China is a prime example. While it has been described as the business destination for any large company its size and different business culture do create some constraints. On the other hand, Latin America, which is currently experiencing impressive annual economic growth of above 5% on the back of rising commodity prices, is enjoying a surge of foreign investment and improving business confidence. It is also a region where South Africa is forging closer political ties that are expected to deliver unique commercial opportunities for the future.

South Africa is therefore well placed to take advantage of the economic opportunities emerging in Latin America. In December last year the long-awaited trade agreement between the Southern African Customs Union (SACU) and the South American trade bloc, Mercosur, was signed. While the SACU-Mercosur agreement is a watered-down version of the full-blown free trade area initially envisaged, provides a channel for preferential trade and a starting point for broader and deeper cooperation between the two regions.

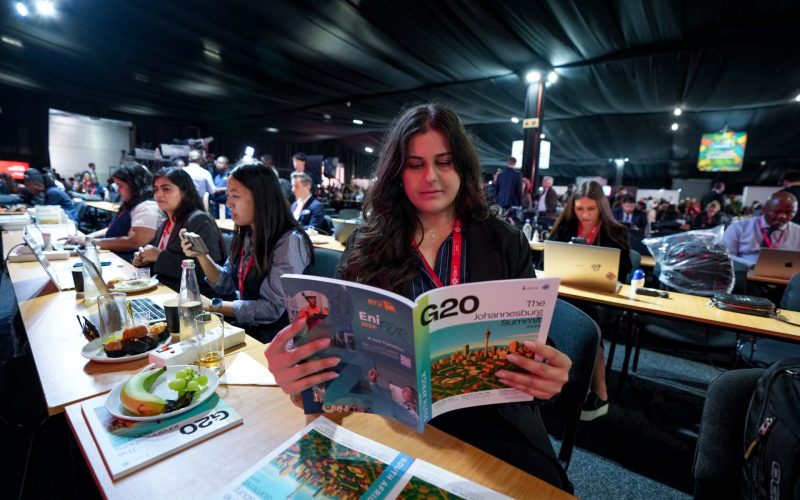

The IBSA initiative, launched two years ago, proposed closer co-operation and integration between three dominant players in the developing world. At the annual meeting, recently held in Cape Town, the IBSA Business Council was launched in an effort to involve the private sector and thus encourage tangible trade and investment exchanges between member countries.

These developments bode well for market access into the mushrooming Latin American market. The commodity boom in the region may well open potential business opportunities for South African companies that have a comparative advantage in mining and related industries.

Anglo American for one, achieved record results with headline earnings of $2.7 billion in 2004 – a 59% increase from 2003 – thanks in large part to its base metal operations in South America where as much as 50% operating profit was recorded at some mines. The group is riding the crest of global economic growth driven by Asia and the insatiable appetite of Chinese industrialisation. Such demand has resulted in a record production of copper, nickel, zinc and steel – cheaply available in South American.

But beside traditional mining operators, which have been reaping the benefits in countries like Brazil, Argentina and Chile for 30 years, there are opportunities in other sectors and countries worth exploring. Natural gas deposits in Bolivia and oil in Venezuela offer huge potential for South African-based companies as political shifts in those countries begin encouraging alternatives to their dependency on traditional US investment in those sectors.

The South African wine industry may also benefit from a trade deal with Mercosur. Brazil is one of the fastest growing wine markets in the world. Admittedly, low cost and quality wines are readily available from Argentina and Chile. But through preferential access South African producers may find a niche market for special varieties like Pinotage or white wines, where South Africa has developed a quality-cost advantage over international competitors. There may also be opportunities for investments or joint ventures in the Argentine and Chilean wine industries, which are gaining increasing market share in the US. South African wines seem to be trailing behind in that lucrative market.

While Chile remains the most feasible investment destination for South Africans in Latin America, Colombia offers an interesting alternative. The fourth largest economy in Latin America, Colombia has achieved impressive results in domestic security since the election of Alvaro Uribe in 2002. Efforts to improve the business climate were recognised in a recent World Bank study, which ranked Colombia as the world’s second most improved business environment for 2005. With a labour force that is rated as the second most competitive in Latin America, a talented and entrepreneurial population and a rich array of natural resources from petroleum and natural gas to gold and emeralds, it is little wonder that FDI is flowing in at a steady rate and economic growth is surging to 4%. South African companies – especially those with experience in natural resource extraction – should look more seriously at the relatively untapped potential in Colombia, which looks set to become the new gem in Latin America.

But business in Latin America does not come without its share of warnings. Low production costs and relative economies of scale have created stiff competition for South African producers in sectors like agriculture, auto parts, textiles and footwear. Differing tax and legal systems add obstacles to South African companies operating there. Political and economic risks are also a serious consideration – just ask the foreign holders of Argentine bonds, which have lost up to 65% of their initial value due to the 2002 financial crisis and the subsequent debt restructuring plan proposed by the Argentine government.

But such risks exist in all emerging markets. If the correct procedures and precautions are taken, South African companies could maximise the opportunities available in Latin America. Through initiatives like IBSA and the SACU-Mercosur trade agreement, some of the risks associated with doing business in Latin America are alleviated. South African companies should take advantage of this unique situation.