Recommendations:

To enable win-win solutions for all stakeholders and investors in the renewable energy space:

- Governments should design incentive structures at national and sub-national levels to create an enabling environment for renewable energy investments.

- Both governments and development partners should develop innovative financing models that enhance strategic partnerships among multiple stakeholders to pool financial resources for enhanced affordability, lower risk and increased investment flows for renewable energy.

- Development partners should provide technical assistance and capacity building support to African governments towards developing an enabling environment for private sector energy investments.

- Private sector investors should expand on investment models that focus on sustainable development outcomes such as universal access and affordability for consumers at the bottom of the pyramid. This in turn creates economic opportunities and improves the overall quality of life for all citizens.

Executive summary

With Africa’s continued economic growth, rapid urbanisation and fast population growth, energy demands are expected to increase exponentially. To meet these demands, governments have placed energy investments among their top priorities, with a special focus on renewable energy sources. Public funds alone are however not enough to meet the scale of investment required, hence the need for innovative and additional sources of financing. Green financing offers new opportunities for scaling up public and private investments in renewable energy generation across Africa. This policy brief explores the catalytic role green financing can play in blending public sector funds with private sector capital for renewable energy projects. Using Kenya as an example, it highlights key elements for success in implementing blended finance in renewable energy projects, as well as associated policy reforms and incentive structures.

Introduction

Africa is home to six of the top 10 fastest growing economies in the world, with East Africa being the fastest growing region on the continent at the rate of 5% as of 2019.1African Development Bank (AfDB) Group, African Economic Outlook 2020: Developing Africa’s Workforce for the Future (Abidjan: AfDB Group, 2020): 1. Fast economic growth, rapid urbanisation and a high population growth rate will greatly raise the demand for energy on the continent. As of 2019, Africa’s electricity demand stood at 700 TwH (terrawatt-hours). To meet this demand and achieve reliable electricity supply for all, the International Energy Agency estimates that investments of $120 billion per year will be required until 2040.2International Energy Agency (IEA), Africa Energy Outlook 2019, World Energy Outlook special report (Paris: IEA, 2019): 16, https://www.iea.org/reports/africa-energy-outlook-2019.As energy is a key driver of development,the continent must, therefore, secure affordable and reliable energy for all to sustain and grow its economy and improve the lives of its peoples. However, access to energy still remains a challenge, with 640 million Africans lacking access to electricity – this translates to an access rate of 40%, the lowest in the world.3AfDB, ‘Light Up and Power Africa – A New Deal on Energy for Africa’, https://www.afdb.org/en/the-high-5/light-up-and-powerafrica-%E2%80%93-a-new-deal-on-energy-for-africa.Per head energy consumption in sub-Saharan Africa (excluding South Africa) is 180 kWh, compared to 13,000 kWh in the US, and 6,500 kWh in Europe. As governments invest in meeting Africa’s energy needs, access through affordability should be the main goal, as energy serves as a catalyst towards achievement of all the Sustainable Development Goals and overall inclusive development.

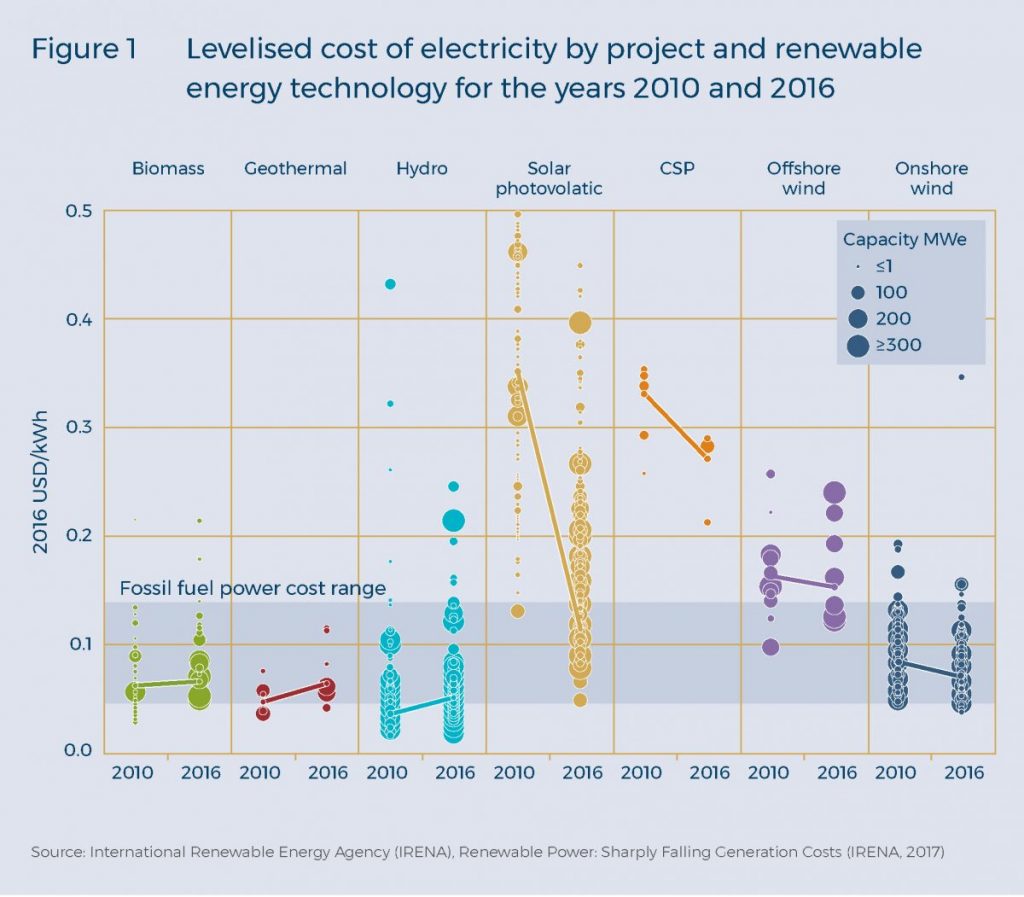

With the world now shifting towards a low carbon development pathway, the focus is largely on the use of renewable energy sources to meet energy demand whilst maintaining environmental integrity. Africa has huge energy generation potential through renewable energy sources such as solar (10,000GW), wind (110GW), hydro (350GW), natural gas (400GW) and geothermal (15GW). These sources have been at the forefront of energy investments in Africa, accounting for three quarters of new generation, with solar photovoltaic (PV) being the highest in terms of installed new generation capacity, ahead of natural gas and hydropower.4IEA, Africa Energy Outlook 2019.With the cost of renewable energy rapidly declining, the opportunity to invest at scale exists. According to the International Renewable Energy Agency, between 2010 and 2016 the global weighted average cost of utility scale solar PV plants fell by 69%, while that of onshore wind fell by 18%.5International Renewable Energy Agency (IRENA), Renewable Power: Sharply Falling Generation Costs (IRENA, 2017), https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2017/Nov/%20IRENA_Sharply_falling_costs_2017.pdf.

Even as the costs of solar and onshore wind energy continue to decline, the cost of infrastructure required for generation, transmission and last mile connectivity is generally high in Africa. While several governments in Africa have identified energy investment as one of their top development priorities, public funds alone are not enough to meet the costs required. Whereas multilateral and bilate1al development financing is available to enable governments to achieve their respective energy objectives, additional participation of private sector actors is crucial. The private sector has the capacity to contribute the financial resources, technology, research and development required through the energy value chain from generation to last mile connectivity. Such intervention is critical in ensuring access to energy for the bottom of the pyramid6Bottom of the pyramid is a term coined from the notion that through strategic partnerships with people at the base of the economic pyramid, companies can achieve sustainable win-win solutions that are profitable and solve both environmental and social problems. This term was popularised through C.K Prahalad’s book The Fortune at the Bottom of the Pyramid (Upper Saddle River, N.J: Wharton School Publishing, 2006).consumer and achieving economic and social progress that leaves no one behind.

Financing renewable energy in Africa

In response to the fight against climate change, almost all African countries have made commitments under the Paris Agreement, to invest in renewable energy as part of their efforts to reduce greenhouse gas emissions. In addition to this, the Committee of African Heads of State and Government on Climate Change has endorsed the Africa Renewable Energy Initiative, with the objective of mobilising generation of at least 300GW of renewable energy by 2030. Meeting these commitments will require significant financing. Developed countries have also made commitments under the Paris Agreement to mobilise $100 billion a year by 2020 (now extended to 2025) as climate finance to support developing countries in meeting their targets and commitments. This target, however, is yet to be achieved, as climate finance flows from developed countries to developing countries stood at $71.2 billion in 2017, up from $58.6 billion in 2016.7European Commission, ‘International Climate Finance’, https://ec.europa.eu/clima/policies/international/finance_en.

To raise the required financing to fund renewable energy on the continent, green financing will be required. Green financing is an innovative financing model that focuses on increasing financial flows from private and public sources, using various instruments (debts, grants, guarantees, etc.) for sustainable development priorities, including renewable energy. Together with addressing energy needs, this form of financing will enable developing countries to reach their respective climate change mitigation targets while stimulating foreign direct investment. This will in turn provide the opportunity for a decent return on investment, and enhance skills and technology transfer for the renewable energy sector. Importantly, realising the potential of green finance in Africa will require governments to design policies, models and approaches that mitigate investment risks (political, economic and regulatory risks) that could cause apprehension among potential investors.

The EU has long supported Africa in financing its development priorities and continues to do so. Through its New European Consensus on Development, the EU has committed to support the 2030 Agenda for Sustainable Development, which seeks to achieve sustainable development while leaving no one behind. Among the activities listed in the consensus is the ‘improvement of access to sustainable and affordable energy without causing damage to the environment.’ 8Joint Statement by the Council and the Representatives of the Governments of the Member States Meeting Within the Council, The European Parliament and the European Commission, ‘New European Consensus on Development: ‘Our World, Our Dignity, Our Future,’ (June 26, 2017): 10.The EU has also released its joint communication ‘Towards a Comprehensive Strategy with Africa’, which recognises that both regions have mutual interests and responsibilities in, among other things, developing a green growth model, combating climate change and ensuring access to sustainable energy.9European Commission, Towards a comprehensive Strategy with Africa, JOIN (2020) 1 (Brussels: European Commission, 2020), https://op.europa.eu/en/publication-detail/-/publication/55817dfb-61eb-11ea-b735-01aa75ed71a1/language-en.

Investing in the renewable energy sector in Africa presents an opportunity for EU countries to continue implementing their commitments through financing projects that address climate change while partnering with governments, development partners, climate funds and the private sector to pool financial resources and implement innovative technology and solutions in the sector.

Insights from Kenya’s renewable energy sector

Kenya remains a leader in East Africa for renewable energy production. Demand for power in the country is expected to grow from 1,841MW in 2018 to 3,348MW in 2022. With energy having been identified as an enabler of the socio-economic pillar of Kenya’s Vision 2030, the country has set an ambitious target of achieving 100% renewable energy by 2030 and seeks to deliver universal access to electricity for households and businesses by 2022.10Government of Kenya, Ministry of Energy, Kenya National Electrification Strategy: Key Highlights Nairobi: Government of Kenya, 2018): 8, http://pubdocs.worldbank.org/en/413001554284496731/Kenya-National-Electrification-Strategy-KNES-Key-Highlights-2018.pdf.

To achieve these targets, investment of $2.75 billion is required, with an additional $58 million every year after 2022. As traditional financial sources are inadequate in Kenya, developing innovative financing that incentivises a green transition and energy affordability (especially for the bottom of the pyramid) is critical. Kenya has invested in renewable energy sources such as solar, wind and geothermal through multiple sources: public finance, climate finance, development finance and commercial finance.11Energy and Petroleum Regulatory Authority, Financing Renewable Energy (Nairobi: Energy and Petroleum Regulatory Authority, 2020, https://epra.sandbox.co.ke/resources/financing-renewable-energy/.It has also set in place incentives for renewable energy generation, for example by promulgating the Public Private Partnerships Act, Number 15 of 2013, which provides a framework for combining public and private financing, and by creating a Feed in Tariff policy, which allows renewable energy power producers to sell to an off-taker at a pre-determined rate over a 20 year period.

The Government of Kenya also works with development banks to offer letters of support and guarantees to investors in order to ameliorate certain risks, such as those arising from delayed completion of projects. During the development of the 300MW Turkana Wind Project, the African Development Bank (AfDB) provided the Partial Risk Guarantee, which is a risk mitigation instrument to cover the private sector (lenders and investors) against the risk of government failure to meet project contractual obligations. Specifically, it provided partial risk mitigation to the investors of the project for risks associated with delays in construction.12‘First ADF partial risk guarantee approved in Kenya for largest African wind power project,’ African Development Bank, October 2, 2013, https://www.afdb.org/en/news-and-events/first-adf-partial-risk-guarantee-approved-in-kenya-for-largest-african-wind-powerproject-12324.The Multilateral Insurance Guarantee Agency also provides political risk insurance for projects in the energy sector in Kenya.13Government of Kenya, Ministry for Energy and Petroleum and Sustainable Energy for All, Sustainable Energy for All, Kenya Investment Prospectus, Pathways for Concerted Action towards Sustainable Energy for All by 2030 (Nairobi: Government of Kenya, 2015): 6, https://www.se4all-africa.org/fileadmin/uploads/se4all/Documents/Country_IPs/Kenya_SE4All_IP_January_2016.pdf.Importantly, the EU-Africa Infrastructure Trust Fund, which blends development finance institution resources with grant resources from the European Commission, was crucial in filling the equity gap for the project.

Concessional financing is another means to mitigate risks for investors. In the development of the Kopere Wind Project (50MW), a project owned by the European company Voltalia, the AfDB provided concessional loans to enhance the project’s bankability by mitigating credit risk for co-lenders. This was achieved by improving debt service coverage ratios14Debt Service Coverage Ratio (DSCR) refers to a project’s available cash flow, which enables it to pay its existing debt obligations., given the low feed-in-tariff for solar PV projects.15African Development Bank, Project Summary Note Kopere 40MW Solar PV IPP, Nairobi: African Development Bank, 2018).When the Government of Kenya was developing the Menengai Geothermal Project (105MW), with support from the AfDB, the country received funding from the Climate Investment Funds to ‘create a concessional lending program designed to enhance the projects’ financial viability and commercial bankability by shoring up conventional financing and breaking down barriers to private investment’.16‘Kenya to tap into Rift Valley geothermal resources and strengthen private sector investment in renewable energy,’ African Development Bank, April 7, 2016, https://www.afdb.org/en/news-and-events/kenya-to-tap-into-rift-valley-geothermal-resourcesand-strengthen-private-sector-investment-in-renewable-energy-15569.

As these examples illustrate, collaboration and strategic partnerships between national governments, development finance institutions and climate funds are instrumental in providing enabling conditions, incentives, support and financing to facilitate private sector investment in renewable energy projects in Africa. The successful implementation of these projects are a reference to other investors and encourages their participation in enabling Africa’s achievement of sustainable, affordable and reliable energy for all.

As the EU implements its strategy with Africa by investing in renewable energy, emphasis should be placed on developing partnerships that create win-win situations for all stakeholders. European development finance institutions have been active on the continent for a long time and have provided financing for several renewable energy projects. For example, the European Investment Bank was a key financier of the Lake Turkana Wind Power Project in Kenya, which is the largest single wind farm in sub-Saharan Africa. Creation of risk mitigation products by such development finance institutions for private sector actors interested in investing in Africa will be instrumental in raising investor confidence and unlocking much-needed financing to meet growing energy needs.

Great opportunity also lies in partnering with both the local private sector and local financial institutions to create local solutions. The European Investment Bank and the Netherlands Entrepreneurial Development Bank have been supporting local private sector actors through jointly investing in an 80MW solar project in Kenya, which will increase energy reliability and affordability for Kenyans. This model of local private sector and financial institution support can be replicated across different countries on the continent to enhance various government’s efforts to provide electricity for all its citizens.

Conclusion

Investing in the continent’s abundant renewable energy sources offers an opportunity to both meet growing energy demand and facilitate a green transition. Innovative financing is the centre of required partnerships among relevant actors. As the EU seeks to implement its strategies and pool private sector financing for the implementation of renewable energy projects in Africa, it can capitalise on partnerships with development finance institutions to secure risk mitigation strategies and instruments that will benefit foreign investors interested in the renewable energy sector.

Building the capacity of governments to create enabling investment environments is also instrumental in attracting private sector finance. The EU should work with various governments on the continent to ensure investor friendly policies are in place to encourage private sector investment.

Acknowledgement

This policy briefing has been published as part of a series under the project Partnership for a Green Transition and Energy Access: Strategic priorities for Africa and Europe. The project is a partnership between SAIIA and the Konrad Adenauer Stiftung’s Regional Programme on Energy Security and Climate Change in Sub-Saharan Africa.