Recommendations

- EMEs and developing countries should prioritise enhancing their capital markets to attract investors and raise finance for green investment.

- Different sources of finance, including commercial sources, international assistance, aid and foreign direct investment provide opportunities for regional cooperation between countries across the global South.

- International collaboration between various stakeholders in developed and developing countries could facilitate knowledge sharing beyond South-South cooperation

- Given that green finance is concentrated in North-South flows, coordinated efforts between the global North and the global South would have positive impacts on the design, management and monitoring of green projects.

Executive summary

The COVID-19 pandemic and socio-economic crises that have followed it, have left many countries designing recovery packages to effectively respond to its impacts on markets, human lives and livelihoods. The most common responses have been economic recovery packages designed to stimulate economic activities, which came to a halt under global national lockdowns to curb the spread of the coronavirus. However, as countries continue to address the socio-economic impacts of the pandemic, there is a risk that stimulus and recovery packages designed to resuscitate economies could undermine environmental sustainability due to the urgent need to subsidise health sectors. It is against this backdrop that this paper explores the implications of COVID-19 on green finance flows in the global North and South, with specific reference to emerging market economies (EMEs) and developing countries. This policy brief also provides an analysis of the challenges posed by COVID-19 to green development in the global South and concludes by offering recommendations.

Introduction

Climate finance comprises both public and private sources, transferred predominantly through North–North and North-South financial flows. The 2017/18 Climate Policy Initiative (CPI) report shows that climate finance flows reached a ground-breaking $612 billion in 2017, driven mainly by renewable energy capacity additions alongside increased commitments to energy efficiency.1Barbara Buchner et al., Global Landscape of Climate Finance 2019, Climate Policy Initiative (CPI) Report, (London: CPI, 2019), https://climatepolicyinitiative.org/wp-content/uploads/2019/11/2019-Global-Landscape-of-Climate-Finance.pdfHowever, in 2018 CPI recorded an 11% decline, reaching about $546 billion in climate finance flows. These figures are significantly below the Intergovernmental Panel on Climate Change’s approximations of between $1.6 trillion and $3.8 trillion annually that is needed between 2016 and 2050 to achieve a low-carbon transition.2Helen de Coninck et al., “Strengthening and Implementing The Global Response,” chap. 4 in An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty (Netherlands: In Press, 2018), https://www.ipcc.ch/site/assets/uploads/sites/2/2019/02/SR15_Chapter4_Low_Res.pdfFurther, the Global Commission on Adaptation estimates that the cost of adaptation to climate change is about $180 billion annually.3Global Commission on Adaptation, Adapt Now: A Global Call for Leadership on Climate Resilience, report (Rotterdam: Creative Commons Publishers, 2019), https://gca.org/reports/adapt-now-a-global-call-for-leadership-on-climate-resilience/.Therefore, there is a preexisting shortfall between the approximated costs of green recovery and available financial resources, meaning that green development still has relatively lower investments compared to traditional investments.

While there is contention over what exactly constitutes ‘green’ and what does not, there is a consensus that green development is concerned with the impact of human practices on the environment and ecosystems. For the Organisation for Economic Cooperation on Development (OECD), green development is a ‘practical and flexible approach for achieving concrete, measurable progress across economic and environmental pillars while taking full account of the social consequences of greening the growth dynamic of economies.’ 4OECD, ‘What is Green Growth And How Can It Help Deliver Sustainable Development?’, http://www.oecd.org/greengrowth/whatisgreengrowthandhowcanithelpdeliversustainabledevelopment.htm.In line with this definition, it follows that green development is not only concerned with the economy and the environment alone, but it also has a social dimension, under which the improvement of the quality of human lives fall. These multidimensional tenets of green development make it even more important in light of responding to the impacts of the COVID-19 pandemic on the economy, society, human welfare and the environment.

COVID-19 has, in a short time, exacerbated existing vulnerabilities and inequalities. The pandemic has prompted several states to adopt measures to reduce its potential of becoming a full-blown national crisis and also created new budgetary pressures on all countries, with urgent redirection of funds towards health sectors. As countries continue to address the socio-economic impacts of the COVID-19 crisis, there is a risk that economic recovery stimulus packages designed to resuscitate economies could undermine environmental sustainability. It is against this backdrop that this policy brief explores, specifically, the implications of COVID-19 on green finance and green development.

This paper provides an overview of green finance flows and outlines green finance commitments that have been incorporated into the post-COVID-19 economic recovery stimulus packages. The outline of green finance commitments facilitates an assessment of the prioritisation, or lack thereof, of green development during the pandemic. The paper then provides an analysis of the challenges posed by COVID-19 to green development in the global South with the intention of identifying possible opportunities for collaboration between countries to enhance their capacities through initiatives such as South-South cooperation. It then concludes by making policy recommendations on how the global South can enhance green development during and post the COVID-19 pandemic.

Overview of green finance flows

The Global Sustainable Investment Review, which collates trends on sustainable investments in local investment forums across continents, approximated global assets within the sustainable investment portfolios to be $30.7 trillion at the beginning of 2018.5Global Sustainable Investment Alliance, 2018 Global Sustainable Investment Review, report (Brussels: GSIA Research and Publications, 2018), http://www.gsi-alliance.org/wp-content/uploads/2019/03/GSIR_Review2018.3.28.pdf.In European markets, sustainable investing has been broadly practised and accepted compared to developing markets. Thus, signs of widespread investment in green development and the subsequent maturing of the green market are expected. As early as July 2007, the European Investment Bank (EIB) had pioneered assigning bond proceeds for environmentally friendly initiatives with a EUR6Currency code for the Euro.600 million (about $733 million) Climate Awareness Bond focusing on renewable energy.7European Federation of Investment Funds and Companies (EFAMA), Asset Management in Europe: An Overview of the Asset Management Industry (Brussels: EFAMA, 2020), https://www.efama.org/Publications/AssetManagement%20in%20Europe%2026%20NOV%202020.pdf.This illustrates that green finance flows in developed markets have long been in existence. By 2018, sustainable investments reached a record of EUR 25.2 trillion in Europe8EFAMA, “Asset Management in Europe”.(approximately $31 trillion), while the total USdomiciled assets under management using sustainable investing strategies grew from $8.7 trillion at the start of 2016 to $12 trillion at the start of 20189GSIA, “2018 Global Sustainable Investment”., reflecting a 38% increase.

For Japan, which is the third-largest centre for sustainable investing after Europe and the US, sustainable investments increased from 3% to 18% of total professionally managed assets between 2016 and 2018.10GSIA, “2018 Global Sustainable Investment”.In all three cases, the incorporation of environmental, social and governance (ESG) factors is common. The ESG criteria is a set standard, including central factors that are used in measuring the sustainability and societal impact of an investment in a company or business. In the US, asset management firms and community investment institutions apply the ESG criteria in their investment analysis and portfolio selection, predominantly through ESG integration and negative screening.11GSIA, “2018 Global Sustainable Investment”.These measures offer investors prospects for long-term performance advantages.

Moreover, increasing green finance flows in developed economies are attributed to a multistakeholder approach. This approach includes banks as financial intermediaries supporting sustainable investments and green financing. For example, international capital market players such as Morgan Stanley created a Global Sustainable Finance platform in 200912Audrey Choi, ‘A New Threshold for Sustainable Finance,’ Morgan Stanley, September 26, 2018, https://www.morganstanley.com/ideas/sustainability-morgan-stanley-audrey-choi., and the European Bank of Reconstruction and Development issued the first dedicated climate resilience bond for $700 million in September 2009.13EFAMA, “Asset Management in Europe”.In Japan, the state revised the Financial Services Agency’s Stewardship Code and formulated its Guidance for Collaborative Value Creation, which provides guidelines for responsible and sustainable investments to companies and institutions.14GSIA, “2018 Global Sustainable Investment”In developed markets such as Germany, green finance flows have been enhanced by using third parties as a buffer against risks for green projects through public-private partnerships.15Wang Yan et al., ‘Exploring the Risk Factors of Infrastructure PPP Projects for Sustainable Delivery: A Social Network Perspective,’ Sustainability 12, no. 10 (2020): 4152.These measures collectively boost active investment in the green market and increase investor confidence, which in turn increases green finance flows.

Based on the aforementioned factors, green development in developed countries is promising, owing to, inter alia, existing political will to enhance green growth and the availability of financial resources. In developing countries there has been significant progress over the past decades, albeit at a slow pace. According to the European Commission, developing economies and emerging markets are expected to continue growing faster because of their increasing labour force and expanding market potential compared to advanced economies. 16European Commission, ‘Developing Countries and Emerging Markets’, https://knowledge4policy.ec.europa.eu/foresight/topic/growing-consumerism/developing-countries-emerging-markets_en.Countries including Brazil, Chile, India, Turkey and South Africa are widely classified as EMEs, and EMEs collectively are home to over 80% of the world’s population.17OECD, “Towards Green Growth In Emerging Market Economies: Evidence From Environmental Performance Reviews” (Paris: OECD Green Growth Papers, 2019), https://en.unesco.org/inclusivepolicylab/sites/default/files/publication/document/2020/3/OECD%20%20green%20growth%20d5e5b5d7-en.pdf.Although EMEs experience significant economic growth, it is coupled with increasing pressure on the environment and natural resources.

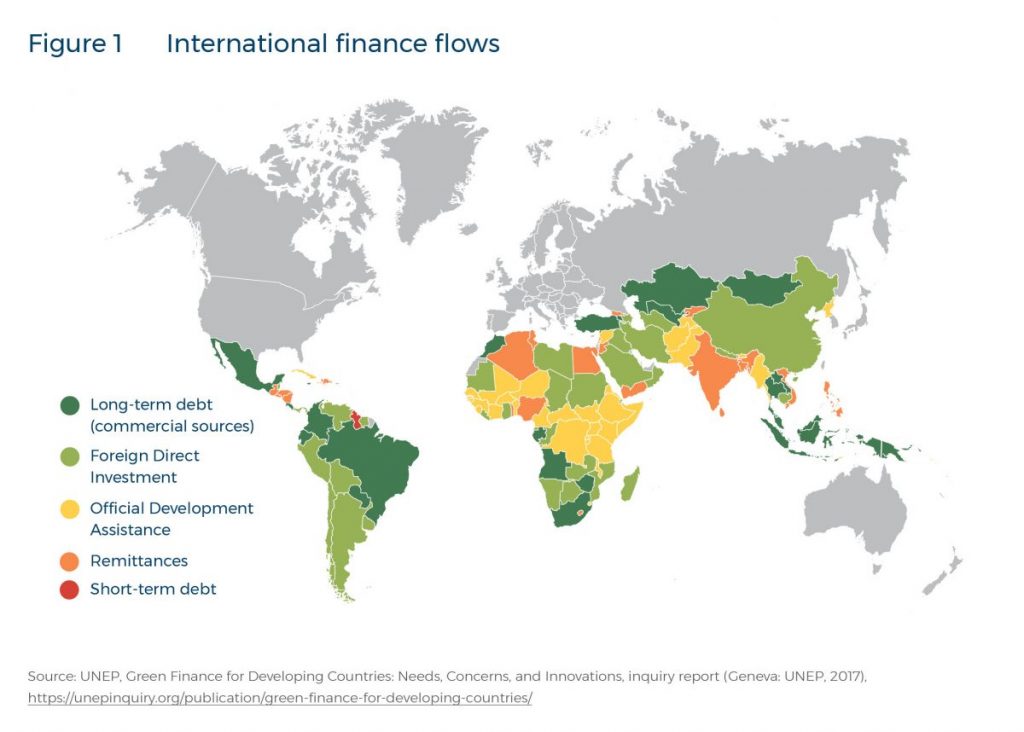

Increasing environmental pressures mean there is an urgent need for investment in environmentally friendly practices. Sources of green finance in many developing countries are primarily reliant on external capital such as international financial flows, particularly for longer-term investments, including concessional lending from international financial institutions and foreign direct investment (FDI).18UNEP, Green Finance for Developing Countries: Needs, Concerns, and Innovations, inquiry report (Geneva: UNEP, 2016), https://unepinquiry.org/publication/green-finance-for-developing-countries/.EMEs also rely on aid and where the economy is stable and capital markets are sophisticated, long-term commercial debt is given. Figure 1 from the UN Environment Programme (UNEP) report shows international resource flows across continents and corroborates the reliance on external capital in Africa. Development assistance dominates the continent except for South Africa and Morocco, which have high commercial sources. FDI is more widely spread across South America where EMEs such as Brazil are located.

In addition to the finance flows depicted above, the International Development Finance Club reported total green finance commitments of $197 billion in 2019, marking a 47% increase from 2018.19June Choi et al., IDFC Green Finance Mapping Report 2020, report (New York: IDFC, 2020), https://www.climatepolicyinitiative.org/publication/idfc-green-finance-mapping-2020/.Of the $197 billion, East Asia and the Pacific region accounted for 69% while commitments from Eastern Europe and Central Asia increased from $2.1 billion (2%) to $10 billion (5%), and sub-Saharan Africa (SSA) saw an increase in commitments from $3 billion to $4.5 billion (2%).20Choi et al., “IDFC Green Finance Mapping”.Despite this increase, SSA’s green commitments lag behind in comparison to other regions.

While there are apparent discrepancies in green finance commitments across continents, green finance flows in developing markets have made significant progress. The Egyptian Stock Exchange, for example, was a founder member of the Sustainable Stock Exchange Initiative, making it one of the first to launch a Sustainability Index in Africa.21UN Conference on Trade and Development (UNCTAD), ‘Five Stock Exchanges Win Inaugural Award For Commitment To Sustainable Development,’ UNCTAD News, October 23, 2018, https://unctad.org/news/five-stock-exchanges-win-inaugural-awardcommitment-sustainable-development.In 2018, the Latin American Sustainable Investment Forum (LatinSIF), comprising Brazil, Chile, Columbia, Mexico and Peru, joined the UN Principles for Responsible Investment (PRI) network, which has over 65 signatories with over $1.2 trillion in collective assets under its management.22GSIA, “2018 Global Sustainable Investment”, 16.LatinSIF’s partnership with PRI shows that developing market economies are proactive in adopting international norms and sustainable investment principles, which boost green development.

In Brazil, regulatory changes such as adopting the recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures were followed by the signing of the Rio Declaration on Climate Risk Transparency in 2018.23Principles for Responsible Investment, ‘LatinSF members join forces with PRI’, https://www.unpri.org/news-and-press/latinsifmembers-join-forces-with-the-pri/2875.article.Brazil’s Rio Declaration includes provisions for shaping the global sustainable insurance agenda, managing ESG risks in non-life insurance underwriting, and sustainable investment strategies. South Africa’s approach to increased climate finance options involves multiple stakeholders such as national government, local municipalities and the private sector. In 2014, the City of Johannesburg pioneered a municipal green bond to raise funds to respond to climate change and address the need for sustainable resources management. The city’s green bond was worth ZAR24Currency code for the South African Rand1.5 billion (about $143 million)25C40 Cities, ‘C40 Good Practice Guides: Johannesburg – Green Bond’, https://www.c40.org/case_studies/c40-good-practice-guidesjohannesburg-green-bond., funding projects across a range of sectors including using biogas fuelled buses to lower carbon emissions. More recently, the Standard Bank Group in South Africa sold a $200 million green bond to the International Finance Corporation, the largest sale of its kind from the continent yet.26Londiwe Buthelezi, ‘Standard Bank’s landmark green bond issue fetches US$200m,’ Fin24 News, March 2, 2020, https://www.fin24.com/Companies/Financial-Services/standard-banks-landmark-greenbond-issue-fetches-us200m-20200302.Despite the reliance on international capital in developing countries, EMEs seem to have diverse sources of green finance, but the question remains: How have these been affected by COVID-19?

Green finance during COVID-19

The EU, on 27 May 2020, unveiled a EUR 750 billion (approximately $826 billion) recovery proposal as the nucleus of its economic response to the COVID-19 crisis, and 25% of this stimulus package would be set aside for climate-friendly measures including clean energy technologies and low-carbon vehicles.27Frédéric Simon, ‘EU to unveil trillion-euro ‘Green Deal’ financial plan,’ Euractive, January 15, 2020, https://www.euractiv.com/section/energy-environment/news/eu-to-unveil-trillion-euro-green-deal-financial-plan/.By July 2020, EU nations had agreed to a $2.1 trillion budget and a coronavirus relief plan under which 30% of their total expenditure from the recovery fund is committed to addressing climate concerns. In addition, individual country commitments to a green recovery include France’s unveiling of the new EUR 100 billion (approximately $122 billion) stimulus package of which a third (4% of the gross domestic product [GDP]) is allocated to green measures.28IISD, ‘French Stimulus Package: About 30 billion for Green Recovery Measures,’ September 3, 2020, https://www.iisd.org/sustainable-recovery/news/french-stimulus-package-about-e30-billion-for-green-recovery-measures/.Brussels, too, unveiled a financial plan for moving to a green economy during the COVID-19 pandemic with a projected amount of at least EUR 1 trillion (about $1.2 trillion) of investment over the next 10 years.29Luke Hurst, ‘European Green Deal: Brussels unveils €1 trillion plan to make EU carbon neutral by 2050,’ Euronews, January 14, 2020, https://www.euronews.com/2020/01/14/eu-commission-to-unveil-green-deal-to-make-europe-the-first-climate-neutral-continent.These recovery packages promise environmental safeguards during COVID-19 and beyond. Based on the examples provided above, it is clear that governments within the EU have included green recovery measures designed to address the short- and medium-term socio-economic and environmental impacts of COVID-19 in their policy responses.

In most developing countries, the economic recovery stimulus packages in response to the COVID-19 pandemic did not explicitly articulate the budgets allocated to green development. For example, Kenya’s KSH30Currency code for the Kenyan Shilling54 billion (about $540 million) COVID-19 relief package31Njoki Kihiu, ‘Youth To Reap Big From Uhuru’s Sh53.7bn Stimulus Package For COVID-19,’ Capital News, May 23, 2020, https://www.capitalfm.co.ke/news/2020/05/youth-to-reap-big-from-uhurus-sh53-7bn-stimulus-package-for-covid-19/did not specify the amount reserved for green development. However, the African Development Bank (AfDB) approved a $10 billion COVID-19 Response Facility (CRF) to help African countries respond to COVID-19 and to stimulate green and resilient recovery.32AfDB, Climate Finance Newsletter, January – June 2020, newsletter no. 45 (Abidjan: AfDB, 2020), https://www.afdb.org/en/documents/climate-finance-newsletter-issue-ndeg45-january-june-2020.The latest annual report by the AfDB showed that contributions to Africa’s Climate Change Fund (ACCF) in 2019 totalled $15,757,255 million.33AfDB, Africa Climate Change Fund Annual Report 2019, (Abidjan: AfDB, 2019), https://www.afdb.org/en/documents/africa-climate-change-fund-annual-report-2019, 24.This amount is significantly lower than the EUR 63.3 billion (about $77 billion) in climate finance reported by the EIB34European Investment Bank Group, Sustainability Report 2019, (Luxembourg: European Investment Bank, 2020), https://www.eib.org/attachments/general/reports/sustainability_report_2019_en.pdf.for the same year. Moreover, the main contributors to the ACCF in 2019 were Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH with a contribution of $6,191,640, Italy contributing $5,559,630, and the Government of Flanders contributing $3,548,282, while $457,703 of the total amount was accrued interest.35AfDB, “Africa Climate Change Fund”.It is alarming that the main contributors to the ACCF are European rather than African countries and this method of climate financing is not without its own challenges, as discussed later in the paper.

In many countries, foreign reserves dropped sharply due to large-scale capital outflows at the outset of the COVID-19 crisis. In 2020, Egypt mobilised external financing, including a $2.8 billion stopgap loan issued under the International Monetary Fund’s Rapid Financing Instrument, a $5.2 billion Stand-by Arrangement, a $5 billion sovereign Eurobond, and a $0.75 billion sovereign green-bond.36The World Bank, ‘The World Bank in Egypt,’ Country Office Profiles, October 1, 2020, https://www.worldbank.org/en/country/egypt/overview.Similar to the ACCF, these funds are external, substantiating that green finance is predominant within North-North and North-South rather than South-South flows. Moreover, the total amount for sovereign green bonds, which add to green development, is the lowest of all mobilised external funds in Egypt. In Ghana, when the National Climate Change Policy (NCCP), which provides guidelines for climate change adaptation, social development and mitigation, was enacted in 2014, the budget allocation was GH₵37Currency code for the Ghanaian Cedi.637 million (approximately $210 million).38Government of the Republic of Ghana, Ministry of Environmental Science, Technology and Innovation, Ghana National Climate Change Policy. (Accra: Ministry of Environmental Science, Technology and Innovation, 2014), https://www.un-page.org/files/public/ghanaclimatechangepolicy.pdf.According to the Overseas Development Institute (ODI) report, this budget allocation represented a low base upon which the NCCP had to reach its objectives, especially within the first five years since establishment.39Felix Ankomah Asante et al., Climate Change Finance in Ghana, report (London: Overseas Development Institute, 2015), https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/9684.pdf.

The ODI’s observation suggests that before COVID-19, the national policy on climate change in Ghana was underfunded. Moreover, even though there are several sector-specific guidelines that inadvertently affect the financial institutions and their clients, there is no clear government policy on green finance to guide investors in Ghana.40Asante et al., “Climate Change Finance in Ghana”.

Similar to COVID-19 relief efforts in Africa by the AfDB, in November 2020 the Green Climate Fund (GCF) approved a new $23.1 million grant towards increasing climate resilience in Mongolia, Asia.41UN Development Programme, ‘Green Climate Fund Invests $23.1 Million Towards Building the Climate Resilience of Mongolian Herder Communities’, https://www.adaptation-undp.org/green-climate-fund-invests-231-million-towards-building-climateresilience-mongolian-herder.In Egypt, the European Bank for Reconstruction and Development, the EU and the GCF launched two programs during the pandemic to boost green finance and improve value chains.42IISD, ‘Two Programs Support Green Recovery in Egypt,’ November 13, 2020, https://www.iisd.org/sustainable-recovery/news/twoprograms-support-green-recovery-in-egypt/The programmes, cumulatively worth EUR 220 million (approximately $268 million) are supplemented by EU grants of over EUR 30 million (about $36.5 million) and GCF co-financing and technical assistance of up to $24 million, offering sub-loans to businesses for green investments in energy, water and resourceefficient solutions.43IISD, “Two Programs Support Green”.In reference to Figure 1, climate finance appears to be concentrated within North-North and North-South rather than South-South relations.

Challenges with green finance in the global South

Even though climate policies are linked to development, climate finance flows to developing countries face more challenges compared to development aid.44Anmol Vanamali, “Emerging Trends in Climate Finance” (Discussion Paper, Center for Clean Air Policy, Washington, D.C, 2012), https://ccap.org/resource/emerging-trends-in-climate-finance/.One of the main challenges of climate finance relates to the source of funding. Regulations and policies that govern international capital flows are often outside the jurisdiction of recipient countries resulting in funds being hinged on politics and conditionalities. Moreover, limited inward investment in green development within developing countries results in a single finance approach which is heavily dependent on FDI and international aid. Again, this has adverse effects on the maturing of local market capacities. Reliance on international assistance and FDI interferes with the income-generating capacities of local markets. In worse cases, this reliance turns into a ‘dependency syndrome’ – an attitude and belief that EMEs and developing countries cannot solve their own problems without outside help.

The UN Economic Commission for Africa (UNECA) rebuts suggestions that African countries cannot afford to address climate change, biodiversity loss and economic crises at the same time45UNECA, “Climate Change and Development in Africa Post COVID-19: Some Critical Reflections” (Discussion Paper, UNECA, Addis Ababa, June 2020), https://uneca.org/storys/treat-climate-crisis-same-urgency-covid-19-pandemic-new-eca-paper., as this suggests there is a choice. In fact, while climate change is a global phenomenon, developing countries are more vulnerable because of the structural and historical factors that restrict their abilities to withstand the costs of climate crises such as droughts, floods and heatwaves. Furthermore, investments in clean, renewable energy, climate-proofing infrastructure, or adopting smart agriculture options remain very low 46Choi et al., “IDFC Green Finance Mapping”.compared with developed countries.

For developing countries, especially in SSA, infrastructure financing deficit is a real challenge. Infrastructure investment contributes to using resources and energy efficiently, reducing greenhouse gas emissions and improving the resilience of infrastructure to climate change. However, UNECA observed that many developing countries do not effectively integrate environmental adaptation criteria into infrastructure investment strategic decisions.47UNECA, “Climate Change and Development”.Africa in particular is characterised by extremely low levels of investment in weather and climate observation infrastructure. These low levels of investment limit capacity to analyse and interpret existing climate information. In addition uptake and use of climate information in policy and decision-making is limited. According to the World Bank, only 10 out of 54 African countries offer adequate meteorological services, and fewer than 300 of its weather stations meet the World Meteorological Organization’s observation standards.48The World Bank, ‘Modernizing Meteorological Services to Build Climate Resilience Across Africa,’ World Bank News, November 11, 2016, https://www.worldbank.org/en/news/feature/2016/11/10/modernizing-meteorological-services-to-build-climate-resilienceacross-africa.Limited infrastructure investment leaves many developing countries with reduced adaptive capacity and in need of rapid green development.

The OECD observes that EMEs, including Chile, Colombia, Mexico and Peru, have since 2011 set sustainable development and green growth strategic frameworks in their economic development planning documents. However, these countries face governance and implementation challenges, partly due to inadequate human and financial capacity.49OECD, “Towards Green Growth”, 7.Some reasons for the weak implementation of green policies are that responsibilities for delivering results are often not clearly identified and there is no mechanism to hold those with responsibilities accountable for delivering results. A study by the International Institute for Sustainable Development (IISD) showed that greener economic development in Brazil could create 2 million jobs and increase the country’s GDP by $535 billion by 2030.50IISD, ‘Brazil: Low-Carbon Recovery Could Save Rainforest and Boost Economy’, August 10, 2020, https://www.iisd.org/sustainablerecovery/news/brazil-low-carbon-recovery-could-save-rainforest-and-boost-economy/.IISD also argues that Brazil could even exceed its climate pledge by embracing a green recovery and investing in low-carbon growth. Despite this potential, limited implementation capacity and governance challenges hamper green development in Brazil, as well as other EMEs.

In addition, green development in EMEs face hurdles in aligning economic objectives and environmental growth. Policy documents such as national development plans state clearly countries’ intentions to advance green development. Implementing such plans is more difficult in reality, due to limited financial resources and little political will to prioritise environmental programmes over social security and service delivery programmes, which get the attention of voters.

Conclusion and recommendations

COVID-19 economic recovery stimulus packages should not only be comprehensive, but they should also involve a wide range of stakeholders. In developing countries there are many competing priorities such as existing budget constraints coupled with the urgent need to revitalise health sectors and respond to the socio-economic impacts of COVID-19. Nonetheless, governments should promote green development that is multidimensional and thus not divorced from improving social, economic and even political aspects of human lives. The need for green development is dire in EMEs and developing countries, whose citizens are more vulnerable to long-term climate impacts.

This policy brief provided an overview of green finance flows in developed and developing countries, as well as EMEs. It also unpacked challenges that are faced by the global South and more specifically in Africa, which include limited financial resources, infrastructure financing deficits, limited implementation capacities and gaps in policymaking and legislation. Based on an analysis of these factors, the following recommendations are made.

Institutional reforms to enhance the green market

Governments in EMEs and developing countries should prioritise enhancing their capital markets to attract investors and raise finances for green development. This could be achieved through effective implementation of institutional reforms such as ESG-like standards for investment.

Increased South-South cooperation

International financial flows in EMEs and developing countries are diverse, with a few countries proving to have more access to commercial sources while many countries in subSaharan Africa depend on international assistance. These differences provide opportunities for regional cooperation between countries across the global South. Peer-learning measures can be initiated to facilitate the transfer of lessons between countries, which should be preceded by the effective implementation of green standards and institutional reforms recommended above.

Globally coordinated efforts in support of green development

Even though the responsibility to leverage climate finance for investment in green development lies with EMEs and stakeholders within developing countries, linkages between environmental factors and financial risks are complex, often requiring the development of new capacities.51UNECA, “Climate Change and Development”.This can be more challenging for developing countries where climate finance is not readily available compared with developed markets. International collaboration between various stakeholders in developed and developing countries, therefore, could facilitate knowledge sharing beyond South-South cooperation. Given that climate finance is concentrated in North-South flows, coordinated efforts between the global North and the global South would have positive impacts on the design, management and monitoring of green projects. Moreover, globally coordinated efforts will enable a multidimensional approach to evidence-based reporting and accountability within green development.

Acknowledgement

SAIIA gratefully acknowledges the support of SIDA for this publication.