Recommendations

- Recipient governments should normalise the publication of all loan contracts on infrastructure projects with external funders.

- Provision should be made for the long-term future impacts of large-scale infrastructure projects, for example by setting up land acquisition systems and protocols and fast-tracking human resource development plans.

- The Association of Southeast Asian Nations and the AU should set up common dialogue platforms to promote the sharing of ideas towards articulating joint ESG project standards.

- Recipient countries’ parliaments or legislatures should establish a mid-process review in which they draw in various stakeholders, including civil society.

Executive summary

In the past two decades, China has become a major funder and builder of infrastructure in the Global South. Many of these projects have offered mutual benefits and encouraged development in recipient countries, providing new points of economic growth and an alternative to traditional donors. However, the projects have not been without challenges. This policy briefing provides a brief multi-sector comparison between African and Southeast Asian experiences of environmental, socioeconomic and governance (ESG) implementation in Chinese-led infrastructure projects. It highlights recurring challenges and proposes concrete recommendations to mitigate these challenges in the future.

Introduction

China has played a dual role as both a funder and a builder of infrastructure in Global South countries, transforming their development options. Not only has this infrastructure provided new paths towards economic growth for these countries but it has also helped to boost trans-frontier integration. This, in turn, has helped to increase trade between countries and boost regional development. However, these projects have also triggered controversy, especially in terms of ESG issues, frequently leading to disputes between local communities and recipient governments, as well as reputational damage for Chinese

contractors. Roughly two decades into this process, it is important to take stock and provide more nuanced analyses to fully grasp its complexity.

China has been involved in projects across several sectors, including electrification infrastructure (both coal and hydropower); ports; railway provision; and information and communications technology (ICT). Chinese contractors have implemented such projects in both Africa and Southeast Asia, with the same companies sometimes implementing projects in both regions.

China has provided the lion’s share of the funding for many of these projects, often through concessional loans extended by Chinese policy banks such as the China Exim Bank and China Development Bank. At their best, the projects have provided crucial tools to African and Southeast Asian countries to support industrialisation. This has had several positive impacts, including aiding industries to become more competitive, reducing prices and giving the regions greater negotiation leverage with traditional donors. Specifically, from the launch of the Belt and Road Initiative in 2013 until the COVID-19 pandemic Chinese banks were more willing than Western donors to fund riskier projects.1Zainab Usman, “What Do We Know About Chinese Lending in Africa?”, Carnegie Endowment, June 2, 2021 As a result, areas that had been neglected by Western donors were given new life.

However, these projects have also experienced challenges, as highlighted in a series of research reports published by SAIIA comparing Chinese infrastructure provision in Africa and Southeast Asia.

This policy briefing aims to provide a better understanding of these interactions in order to make recommendations on how to improve the implementation of ESG standards in Chinese-led projects in the Global South. It first touches on the impact of China’s evolving ESG environment on international implementation. Then it outlines shared trends identified in Chinese infrastructure provision in Africa and Southeast Asia, before concluding with recommendations for overcoming these challenges.

Changes in China’s domestic ESG standards and their impact on transnational implementation

China’s approach to large-scale infrastructure has shifted, owing to a combination of international and domestic factors. The impact of the COVID-19 pandemic and the knock-on effects of the Ukraine crisis have depressed growth across the Global South. This has increased the danger of debt distress, which has factored into China’s recalibration of its infrastructure funding. It has responded by reducing funding for large-scale infrastructure, moving towards smaller projects, and introducing innovative public–private funding models.2Kevin Acker and Deborah Brautigam, “Twenty Years of Data on China’s Africa Lending” (Briefing Paper 4, China–Africa Research Initiative, Washington DC, 2021).

At the same time, China has also moved towards becoming a responsible leader in global green – or environmentally-friendly – development. In the past, Chinese contractors tended to be led by the ‘host country principle’ (where contractors only aim to conform to recipient country norms, even if those do not provide sufficient ESG protection). However, the rapid development of domestic ESG norms in response to public pressure for environmental reforms during President Xi Jinping’s first two terms has also impacted transnational activities by Chinese firms. The promulgation of norms for green development by the Chinese Ministry of Commerce and Xi’s 2021 commitment to halting funding for transnational coal power projects have improved ESG implementation by Chinese contractors. This has been further enhanced by norm-setting by Chinese-led multilateral development bodies such as the Asian Infrastructure Investment Bank. While these developments have encouraged some Chinese contractors to adopt enhanced standards and practices even where host laws and standards are low, this has not been necessarily true in all cases, and significant challenges remain.

Cross-cutting dynamics

SAIIA’s comparison of African and Southeast Asian projects in five infrastructure sectors revealed a few key dynamics that affect ESG implementation in Chinese-led projects.

First, weak domestic financial governance tended to manifest as high levels of opacity in tender processes and loan negotiations. Several projects were characterised by a lack of transparency, which allowed local and foreign stakeholders to manipulate the deals for their own gain. This seriously affected public confidence in the projects and caused reputational damage both for recipient governments and for Chinese contractors.

Second, interactions between recipient governments and state and non-state regional actors exacerbated problematic land acquisition and community relocation processes. This increased local unhappiness with projects, sometimes resulting in community protests that disrupted project timelines. Greater community and civil society engagement would arguably help to ameliorate some of these problems.

Third, recipient countries sometimes lacked long-term economic sustainability plans for these projects. This was true at both national and regional levels. More realistic profit projections and more inclusive plans to boost regional development would help to maximise the economic benefits of the projects while limiting reputational risk for all parties.

Lessons learnt

Strengthen domestic regulations

The research highlighted that, in some cases, Chinese contractors have no choice but to respond to internal contexts where pre-existing political factors present a reputational risk for them. This has sometimes led to the forfeiture of ESG standards. However, there is also evidence that, in a stronger regulatory environment, high ESG outcomes have resulted, regardless of political bias.

For example, although a coal bias played a key role in both Zimbabwe and Indonesia’s decisions to opt for Chinese-led coal-fired power, the stronger regulatory environment in Indonesia limited the environmental impact of coal-based electricity.3Xue Gong and Cobus Van Staden, “China-Driven Coal Power: Lessons from Zimbabwe and Indonesia” (Policy Briefing 258, South African Institute of International Affairs, Johannesburg, December 15, 2021). In Zimbabwe, however, the low levels of government standard-setting and implementation resulted in poor ESG standards.

Although the research demonstrated that many Chinese firms respect local laws and regulations, more must be done to promote higher standards. One possible solution is for The Association of Southeast Asian Nations (ASEAN) and the AU to set up dialogue platforms dedicated to the formulation of shared ESG project standards and the sharing of ideas about best practices. This would strengthen the regulatory environment in host countries.

Ensure transparency and coordination at all levels

A major cross-cutting issue present in Chinese-led infrastructure projects in all sectors was a lack of transparency and coordination in the host government’s domestic context. Although ESG standards are frequently integrated into projects’ planning and construction phases, there is a concerning lack of follow-through on the part of host governments. This, coupled with a lack of transparency, has caused complications and disruptions.

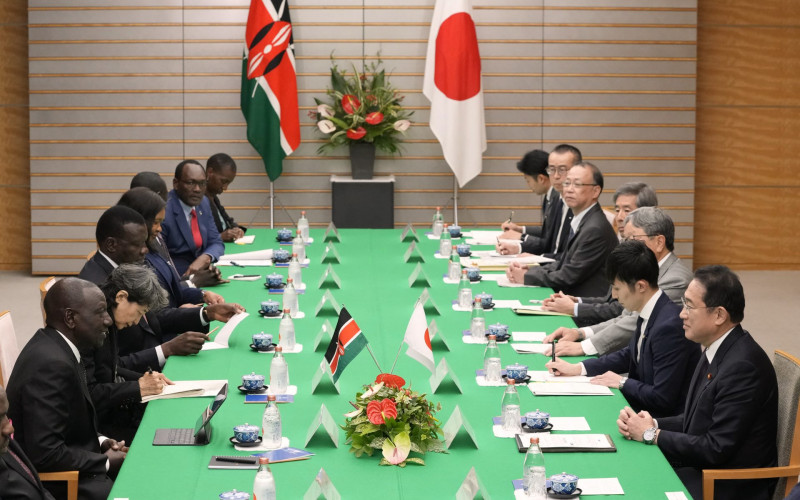

For example, in two Chinese-funded and -built ports – Lamu Port in Kenya and Kuantan Port in Malaysia – the projects fit into larger development and industrialisation zones and long-term plans.4Chris Alden et al., “China-Driven Port Development: Lessons from Kenya and Malaysia” (Policy Briefing 257, SAIIA, Johannesburg, December 14, 2021). In both cases, fisheries and marine environments were damaged, which harmed the livelihoods of local communities. In the case of Lamu, which is recognised as a World Heritage Site, the risk to tourism was also significant. These impacts resulted in community resistance to the projects, for example, the ‘Save Lamu campaign’, which led to disruptions and delays.

It is therefore in the interest of the host government and Chinese contractors to ensure these projects are conducted with transparency and in consultation with community members, and consider the wider regional impacts. A possible solution would be for recipient countries’ parliaments or legislatures to establish a mid-process review, in which they draw in the various stakeholders, including civil society. Recipient governments should also normalise the publication of all loan contracts on infrastructure projects with external funders. This would allow for consultation throughout the process, which could in turn reduce the risk of disruptions by aggrieved community members.

Make provisions for the future

Many recipient governments integrate Chinese-led infrastructure projects into larger, long-term development plans. Frequently, however, there is inadequate planning for their long-term developmental impacts.

For example, in order for these infrastructure projects to be sustainable, there needs to be sufficient local capacity to maintain and operate the infrastructure. This is especially important in the ICT sector, which requires technical expertise. Although Chinese projects contribute significantly to local job creation, research comparing two large Chinese ICT provision projects in Tanzania and Cambodia highlighted that Chinese companies make greater efforts in Southeast Asia than in Africa to use local labour.5Motolani Agbebi, Gong Xue and Zheng Yu, “China-powered ICT Infrastructure: Lessons from Tanzania and Cambodia” (Policy Briefing 252, SAIIA, Johannesburg, November 2021). This, in turn, impacts local capacity building, without which the long-term sustainability of projects is jeopardised.

Furthermore, many of these mega-infrastructure projects involve the relocation of communities to free land for construction. This often leads to controversial issues around land compensation, as with the Standard Gauge Railway in Kenya.6Oscar Otele, Guanie Lim and Ana Alves, “China-Driven Rail Development: Lessons from Kenya and Indonesia (Policy Insight 121, SAIIA, Johannesburg, January 28, 2022). The research showed that Chinese contractors played a small role in the controversy and the responsibility lay with the Kenyan actors. Regardless, the controversy caused reputational damage for the Chinese contractors.7Yuan Wang and Uwe Wissenbach, “Clientelism at Work? A Case Study of the Kenyan Standard Gauge Railway Project”, Economic History of Developing Regions 34, no. 3 (2019): 280–299.

Considering the above examples, it is recommended that these projects make sufficient provisions for the future in order to ensure their sustainability. One solution could be to prioritise capacity building and skills development of local actors to take over technical roles. Although there is legislation in the pipeline with this provision – for example, Kenya’s local content bill8Government of Kenya, “Local Content Bill 2018”, 2018. – this should be fast-tracked and its implementation prioritised.

Another recommendation would be to set up land requisition systems and protocols. As a key issue across several sectors, such a mechanism could guard against disruptions in the project timelines and reputational damage for the contractors, and ensure the community feels fairly compensated. Such a mechanism ought to take into account the current and future commercial value of the land in a way that gives local communities some access to future profits.

Conclusion

There are several challenges to ESG prioritisation in overseas infrastructure projects, including a lack of policy incentives and lapses in coordination and structuring of ESG policies and implementation. China has been a lender that has learnt by doing.

There is evidence that Chinese contractors are willing to adapt to local laws and norms to adequately mitigate ESG concerns. However, the global impact of Chinese infrastructure investment highlights the need for more robust, Chinese-led norm-setting on ESG issues.

There is a particular need for Chinese actors to use this global presence for pro-active norm-setting that moves beyond simply reducing harm towards a more comprehensive approach to ESG implementation that considers local stakeholders and environments.

To this end, the research points to the need for closer coordination between Chinese funders and contractors and national, regional and civil society actors in recipient countries to ensure that projects achieve broader sustainability and long-term developmental impacts. Because Chinese contractors tend to be led by recipient-country laws, it is crucial that recipient countries take the lead in setting better norms. It is particularly important for governments across the Global South to share ideas and coordinate in setting cross-cutting ESG norms. To that end, we recommend the formation of joint platforms where ASEAN and AU member states can share ideas and develop integrated ESG norms that will maximise developmental impacts while ensuring the optimum environmental and social outcomes.

Acknowledgement

SAIIA gratefully acknowledges the support of the Embassy of the People’s Republic of China in South Africa for this publication which forms part of the China–Africa Joint Research and Exchange Programme, an initiative of the Forum on China–Africa Cooperation.