Summary:

- In line with SADC’s objective to establish a real-time integrated network of capital markets, CoSSE established an interconnectivity model that will allow investors in each country to trade on all SADC exchanges through their local brokers.

- An integrated regional capital market was expected to allow better investment choices, thereby bringing more customers to regional bourses and exposing companies listed on SADC exchanges to local and foreign investors.

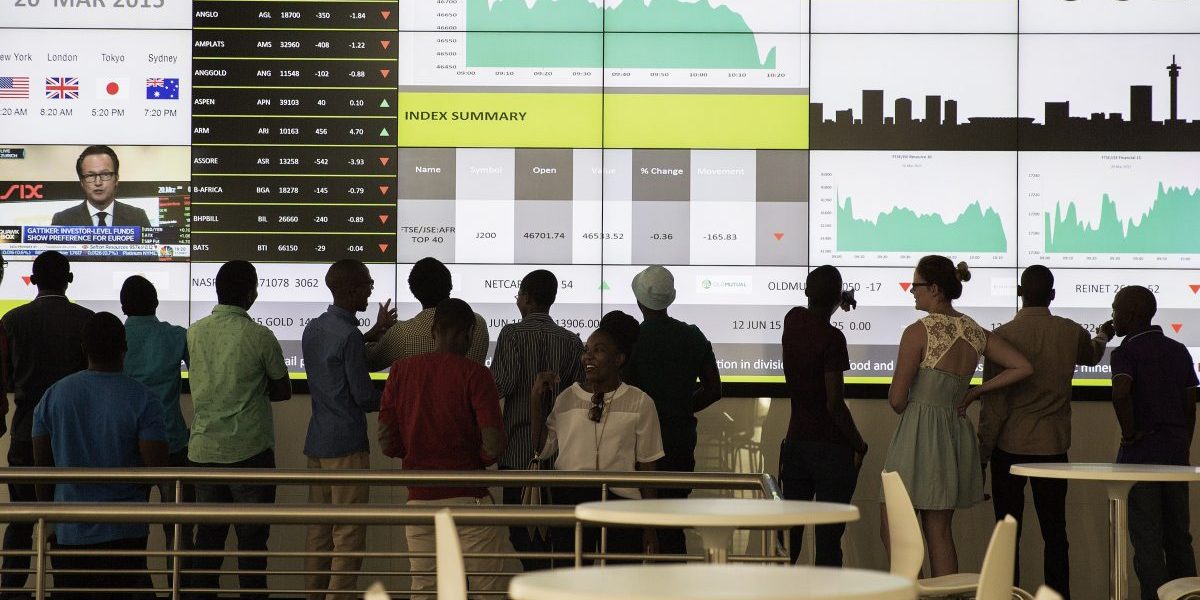

- Interconnectivity is hampered by low levels of cross-border flows, and the lack of readily accessible information and market data about products listed on other SADC exchanges.

- One requirement for cross-border trading is access to information about prices, trading and opportunities in each SADC country – there is thus a need to improve the offerings of the SADC Brokers Network platform.

- Regional cooperation allows exchanges to overcome common impediments that constrain the growth of fledgling and fragmented national capital markets.

- CoSSE could encourage national exchanges to work towards interconnectivity and integration by leveraging the support of the private sector and donor community, and lobbying for political support in SADC structures.