Covid-19 is acting as a kind of X-ray, revealing weaknesses that had been hiding in plain sight. In Africa, these centre on the need for infrastructure, and the limited ways of funding it. African debt was already hitting worrying levels in 2019, but the pandemic has made the problem much worse, in ways that will not only affect Africa, but also one of its biggest creditors, China.

An ominous sign came on September 22 when Zambia confirmed what many have been predicting for months. The government requested a pause on a $120m repayment on three large bonds, worth a total of $3bn. A new repayment plan will be formally presented to its creditors this week and depends on a two-thirds majority to be accepted. However, the fallout is already starting. Taken as tantamount to a default, the request led to a swift downgrade by Fitch Ratings, raising doubts about Zambia’s future access to capital.

While Zambia’s crisis was precipitated by the repayment of private sector debt, an estimated 44% of its total debt is to China. The country is now Africa’s largest official bilateral lender, and about 60% of this year’s debt repayments by the world’s poor countries will go to China.

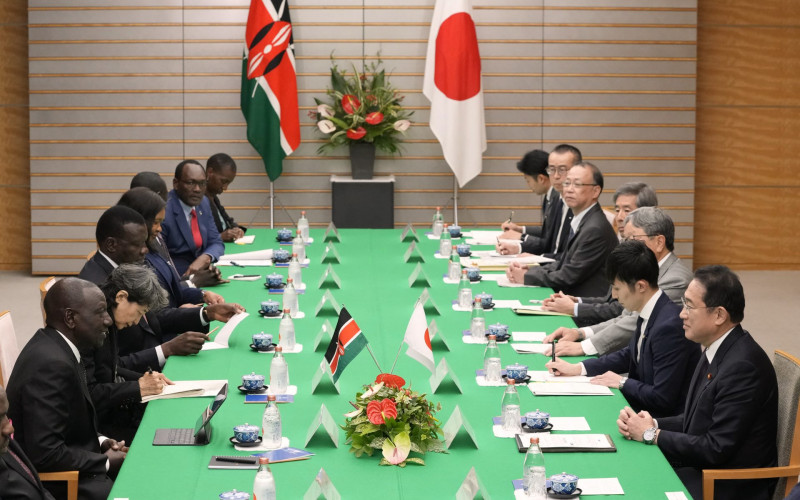

The question now becomes whether Zambia will be the first domino in a series of African defaults. Kenya’s parliamentarians are already calling for a renegotiation of the Chinese loan that financed its standard gauge railway, a project that is apparently losing $9.2m per month, and the continued global disruption of commodities trading could nudge many other African countries over the edge.

Pressure on China is increasing. The Group of Seven (G7) has issued a sharp (albeit veiled) statement calling China out for not fully participating in the Group of 20’s Debt Service Suspension Initiative (DSSI). The initiative will pause official bilateral debt servicing payments until the end of the year, to give poor countries the opportunity to use the funds to support health and social services amid the pandemic. While China has joined the DSSI, it has not been forthcoming about exactly how it is participating.

Rather than implementing a blanket suspension for all its debtors, it insists on negotiating debt relief on a case-by-case basis, and these negotiations are usually highly opaque. In addition, only some of China’s state-owned lending institutions (for example, the China Exim Bank) are categorised as providing loans, and the China Development Bank, which also provides large-scale infrastructure loans and is a major lender to Angola, is classified as a commercial (not official bilateral) lender. It is therefore exempt from the DSSI, a situation that has led to much criticism from the G7 and the World Bank.

The bigger question is how China will respond to a string of African defaults. The Trump administration has accused China of “debt-trap diplomacy”, luring poor countries into debt to then seize control of state assets once they fall into debt distress. Growing concern about debt has fuelled rumours in Zambia that China is about to seize assets, including the national broadcaster. This hasn’t happened. While the debt may well increase China’s political leverage over these countries, no asset seizures have taken place. This is true even for Sri Lanka’s Hambantota Port, frequently cited as an example of a government in debt distress that had to cede sovereignty to China.

That said, we recently saw a glimpse of one possible route open to Chinese lenders faced with default. In early September Laos’s state-owned electricity company announced a new shareholding deal with China Southern Power Grid, negotiated to forestall default on a loan for a hydroelectric plant. The small Southeast Asian country had invested heavily in becoming a regional electricity supplier, but Covid-19’s impact on tourism and remittances has pushed it into debt distress. The deal creates a new company with China Southern as the majority shareholder, essentially putting it in control of Laos’s national power grid. It stipulates that the power grid will operate under Laotian government regulation and allows Laos to reacquire shares over time, but this is unlikely to comfort those worried about a loss of sovereignty.

Will African governments go for similar deals if given the chance? My hunch is they might consider it, despite the inevitable public uproar this kind of deal will spark. I base this on two factors: Africa’s real value to China is increasingly political, rather than extractive. While China can source commodities from many places, African governments’ unified political support in multilateral forums on issues such as Huawei, Hong Kong and Xinjiang is invaluable. This makes me think Chinese players might be open to negotiating deals in ways that will soften the political blow to African governments at home.

Second, initiatives such as the DSSI do not apply to Eurobond or other private debt. Zambia’s request for a repayment pause had hardly been uttered before it was downgraded by Fitch Ratings, and 30 eligible countries did not dare sign up for the DSSI for fear of being downgraded, despite the initiative not even applying to commercial debt. Africa already faces unfair risk assessments and sky-high yields, and this kind of downgrade could jeopardise countries’ financing options for years to come. The G7’s call for “for private creditors to implement the DSSI on a voluntary basis” is exactly as weak as it sounds, and private creditors at present have little incentive to do anything except settle in for a free ride.

For all its (very significant) downsides, Laos’s deal with China allows it to keep servicing its commercial debts and avoid being branded a defaulter. I wouldn’t be surprised if countries such as Zambia make the same choice. Covid-19 could end up pushing Africa even more firmly into China’s corner. Not only will China remain a major lender to Africa, it might also become the majority shareholder in some of the assets emerging. This would not be great for African sovereignty, but in this nightmare of a year, what is?