Recommendations

- Despite higher initial costs, rail infrastructure is recommended for African countries moving towards a low-carbon future.

- African governments should prioritise integrated cross-border rail solutions.

- African governments are encouraged to promote high levels of transparency in the bidding and financing process.

- African countries should locate rail expansion within larger strategies to boost cross-border trade. This will increase the affordability of rail infrastructure and maximise its development impacts.

Executive summary

One of the hallmark project types of the Belt and Road Initiative, driven by the People’s Republic of China, is the construction of railways to connect developing countries to markets using high-speed rail where possible, and often using standard-gauge rail, which is sometimes different from existing infrastructure. As African countries – and the continent at large – face decisions about how to move ahead with railway development, lessons can be learned from the projects underway in the Trans-Asian Railway Network, a 1960s plan to expand railways across Asia and toward Europe in a world where railway standards globally – not just in China – are coalescing around high-speed, standard gauge rail. Strong regional planning, transparency in procurement and planning, and improving cross-border trade facilitation and domestic economic planning will be key to successful dialogue with suppliers of rail systems wherever they should come from.

Introduction

With the launch of the African Continental Free Trade Agreement (AfCFTA), African countries are faced with the opportunities and challenges of economic integration to take advantage of the unique strengths that each country can offer to value chains both within the area of the AfCFTA, but also globally. Transportation infrastructure will be key to achieving this goal. Railways offer permanent, operationally inexpensive and reliable transportation of heavy goods and people over long distances and are favoured by public financiers increasingly concerned about climate change – including mega-projects such as People’s Republic of China’s Belt and Road Initiative (BRI). The BRI has become an important and attractive source of investment for countries as they build out their rail systems, but BRI investment comes with new standards – especially the high-speed, standard gauge rail that differs from colonial systems installed more than a century ago. Countries are hesitating to take a leap towards these expensive systems that would nonetheless prepare them for the future.

Countries in Africa, and Africa as a region, are not alone in facing these decisions. Since the 1960s, the Trans-Asian Railway (TAR) Network has focused on connecting all the countries of Asia by overland links, and has also become an important part of the BRI. This paper seeks to examine the experiences of countries in Southeast Asia and draw out recommendations for African countries in the age of the railway.

The Trans-Asian Railway (TAR) Network

The idea of the Intergovernmental Agreement on the TAR Network has been under formal discussion since the 1960s, with the aim of connecting member countries in the Asia and Pacific region as well as the Middle Eastern and European rail systems. The agreement was adopted by the members of the UN Economic and Social Commission for Asia and the Pacific (UN ESCAP) in April 2006.1UN Economic and Social Commission for Asia and the Pacific (UN-ESCAP). “Trans-Asian Railway Network”, no date, https://www.unescap.org/our-work/transport/trans-asian-railway-network.The TAR is currently made up of over 117,500 km of rail routes that have been selected for their potential to serve international trade within the ESCAP region as well as between Asia and Europe, while improving the economies of landlocked countries like the Lao People’s Democratic Republic (PDR), Afghanistan, Mongolia and the Central Asian republics.

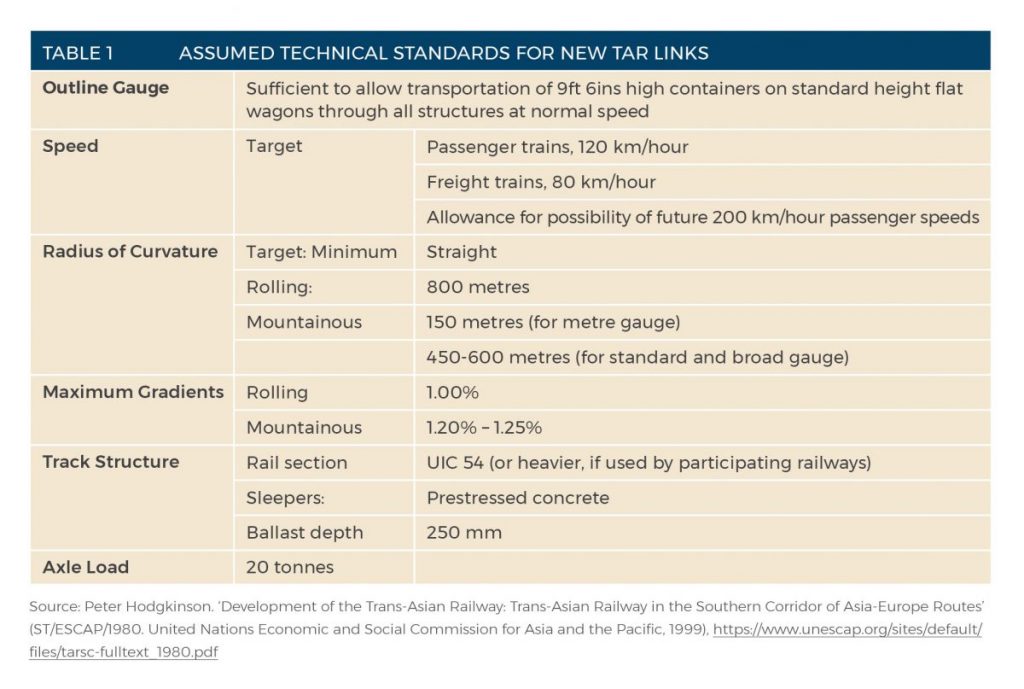

The planning of the TAR recognized that while international container transportation would be the one of the primary objectives for development of the network, there should be compatibility in standardization with this objective – but that it would still be a matter for each participating railroad to decide. Minimum standards for the cost-effective movement of containers were established to allow for block trainloads of at least 30 bogie flat wagons to move containers, assuming the use of locomotives with a power rating of at least 2400- 3000 horsepower (HP) and axle loading of at least 15 tonnes for metre gauge track and 20 tonnes for standard or broad-gauge track. Additionally, all new rail lines would be compatible with transportation of high cube containers and with appropriate adjustments to allow for differences due to track gauge.2Peter Hodgkinson. ‘Development of the Trans-Asian Railway: Trans-Asian Railway in the Southern Corridor of Asia-Europe Routes’ (ST/ESCAP/1980. United Nations Economic and Social Commission for Asia and the Pacific, 1999), https://www.unescap.org/sites/default/files/tarsc-fulltext_1980.pdf.Other technical standards agreed upon for the TAR are noted in Table 1.

For many years, how the TAR network would be financed to completion had been a question, whether it would be development banks, the private sector, or national governments financing the initiative themselves. Then, in 2015, President Xi Jinping of The Peoples Republic of China, announced the BRI – which was at that time referred to as the ‘One-Belt, One-Road’ Initiative – a global project to expand infrastructure in developing countries, driven by China. The BRI was a vision for China to offer developing countries support for construction of rail and marine networks including many parts of the TAR network using excess financial and industrial capacity from China.

The BRI has indeed gathered its share of both praise and criticism from around the globe for many reasons, but one clear positive benefit of the initiative is that it has created a useful examination of the needs for infrastructure in developing countries and has offered a means for countries to access new sources of finance to bring some of those projects into reality. A 2019 study done by the World Bank concluded that the BRI transport corridors have the real potential to substantially improve trade, foreign investment, and living conditions for citizens in the countries it touches. At the time of the study, trade was estimated to be 30% below potential in BRI corridor countries, and FDI to be 70% below potential – with BRI transport projects potentially increasing trade between 1.7 and 6.2% globally, and global real income by 0.7 to 2.9%.3World Bank, Belt and Road Economics: Opportunities and Risks of Transport Corridors (Washington, DC: World Bank, 2019). https://www.worldbank.org/en/topic/regional-integration/publication/belt-and-road-economics-opportunities-and-risks-of-transport-corridorsThe study also noted that the BRI presents risks common to all large infrastructure projects, including those involving Chinese finance or those involving other sources of finance: Debt sustainability risks; Governance risks; Environmental risks, and Social risks.

Finally, the World Bank report concluded, ‘Real incomes for corridor economies could be an estimated two to four times larger if they implement reforms to reduce border delays and ease trade restrictions.’ 4World Bank, Belt and Road Economics: Opportunities and Risks.There is a clear opportunity in adopting the measures outline in the TAR and facilitate by the BRI.

The TAR Network, the BRI and the evolution of modern rail systems

Table 1 implies that some standardization would be left to member countries. Perhaps one of the most important parts of the table of standards is that there would be an allowance for possibility of future 200 km/hour speeds. High speed rail is clearly indicated to be a future direction of the system.

Globally, across Europe, Japan and China, high speed rail has evolved with trains that travel more than 200 km/hour. Furthermore, with rare exception, high speed rail is built on the 1,435 mm standard gauge rail standard. In the case of Japan, the Shinkansen, operating at 210 km/h, opened in 1964 built on standard gauge rail, replacing its own metre gauge rail.5International Union of Railways, High Speed Rail – Fast Track to Sustainable Mobility (2018), https://uic.org/IMG/pdf/uic_high_speed_2018_ph08_web.pdfOther countries such as Spain have built high speed rail on standard gauge rail, differing from their traditional Iberian rail gauge standard.

The International Union of Railroads (UIC) has noted that it is very costly to change fixed installation such as the width of track, the electrification mode or signalling systems of railways. Indeed, some countries in Southeast Asia have also voiced concerns that it would be too costly to invest in new standards. Cambodia, for example, has proposed metre gauge projects rather than standard gauge projects for the TAR network and BRI, and where critics have said, ‘Southeast Asia’s rail systems are relatively easy to connect as they run on the 1,000 mm metre gauge … As the BRI advocates high speed rail connections, it disregards rather than leverages each country’s existing infrastructure’.6Stephen Chin, ‘Trans-Asian Railway chugs closer to becoming a reality,’ The ASEAN Post, 14 July, 2018. https://theaseanpost.com/article/trans-asian-railway-chugs-closer-becoming-realityEurope has approached this problem by mandating Technical Specifications for Interoperability which are compulsory today for both infrastructure and rolling stock. In fact, norms are starting to converge globally as the international rail market becomes more competitive.7Marc Guigon, ‘The perpetual growth of high-speed rail development,’ Global Railway Review, 3 November, 2020, https://www.globalrailwayreview.com/article/112553/perpetual-growth-high-speed-rail/.

The high-speed rail system in China, once it kicked off in 2003, changed the global landscape for high speed rail development. The country has rolled out more than 35,000 km of new high speed lines using more than 1,200 trainsets, taking the global lead in high speed rail development. Today, the China State Railway Group owns 64% of the 6,000 high speed train sets in the world, and 14% owned by Japan’s JR Group. The remaining sets are owned primarily by European companies. Chinese rail operators and manufacturers have become a global powerhouse of HSR development.8Guigon, Global Railway Review.

Railway Development along the BRI

Regardless of whether rail projects have been proposed as part of the BRI or under other initiatives such as with Asian Development Finance, the development of the TAR network has not been smooth. Negotiations have been ongoing since the early 2000s to build a variety of railway linkages that would complete the connections between the countries of Southeast Asia from China to Singapore, but these have run into controversies of one kind or another, and many projects, while approved in principle, have encountered delays. A high speed rail link from Kuala Lumpur to Singapore was initially put forward as early as the 1990s, with proposals for development coming from Japan and South Korea, only to be shelved, and finally cancelled in 2021 due to high costs and governance issues.9Shannon Teoh, ‘High-speed rail project cancellation just tip of the iceberg in Malaysia’s recent rail controversies’ The Straits Times 8 January, 2021, https://www.straitstimes.com/asia/se-asia/high-speed-rail-project-cancellation-just-tip-of-the-iceberg-in-malaysiasrecent-rail.

Meanwhile, the East Coast Rail Link, to be built by a Chinese engineering firm, was first agreed on in 2017, then put on hold in 2019 while the Malaysian government renegotiated the price of the project, which was felt to be far too high – the project was not cancelled outright due to the overwhelming cost of breach of contract. The renegotiated project, which will stretch from Kuala Lumpur to Southern Thailand, will be a 50-50 joint venture between Malaysia and the Chinese engineering firm, and was reduced to only 85% the original cost of the project with far better details available such as technical specifications, price and economic justification.10Tom Mitchell and Alice Woodhouse. ‘Malaysia renegotiated China-backed rail project to avoid $5bn fee’ Financial Times. 15 April, 2019. https://www.ft.com/content/660ce336-5f38-11e9-b285-3acd5d43599e.It is important to note that this project was not controversial specifically due to disagreements about standards, but rather due to the total cost of the project and the burden of the rail link on the Malaysian economy.

Perhaps the linkage that has experienced the smoothest progress has been in the Lao PDR, linking Kunming in Southwest China, to the Laotian capital of Vientiane. The link, announced in 2015, is a 414 km high-speed standard gauge rail that the project proponents say will transform the land-locked country to ‘land-linked’ and bringing economic opportunities. The line is nearly complete and it is planned to enter service in 2022. Standards for rail development have been implemented according to Chinese standards to ensure compatibility with the broader planned rail line from Kunming to Singapore. The World Bank reports that the real challenge – and perhaps the make-or-break developments that will need to occur for the railway to succeed will be in trade facilitation and crossborder procedures to ensure smooth transfer of goods and passengers from one country into the other.11World Bank, From Landlocked to Land-Linked: Unlocking the Potential of Lao-China Rail Connectivity (2020), https://documents1. worldbank.org/curated/en/648271591174002567/pdf/Main-Report.pdf.

An overview of the existing rail projects along the BRI – which follows the plans laid out in the internationally-agreed Trans-Asia Railway Network – reveals that while standards are a concern for some countries such as Cambodia, which aims to see its existing infrastructure be leveraged rather than replaced, the main challenge is around costs related to railway construction in general, and around the complementary policies that need to be put in place to facilitate the movement goods across national borders, and to allow various countries to capture the value of the rail line running through. In many cases, existing metre gauge rail will still be used for domestic transport, while the standard gauge rail serves international transportation.

Conclusions and recommendations

The global rail industry is growing and evolving quickly. The introduction of China into the high speed rail market has greatly accelerated this industry. Now that the high speed network in China is, for the most part, complete, the country’s manufacturers and service providers are looking for new places around the world to compete with Japanese and European manufacturers to absorb excess capacity. The BRI is the outlet for this capacity, bringing both potential benefits and risks to participating countries. In order to maximise benefit from the BRI, this paper makes four recommendations:

- A broad shift towards low carbon transportation is occurring, with rail transport at the heart of international dialogue and efforts. To date, the aviation sector has dominated in long-distance transport in some developing countries that haven’t had the opportunity or circumstances to install infrastructure-heavy rail projects. Yet the aviation sector represents a significant increase in greenhouse gas emissions, which presents risks and costs of its own to developing countries, where the impacts are likely to be most greatly felt. A modern rail infrastructure presents an opportunity to develop a durable and clean transport sector in many developing countries, and should be encouraged, even at higher costs, in order to prepare for a carbon-lean future.

- Integrated planning across borders helps countries to prepare for standardization. The UN ESCAP Trans-Asia Railway network, developed in the 20th century, provided the pathways and the standards framework for future railway development to occur. It was finance that provided the challenge. If countries in other regions such as Africa, could agree on common plans and standards for their own region and demand interoperability of infrastructure, as has been done in Europe, these countries will have the ability to properly evaluate competitive bids for infastructure construction and financing.

- Transparency in the bidding process for projects is key to ensuring that costs of projects are properly managed. Malaysia gives an excellent example of a country that, once the costs and management of the East Coast Rail Link became known to the public, was able to successfully renegotiate with Chinese financiers to get a better deal on its rail project.

- Cross-border trade facilitation and domestic economic planning is at least as much a challenge as infrastructure standards to the success of railways. Countries building new rail systems require comprehensive policies in place to ensure that the benefits and economic value of railway systems can be harnessed to the public good. Intense cooperation with the private sector – even to provide self-finance for rail projects can help anchor domestic benefit. The Kobayashi model used for railway development in Japan, focused on land value capture around stations has made the Japan high-speed rail one of the most financially viable systems in the world.

Acknowledgement

SAIIA gratefully acknowledges the support of the Swedish International Development Cooperation Agency (SIDA) for this publication.