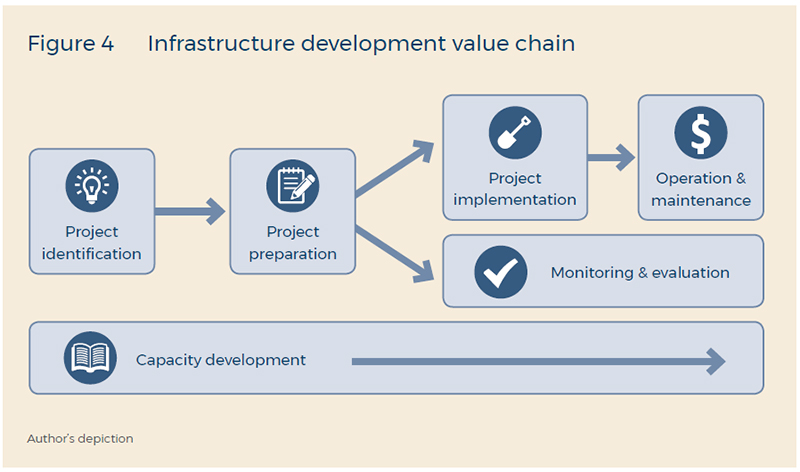

Private financiers are also reluctant to engage in the early stages of infrastructure development (Figure 4). Project preparation costs range between 5% and 15% of total project costs and can take up to 10 years to complete. [16] This time and expense are sunk costs if projects do not come to fruition. It is not a dearth of financing options that hinders infrastructure development, but rather that there is ‘a broad consensus that bottlenecks in project development and preparation are now the most serious constraints [in African countries]’. [17] This highlights the need for more project preparation finance.

Private financiers also typically prefer brownfield investments to greenfield projects. Brownfield investments have lower early stage development and construction risks and provide immediate cash flows.[18] Similarly, private financiers consider regional projects (irrespective of sector or stage) too complex [19] and have little appetite to invest in these projects. [20]

While these characteristics of private finance should not discourage policymakers from engaging private sources of finance, factoring them into infrastructure planning and engagement is vital. Public funds, for example, should be leveraged in those sectors where there is no interest from private financiers (eg, social infrastructure) or in stages of the infrastructure development value chain that are unattractive to private financing (eg, project preparation and capacity development). Piecemeal use of private financing could be more cost effective.

Enhancing African agency in infrastructure development

These characteristics of private capital investors are compounded by two underlying challenges pervasive in African countries that limit their agency in infrastructure development: lack of capacity and reduced public expenditure in infrastructure financing.

Capacity development

Inadequate technical, governance and implementation capacity in African countries exposes them to exploitation (intentionally or unintentionally) by private investors. Examples abound across the infrastructure value chain: a lack of technical capacity results in poorly written terms of reference, and insufficient technical capacity hinders enforceability of standards in infrastructure projects, resulting in poor quality infrastructure.[21] In Mozambique, weak debt management capacity and poor transparency mechanisms contributed to debt distress.[22] And in Lesotho, insufficient legal capacity had dramatic negative consequences in negotiations for a public–private partnership, locking Maseru into an unfavourable long-term contract.[23]

It is in the interest of policymakers to strengthen domestic legislation, institutions and policies governing infrastructure development and investment. Better capacity will lead to more sustainable infrastructure: infrastructure development efficiency will increase, limiting corruption and wasteful expenditure. Availability of domestic skills and production will increase domestic procurement and job creation to maximise the development impact of projects.[24] Enhanced capacity will also increase African countries’ agency in infrastructure development through better engagement with financiers and enforcement of outsourced projects.

Most countries prefer grants for capacity building.[25] Yet, since this is a long-term investment with development benefits akin to physical infrastructure, lending for capacity-building activities should also be prioritised. Capacity development should be viewed as a core component of loans, rather than as an add-on to project lending.[26]

Infrastructure expenditure

Larger infrastructure contributions will allow African countries greater autonomy in the administration and application of funds, curbing fears of undue national interests dominating decision-making in infrastructure development.27 However, infrastructure expenditure across the continent is declining.28 In SADC, for example, capital expenditure has dropped from 23.31% in 2008 to 22.19% in 2016, with countries such as Botswana and Madagascar recording double-digit declines.[29] Governments are increasing their spending on recurring budget expenditure, typically providing social services and servicing debt costs. For African countries to own the development financing process, they need to increase their domestic contributions.

In the absence of increased expenditure, smarter and innovative mechanisms can enhance African agency. As highlighted earlier, public funds should focus on sectors and segments of infrastructure development for which other financiers have little appetite. Outsourcing financing where appetite exists would free up limited public resources. In other cases, blending public and private monies can effectively bring down the interest rate.[30] However, governments should guard against costly financing options where possible and factor in macro-economic factors.

Smarter infrastructure expenditure should also include exploring new forms of public– private financing mechanisms that address both cost and development concerns. Future SAIIA research will focus on the role of green bonds or sub-national pooled financing as two alternative financing mechanisms.

Conclusion

Highlighting the nature of private capital in infrastructure investment is not an indictment of the role private investors could play in promoting sustainable development in African countries. However, it underscores the need for policymakers to consider the costs and benefits of different sources of financing and leverage them accordingly.

Acknowledgement

This work draws on valuable research undertaken by SAIIA and external associates over three years. They include Abdelaaziz Ait Ali, Adedeji Adeniran, Asmita Parshotam, Badr Mandri, Chelsea Markowitz, Cyril Prinsloo, El Mostafa Jamea, Elizabeth Sidiropoulos, Ghazi Tayeb, Gideon Oberholzer, Hanneke van der Westhuizen, Joel Barnor, Kedibonye Sekakela, Kwame Owino, Lesley Wentworth, Luanda Mpungose, Malcolm Pautz, Mma Amara Ekeruche, Neuma Grobbelaar, Olalekan Samuel Bodunrin, Talitha Bertelsmann-Scott, Tulo Makwati and Zinhle Ngidi. Any errors remain the sole responsibility of the author.

Footnotes

[1] AfDB (African Development Bank), ‘African Economic Outlook 2018’, https://www.afdb.org/fileadmin/uploads/afdb/Documents/Publications/2018AEO/African_Economic_Outlook_2018_-_EN_Chapter3.pdf, accessed 12 April 2019.

[2] Prinsloo C et al., ‘Informing the Approach of Multilateral Development Banks to Use of Country Systems’, GEG AFrica (Global Economic Governance Africa) Discussion Paper, September 2017, http://www.gegafrica.com/publications/discussion-paper-informing-the-approach-of-multilateral-development-banks-to-use-of-country-systems, accessed 16 April 2019.

[3] The GEG Africa programme contributed to the international system of global economic governance by ensuring African views and voices were considered and by creating dialogue platforms on global economic governance issues. The GEG Africa programme produced evidence-based research on continental infrastructure priorities, provided input to the South African government on how development finance institutions can increase infrastructure spending in Africa, and contributed to infrastructure financing mechanisms that support economic sustainability. For more information, see GEG Africa, ‘Theme 1: Development finance for infrastructure’, http://www.gegafrica.com/theme/theme-1, accessed 7 June 2019.

[4] Adeniran M et al., ‘Africa’s Rising Debt’, GEG Africa Discussion Paper, November 2018, http://www.gegafrica.org/item/884-discussion-paper-africa-s-rising-debt, accessed 16 April 2019.

[5] As well as other areas of focus, such as the Addis Ababa Action Agenda and the Infrastructure Consortium for Africa.

[6] Oberholzer G et al., ‘Infrastructure as an Asset Class in Africa’, GEG Africa Discussion Paper, November 2018, http://www.gegafrica.org/item/860-infrastructure-as-an-asset-class-in-africa, accessed 16 April 2019.

[7] Ibid.

[8] Adeniran M et al., op. cit. It should be noted that these numbers are not absolute or representative, and should be used as a guide only – particularly as loan interest rates and maturity periods depend on a wide range of factors, including prevailing risks.

[9] Ibid.

[10] Between bidding windows 1 and 4, tariff prices for wind dropped from ZAR 114 c/kWh to ZAR 72 c/kWh, while those for solar PV dropped from ZAR 276 c/kWh to ZAR 85 c/kWh.

[11] Prinsloo C, ‘South Africa and BRICS: Enhancing Economic Cooperation in the Renewable Energy Sector’, forthcoming.

[12] Parshotam A & H van der Westhuizen, ‘Women and The Energy Value Chain: Opportunities for a More Inclusive Renewable Energy Sector in Africa’, GEG Africa Discussion Paper, October 2018, http://www.gegafrica.org/item/844-women-and-the-energy- valuechain-opportunities-for-a-more-inclusive-renewable-energy-sector-in-africa, accessed 16 April 2019.

[13] Ibid.

[14] Oberholzer G et al., op. cit.

[15] Prinsloo C, ‘Partnering with the New Development Bank: What Improved Services Can It Offer Middle-income Countries?’, GEG

Africa Discussion Paper, November 2016, http://www.gegafrica.org/publications/partnering-with-the-new-development-bankwhat-improved-services-can-it-offer-middle-income-countries, accessed 16 April 2019.

[16] Wentworth L et al., ‘SADC Regional Development Fund Operationalisation Imminent?’, GEG Africa Discussion Paper, July 2018, http://www.gegafrica.org/item/718-sadc-regional-development-fund-operationalisation-imminent, accessed 16 April 2019.

[17] Oberholzer G et al., op. cit.

[18] Ibid.

[19] Such complexity stems from having to deal with various funding and implementing agencies, different legislative and regulatory regimes, and competing political interests, among others.

[20] Prinsloo C, op. cit.

[21] Wentworth L et al., op. cit.

[22] Adeniran M et al., op. cit.

[23] Bertelsmann-Scott T, Markowitz C & A Parshotam, ‘Mapping Current Trends in Infrastructure Financing In Low-Income Countries in Africa within the Context of the African Development Fund’, GEG Africa Discussion Paper, November 2017, http://www.gegafrica.org/publications/mapping-current-trends-in-infrastructure-financing-in-low-income-countries-in-africa-within-the-context-of-theafrican-development-fund, accessed 16 April 2019.

[24] Prinsloo C et al., ‘Informing the Approach of Multilateral Development Banks to Use of Country Systems’, GEG Africa Discussion Paper, September 2018, http://www.gegafrica.org/publications/discussion-paper-informing-the-approach-of multilateral- development-banks-to-use-of-country-systems, accessed 16 April 2019.

[25] Bertelsmann-Scott T, Markowitz C & A Parshotam, op. cit.

[26] Wentworth L et al., op. cit.

[27] Ibid.

[28] Adeniran M et al., op. cit.

[29] Wentworth L et al., op. cit.

[30] Bertelsmann-Scott T, Markowitz C & A Parshotam, op. cit.