European Central Bank president Christine Lagarde recently warned that the fight against inflation is not over, and called for a revised economic playbook in the face of a rapidly changing global economic landscape. She highlighted the need to factor into economic models a not-so-smooth transition to a green economy and warned of the possibility of persistent inflation that will require maintaining high interest rates.

High rates in advanced economies are not good news for emerging and developing economies, but Lagarde’s call highlights the need to transform the way the global economy operates. In Africa, rising debt coupled with the growing risks of climate shocks require bold policy interventions domestically and globally to enhance its macroeconomic resilience. A new economic playbook is required.

Research by the South African Institute of International Affairs and its partners over the past three years has found that despite attempts to build up resilience, African countries remain unprepared for the next big crisis as they remain fiscally constrained with limited access to international finance. The research points to the need to extend social safety nets and adjust infrastructure and industrial policy to accommodate climate risk mitigation and adaptation. Most countries barely addressed these in their COVID-19 recovery efforts.

Africa faces many financial challenges, chief of which is servicing debt, which will average 55% of GDP in 2023. The tightening of global monetary conditions has put additional pressure on its debt servicing costs. Nigeria, Africa’s biggest economy, will in 2023 potentially use 73% of its revenue to service debt, having used 96% in 2022.

The International Monetary Fund (IMF) has shown that as climate change intensifies it will be the dominant factor shaping macroeconomic variables worldwide, including debt. As such, climate change will worsen Africa’s financial challenges, making the need for integrating it into Africa’s macroeconomic framework far more urgent. Africa’s COVID-19 response was a missed opportunity for building back better to a climate-resilient economy. Countries such as South Africa and Nigeria implemented sizeable investments in renewable energy as part of their recovery efforts but many others, including Uganda, Senegal, Benin and Tanzania, did far less.

For Africa, the pursuit of macroeconomic resilience cannot be viewed in isolation from the broader global financial context. Developing economies generally face adverse global financial circumstances that limit their policy actions. For instance, the interest developing countries pay on their debt is on average three times higher than that paid by developed countries. Developing countries also face stricter credit ratings. During the pandemic 95% of all ratings downgrades affected developing countries.

Fallen short

Lagarde may not have been thinking about Africa (or other developing countries) when she called for a new playbook, but certainly the global financing architecture does require a paradigm shift. It must be responsive to the needs of the developing world.

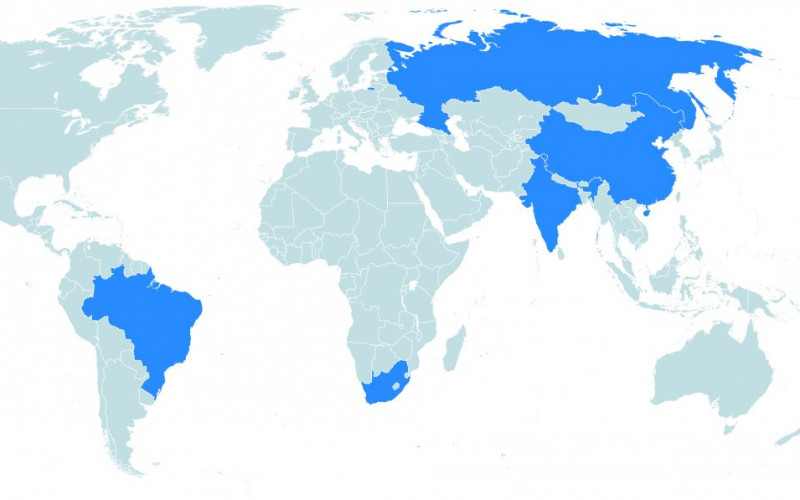

Reform initiatives have so far fallen short. For instance, the G20-led Common Framework on debt treatment has been somewhat underwhelming in addressing Africa’s fiscal challenges. Only four countries — Zambia, Ethiopia, Chad and Ghana — have made requests under the common framework. Other initiatives are pushing for greater financial access for developing countries, with the IMF’s special drawing rights (SDRs) receiving significant attention.

SDRs offer liquidity for developing countries with minimal costs, but their inequitable allocation is a major drawback. In August 2021 $650bn of new SDRs was issued, of which Africa received only $33bn. Because of this, the Bridgetown Initiative calls for reallocating at least $100bn of unused SDRs to those who need it, a call some advanced economies and China have heeded. It further proposes to expand multilateral lending to governments by $1-trillion, activate private sector savings for climate mitigation, and fund reconstruction after climate disasters.

The new IMF Resilience & Sustainability Trust is another initiative that can boost Africa’s macroeconomic resilience, particularly given its attention to climate change and low-income countries. Rwanda has already benefited from it being among the first countries to reach an agreement. However, the $42bn target capital for the trust is only a small contribution to the scale of financing required for Africa and other developing regions. The Bridgetown Initiative’s financial proposal is more in line with Africa’s needs.

Reforms should also reflect the necessity of introducing innovative climate financing arrangements within low-income countries. The perceived risks associated with investments in developing countries often discourage green financing. This can be addressed through financial innovations that encourage risk sharing between international financial institutions and domestic investors. The International Finance Corporation has embarked on such initiatives and more should be rolled out by other such institutions.

Without global financial reforms the sustainable growth and energy transition Africa needs to achieve economic resilience will not be achieved. The world knows global financial reforms are necessary and the key to change lies largely with the Global North. The G20 summit in Delhi, the autumn meetings of the IMF and World Bank, and COP28, should be fully used to do what is necessary and implement these reforms.