Recommendations

- Establish continental and regional policy and regulatory forums tasked with developing a consistent policy and regulatory framework for all signatories to the AfCFTA Agreement. These forums shall prepare relevant policy guidelines while allowing signatories to maintain their policy sovereignty.

- The African Continental Policy and Regulatory Forum should develop an African digital integration policy framework which will concentrate on establishing the policy and regulatory foundation for seamless digital trade and a single digital market in Africa.

- The African Development Bank should prioritise investment in wired, terrestrial digital networking infrastructure, allowing national governments to take responsibility for last-mile digitalisation projects.

- African governments should develop a blockchain-based platform that creates social-impact bond contracts, which are marketed to private investors and digital last-mile project owners. This instrument can be used to coordinate partnerships between the public and private sectors and the project owners.

- African countries should develop an enabling legislative and policy framework that promotes open-access systems and interoperability, while also protecting individual data.

- African countries should establish a specific agency responsible for developing open-access identity and payment platforms, taking advantage of the India Stack application programming interface.

Background

Physical and electronic infrastructure must be in place to support digital identification, document exchange, payment and online trade in Africa. Physical or ’hard‘ infrastructure includes a reliable power supply, internet connectivity and secure data-storage facilities. This infrastructure enables broadband internet access, providing a foundation for individual and business participation in the digital economy. Broadband internet access can be delivered through wired and wireless technologies, such as fibre-optic cables, cabled modems and cellular networks. Wireless infrastructure is more flexible and is more easily deployed in rural areas. However, it is less stable than wired infrastructure, which is less affected by signal interference. Wired connections are less susceptible to congestion and support more data-intensive applications, such as video streaming.1Larry Thompson, Brian Enga, Brian Bell and Warren Vande Stadt, ‘Comparing Wired And Wireless Broadband,’ Broadband Communities, May/June2015, https://www.bbcmag.com/pub/doc/BBC_May15_ComparingWiredandWireless.pdf.

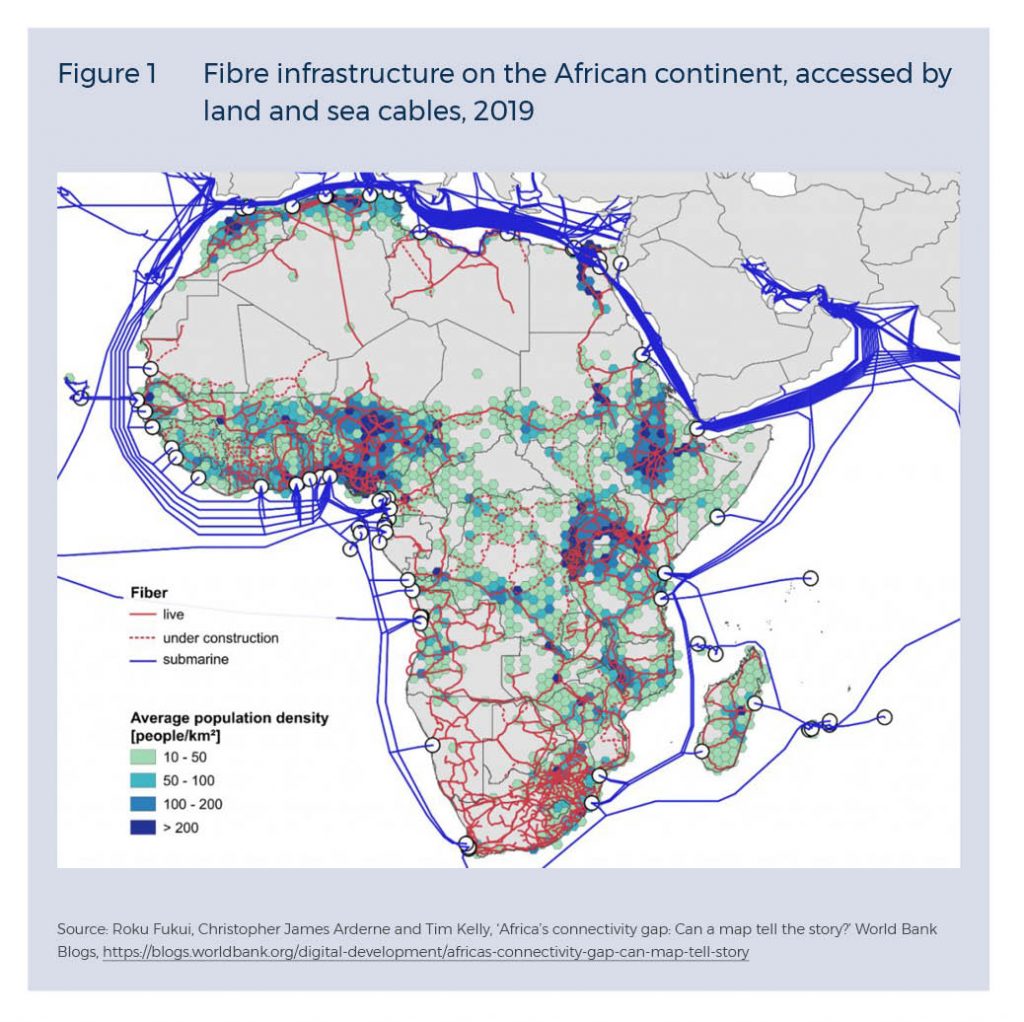

As indicated in Figure 1, fibre-optic connections are sparsely distributed across the African continent, with South Africa and Nigeria benefitting the most from such infrastructure. Various rural communities across Africa lack this connectivity option.

Lack of access to a reliable electricity source in Africa can be an unacknowledged barrier impeding online access. For example, in 2016, an estimated 645 million Africans had no access to electricity.2Daniel Gerszon Mahler, Jose Montes and David Locke Newhouse, ‘Internet Access in Sub-Saharan Africa,’ Poverty & Equity Notes, no. 13 (March 2019): 1–4. https://documents1.worldbank.org/curated/en/518261552658319590/pdf/Internet-Access-in-Sub-Saharan-Africa. pdf; African Development Bank, ‘The New Deal on Energy for Africa. A Transformative Partnership to Light up and Power Africa by 2025’ (Abidjan, 2017), https://www.afdb.org/fileadmin/uploads/afdb/Documents/GenericDocuments/Brochure_New_Deal_2_red.pdf. In 2022, only 40% of adults in sub-Saharan Africa were connected to mobile internet services. In those areas with mobile connectivity, 44% of the population remained unconnected due to a lack of affordability and other access barriers.3GSMA, ‘The Mobile Economy Sub-Saharan Africa 2022’ (London, 2022), https://www.gsma.com/mobileeconomy/wp-content/uploads/2022/10/The-Mobile-Economy-Sub-Saharan-Africa-2022.pdf. In addition, it is estimated that in 2022, only 20 million sub-Saharan African households had a wired internet connection, with Asymmetric Digital Subscriber Lines/ADSL being the most common type.4ITWeb, ‘Africa Shows Low Growth in Fixed Broadband Penetration,’ July 3, 2017, https://itweb.africa/content/KzQenvjVKyovZd2r.

Electronic or ‘soft’ infrastructure refers to the technology and systems used to support digital activities. It includes digital identification systems, document management systems, payment gateways and e-commerce platforms. These systems must securely and efficiently exchange information to support digital trade.5Asian Infrastructure Investment Bank, ‘Digital Infrastructure Sector Strategy (Draft). AIIB’s Role in the Growth of the Digital Economy of the 21st Century’ (Beijing, January 8, 2020), https://www.aiib.org/en/policies-strategies/operational-policies/digitalinfrastructure-strategy/.content/_download/AIIB-Draft-Digital-Strategy.pdf. There is a hierarchical relationship between the various systems and technologies required to support digital activities. At the base of this hierarchy are the foundational digital identity systems upon which other digital services and applications are built.6Carl Dahlman, Sam Mealy and Martin Wermelinger, ‘Harnessing the Digital Economy for Developing Countries’ (Working Paper no. 334, OECD Development Centre, December 22, 2016), https://www.oecd-ilibrary.org/docserver/4adffb24-en.pdf?expires=1674044903&id=id&accname=guest&checksum=1249F8F04498C0B269E3044B0436DBD8. These systems provide a means to verify the identities of individuals, organisations and devices in the digital world, using technologies like biometrics, public key cryptography and blockchain. Such systems are crucial for establishing trust between parties in digital transactions.7Olivia White, et al, ‘Digital Identification. A Key to Inclusive Growth’ (McKinsey Global Institute, New York, April 2019).

It is estimated that nearly 500 million African citizens lack any form of identity and only 30% are formally registered with birth certificates.8Kate Ross Goldman, ‘The Africa Remittance Dilemma,’ Milken Institute Review, July 26, 2021, https://www.milkenreview.org/articles/the-africa-remittance-dilemma. Payment systems are built upon digital identification systems. These systems, including payment gateways, digital wallets and other financial infrastructure, are crucial for a functioning digital economy.9Derryl D’Silva, Zuzana Filková, Frank Packer and Siddharth Tiwari, ‘The Design of Digital Financial Infrastructure: Lessons from India’(BIS Papers no. 106, Bank for International Settlements, Basel, December 2019), https://www.bis.org/publ/bppdf/bispap106.pdf. In 2018, only 43% of African adults had access to formal financial services. Financial coverage, though, has doubled over the past 10 years, with many attributing this to advances in financial technologies (fintech), which have obviated the need for traditional bank accounts. These services have expanded the market as they are more affordable and accessible. However, most of the adult population still lacks access to formal financial services.10International Finance Corporation, ‘Digital Access: The Future of Financial Inclusion in Africa,’ Washington DC, 2018, https://www.ifc.org/wps/wcm/connect/96a4f610-62b1-4830-8516-f11642cfeafd/201805_Digital-Access_The-Future-of-Financial-Inclusion-in-Africa_v1.pdf?MOD=AJPERES&CVID=mdz-QF0 In addition, nearly 83% of micro, small and medium enterprises reportedly have unmet financing needs.11Albert-Eneas Gakusi and Henry Bagazonzya, ‘Recent Trends in Access to Finance in Africa,’ Making Finance Work for Africa, April 27,2022, https://www.mfw4a.org/blog/recent-trends-access-finance-africa.

Thus, despite some progress having been made, a large proportion of the African population is excluded from the digital economy due to physical infrastructure barriers or the limited availability of suitable and affordable digital applications and services. Yet e-commerce depends on the availability, accessibility and affordability of these hard and soft digital infrastructure variants. Africa therefore needs solutions that target these barriers if digital trade is to accelerate across the continent. In addition, there is a need to expand initiatives such as the Pan-African Payment and Settlement System (PAPSS), which promotes central bank collaboration, thereby institutionalising commitments made by African countries.12African Union, ‘The Pan-African Payments and Settlement,’ https://au-afcfta.org/operationalinstruments/papss/

The African Continental Free Trade Area (AfCFTA) Agreement seeks to create a single market for goods and services among the Agreement’s signatories. It further aims to provide a mechanism through which the Protocol on Trade in Digital Services will promote free trade and ensure that the digital economy is open and fair. The negotiations on this protocol, which have been ongoing since 2019, have focused on promoting digital adoption and usage, reducing the cost of digital goods and services, and providing a competitive and level playing field for all African countries.13Karishma Banga, Jamie Macleod and Max Mendez-Parra, ‘Digital Trade Provisions in the AfCFTA: What Can We Learn from South-South Trade Agreements?’ Supporting Economic Transformation, Addis Ababa, April 2021, https://repository.uneca.org/bitstream/handle/10855/43949/b11990405.pdfsequence=1&isAllowed=y. The AfCFTA Agreement presents a unique opportunity to mobilise the resources needed to address digital infrastructure access and affordability barriers and develop interoperable applications and services that serve the continent.

With limited local public finance allocated to digital networking and other infrastructure development initiatives, multinational technology corporates like Google, Apple, Microsoft, Meta and Amazon have led connectivity projects on the continent, funding local telecom operators and subsea cables that circle the continent. China’s Huawei is also a dominant mobile network infrastructure provider, accounting for 50% of the continent’s 3G network and 70% of its 4G infrastructure.14Adio-Adet Dinika, ‘Rethinking Digital Infrastructure Development in Africa’, in Digital Sovereignty: African Perspectives, eds. Gehl Sampath and Fiona Tregenna (DSI/NRF South African Research Chair in Industrial Development, Johannesburg, January 15, 2022), https://doi.org/10.5281/zenodo.5851685

Owing to national fragmentation in Africa, individual countries have less leverage to negotiate a beneficial partnership agreement. Consequently, infrastructure development is not evenly diffused across the continent.15Dinika (2022) By partnering with local private telecom providers, digital platforms, products and services are targeted at those who can afford them. These providers essentially act as gatekeepers to the digital economy, notes South Africa’s Competition Commission.16Competition Commission of South Africa, ‘Competition in the Digital Economy’, United Nations Conference on Trade and Development, Intergovernmental Group of Experts on Competition Law and Policy, 18th Session, Geneva, July 11, 2019, https://unctad.org/meetings/en/Contribution/ciclp18th_cont_South_Africa.pdf. Apart from international technology giants like Google, Microsoft and Meta, other private investors have tended to avoid investing in Africa, resulting in an investment shortfall.17Amaury de Feydeau, Martin Menski and Suzanne Perry, ‘Africa’s Digital Infrastructure Transformation,’ White & Case, May 26, 2022, https://www.whitecase.com/insight-our-thinking/africas-digital-infrastructure-transformation. The International Monetary Fund cites an uncertain policy environment and the high perceived risk associated with infrastructure projects, and therefore unpredictable returns on investment, as reasons for the investment shortfall.18Marijn A. Bolhuis et al, ‘Geoeconomic Fragmentation: Sub-Saharan Africa Caught between the Fault Lines,’ in Regional Economic Outlook Analytical Note: Sub-Saharan Africa, International Monetary Fund, Washington DC, April 2023, https://www.imf.org/-/media/Files/Publications/REO/AFR/2023/April/English/FragmentationNote.ashx In addition, investments in last-mile digital services are limited, with most investments targeted at metropolitan areas. There is also limited coverage of tier-2 cities, largely due to limited terrestrial cabling connecting such cities, towns and rural areas.19Ben Jackson, ‘Africa’s Digital Infrastructure Revolution,’ Infrastructure Investor, December 1, 2021, https://www.infrastructureinvestor. com/africas-digital-infrastructure-revolution/. With mobile network operators acting as gatekeepers in the digital economy, digital products and services become unaffordable for the poor majority. The limited competition also means that network providers have less of an incentive to innovate and improve their services, resulting in less efficient services and high costs for the end user.20Alistair Tempest, ‘The Digital Economy and Ecommerce in Africa – Drivers of the African Free Trade Area,’ Johannesburg, June 2020,

https://saiia.org.za/wp-content/uploads/2020/05/The-digital-economy-and-ecommerce-in-Africa_Special-Report.pdf; Competition Commission of South Africa, ‘Competition in the Digital Economy,’ United Nations Conference on Trade and Development, Intergovernmental Group of Experts on Competition Law and Policy, 18th Session, Geneva, July 11, 2019, https://unctad.org/meetings/en/Contribution/ciclp18th_cont_South_Africa.pdf.

Recommendations

To give impetus to the Protocol on Trade in Digital Services, this section presents recommendations relating to digital infrastructure investment, development, access and affordability and the integration of digital services across the continent.

Developing a standardised policy and regulatory framework for digital infrastructure investment

The African Union (AU) Digital Transformation Strategy (2020–2030) acknowledges that digital infrastructure development on the continent faces significant challenges in the areas of institutional coordination and policy reforms.21African Union, ‘The Digital Transformation Strategy for Africa (2020–2030),’ https://au.int/sites/default/files/documents/38507-docdts-english.pdf In view of these weaknesses, which have led to fragmented policies and regulations across the continent, individual countries have less leverage to negotiate beneficial partnership agreements with private-sector partners and multinational technology companies.22Chloe Teevan and Lidet Tadesse Shiferaw, ‘Digital Geopolitics in Africa: Moving from Strategy to Action’ (Briefing Note, The Centre for Africa-Europe Relations, October 10, 2022), https://ecdpm.org/work/digital-geopolitics-africa-moving-strategy-action. Digital policy fragmentation at the continental level is even more pronounced than at the country level, making it difficult to attract investment in digital infrastructure and to ensure that it is rolled out in a coordinated and comprehensive manner.23More Ickson Manda and Judy Backhouse, ‘Digital Transformation for Inclusive Growth in South Africa: Challenges and Opportunities in the 4th Industrial Revolution,’ African Conference On Information Systems & Technology (ACIST), Cape Town, July 2017, https://www.researchgate.net/publication/318395119_Digital_transformation_for_inclusive_growth_in_South_Africa_challenges_and_opportunities_in_the_4_th_industrial_revolution. This fragmentation contributes to the unequal diffusion of digital services, exacerbating the digital divide.

Standardising the policy and regulatory framework can help to incentivise public digital infrastructure investment and address the policy fragmentation challenge in Africa. To institutionalise a common regulatory framework, the AU should establish a continental policy and regulatory forum supported by regional forums that concentrate on developing an integrated African Digital Infrastructure Policy Framework for all signatories to the AfCFTA Agreement, following the format of the Association of Southeast Asian Nations (ASEAN) Digital Integration Framework.24ASEAN Economic Community Council, ‘ASEAN Digital Integration Framework Action Plan (DIFAP) 2019–2025,’ Jakarta, 2019, https://asean.org/asean2020/wp-content/uploads/2020/12/ASEAN-Digital-Integration-Framework-Action-Plan-DIFAP-2019-2025.pdf. The ASEAN framework endeavours to induce seamless trade by facilitating international digital payments, protecting data, boosting innovation, broadening the digital talent base, fostering entrepreneurship and coordinating actions across the ASEAN region.

While the African forum may identify different priorities, the ASEAN economic community has developed an action plan to guide the AU in the early launch phase. In addition to defining shared regulations, the forum must promote the enforcement of its rules.

It must concentrate on developing regulations about the licensing and operation of digital infrastructure, spectrum management, data protection and privacy, net neutrality, fair competition, bureaucratic processes and intellectual property protection.

Recommendation 1

The AU should establish continental and regional policy and regulatory forums tasked with the development of a consistent policy and regulatory framework for all signatories to the AfCFTA Agreement. These forums shall prepare relevant policy guidelines while allowing signatories to maintain their policy sovereignty.

Recommendation 2

The African continental policy and regulatory forum should develop an African digital integration policy framework which concentrates on establishing the policy and regulatory foundation for seamless African digital trade and a single African digital market.

Prioritising wired, terrestrial digital networking infrastructure by the African Development Bank

As noted earlier, high-capacity, hardwired, broadband network infrastructure is limited across the continent, particularly in landlocked countries, with only some African countries benefiting from such infrastructure. Submarine cables are cheaper than terrestrial cables; hence the limited development of the latter. Countries without such infrastructure tend to depend on satellite and mobile broadband alternatives, which are less reliable.25Liza Rose Cirolia and Andrea Pollio, ‘Financing ICT and Digitalisation in Urban Africa,’ Alfred Herrhausen Gesellschaft (AHG), Cape Town, 2022, https://www.africancentreforcities.net/wpcontent/uploads/2022/05/220519_Paper2_ICT_Digitalisation_final.pdf.

With consistent investments in wired, terrestrial digital network infrastructure, the African Development Bank (AfDB) would contribute to a reduction in the cost of wired, broadband access while also improving the reliability and quality of the continent’s connectivity. Presently, the AfDB is turning its attention to three digital ‘pillars’: (1) the scaling of inclusive digital infrastructure, (2) digital entrepreneurship and skills development, and (3) the sectoral adoption of digitalisation.26African Development Bank, ‘Africa Digital Transformation Action Plan (2022–2026),’ https://www.afdb.org/sites/default/files/2022/04/04/africa_digital_action_plan_brochure_04042022_final_1.pdf. By funding various projects, the AfDB’s focus is split, diverting investment away from the continent’s core challenge of expanding hardwired, broadband infrastructure. The latter is considered a high-risk investment, which attracts limited foreign funding. The AfDB is ideally suited to carry this risk, which would entail extending the reach of the infrastructure to connect metropolitan areas in landlocked African countries. Centralising these developments and developing continental and regional policy and regulatory forums could also reduce the perceived high risks associated with infrastructure development on the continent and accelerate foreign investment in wired, terrestrial digital networking infrastructure.

Recommendation 3

The AfDB should prioritise investment in wired, terrestrial digital networking infrastructure, allowing national governments to take responsibility for last-mile digitalisation projects.

De-risking last-mile digital connectivity investment through blockchain-based social impact bonds

Last-mile digital connectivity projects promote access to broadband services, reduce the cost of digital access, advance digital skills development and enhance local initiatives that deliver substantial investment returns in the short term but with an unclear relationship between the investor, project and beneficiary.27 Aminata A. Garba, ‘Connecting the Last Mile, a Fundamental of Digital Transformation’ (presentation at the ITU Workshop for Europe and CIS, ‘ICT Infrastructure as a Basis for Digital Economy,’ Kiev, Ukraine, May 14, 2019), https://www.itu.int/en/ITU-D/RegionalPresence/Europe/Documents/Events/2019/Workshop Kyiv/Aminata Garba 3 Last Mile Connectivity Kiev.pdf; Thomas Deloison et al, ‘The Future of the Last-Mile Ecosystem,’ World Economic Forum, January 2020, https://www3.weforum.org/docs/WEF_Future_of_the_last_mile_ecosystem.pdf.However, blockchain technology can negate these risks. In particular, a blockchain-based social-impact bond (SIB) system could potentially address such challenges by promoting transparency in social projects, the absence of which typically impedes investment.28Akash Takyar, ‘How Blockchain Can Revolutionise Social Impact Bonds?’ LewayHertz, https://www.leewayhertz.com/blockchain-insocial-impact-bonds/.

The SIBs systems have typically lacked precise definitions of the impact that they have in company systems. However, smart contracts can be established through blockchain systems that remove intermediaries and set clear conditions regarding when the state should release returns to private-sector investors. Blockchain-based SIBs systematise public–private partnerships, bringing together the state as a project underwriter, private investors and the project owner who conceptualises and defines the project’s outputs.29Martin Carnoy and Roxana Marachi, ‘Investing for “Impact” or Investing for Profit? Social Impact Bonds, Pay for Success, and the next Wave of Privatization of Social Services and Education,’ National Education Policy Center, February 2020, https://files.eric.ed.gov/fulltext/ED605809.pdf. Blockchain-based SIBs can align the interests of investors with the public good, helping to direct private investment towards social-impact projects. These investors receive their returns based on the achievements of a predetermined social outcome.

Recommendation 4

African governments should develop a blockchain-based platform that creates SIB contracts, which will then be marketed to private investors and last-mile digital project owners. This instrument can be used to coordinate partnerships between the public and private sectors and the project owners.

Developing public digital infrastructure platforms

African governments should launch public digital infrastructure platforms, similar to the India Stack model, to promote access to digital services among formerly excluded people. The India Stack model, considered a global best practice, is a set of digital infrastructure platforms that facilitate the provision of digital services, such as digital identity and payment infrastructure gateways.30Vivek Raghavan, Sanjay Jain and Pramod Varma, ‘India Stack – Digital Infrastructure as Public Good,’ Communications of the ACM, 62 (11): 76–81, https://doi.org/10.1145/3355625

The success of the India Stack model is due to the leveraging of the collective software development expertise across the Indian subcontinent. In addition, the Indian government released a set of open-source application programming interfaces (APIs), calling on countries to adopt the platform to unlock a collection of cost-effective systems that can serve the financially excluded population.31Simon Sharwood, ‘India Shares Its E-Government Tools with All as India Stack,’ The Register, July 5, 2022, https://www.theregister.com/2022/07/05/india_stack_global/. These APIs are used broadly in India together with its Aadhaar Digital Identity and Unified Payments Interface payment platforms. These platforms have been credited with India’s financial inclusion advances, with 80% of adults possessing a bank account in 2021 (up from 35% in 2011).32Anna Metz, Georgia Marin, Jonathan Marskell, Julia Clark, Karol Karpinski, and Vyjayanti Desai, ‘A Digital Stack for TransformingService Delivery: ID, Payments and Data Sharing,’ World Bank Group, Washington DC, February 22, 2022, https://documents1. worldbank.org/curated/en/099755004072288910/pdf/P1715920edb5990d60b83e037f756213782.pdf; Deepa Krishnan, ‘What theWorld Can Learn from the India Stack,’ Strategy + Business, https://www.strategy-business.com/article/What-the-world-can-learnfrom-the-India-Stack A key to India’s success was the recognition that the payments infrastructure should be considered a public utility, requiring systems to be built with open standards and interoperability in mind. The project was initiated in 2009 as a national project and challenged the business case for a standalone, private payment system.33D’Silva, Filková, Packer and Tiwari, 2019

To take advantage of the India Stack APIs, African governments should set up a suitable agency that is proficient in system design and familiar with the regulatory requirements for open-access identity and payment systems. Such an agency can develop the appropriate legislative and policy framework, while establishing the necessary development teams to customise the available APIs to their country’s context and national banking systems.

Recommendation 5

African countries should develop an enabling legislative and policy framework that promotes open-access systems and interoperability, while protecting individual data.

Recommendation 6

African countries should establish a specific agency responsible for developing open-access

identity and payment platforms, taking advantage of the India Stack APIs.

Developing an African Digital Integration Index

An African digital integration index, similar to the ASEAN Digital Integration Index, would be highly beneficial to Africa for measuring the continent’s digital integration progress. Such an index would be underpinned by a comprehensive approach to measuring African countries’ digital readiness, economy and society.34US-ASEAN Connect, ‘ASEAN Digital Integration Index. Measuring Digital Integration to Inform Economic Policies,’ August 2021, https://asean.org/wp-content/uploads/2021/09/ADII-Report-2021.pdf Collecting and reporting data related to these themes would allow African countries to identify areas for improvement in relation of infrastructure development, human resources and the regulatory environment, thus focusing on future development. Such data would reveal challenges and provide an agile and responsive policymaking tool for the digital economy.35Witada Anukoonwattaka, Pedro Romao, Preety Bhogal, Thomas Bentz and Richard S. Lobo, ‘Digital Economy Integration in Asia and the Pacific: Insights from DigiSRII 1.0’ (Working Paper no. 208, ARTNeT, Bangkok, 2021), https://www.unescap.org/sites/default/d8files/knowledge-products/AWP 208 Witada Pedro Preety_1.pdf

Recommendation 7

The AU should establish a digital integration index, similar to the ASEAN Digital Integration

Index, to measure the progress of digital integration on the continent. This would provide a

comprehensive approach to measuring African countries’ digital readiness and the features

of their digital economy and digital society.

Acknowledgement

SAIIA gratefully acknowledges the support of Swedish International Development Agency for this publication.